As carbon markets spring up across the world, companies are increasingly being made to pay to emit greenhouse gases. To keep one step ahead, many already factor a carbon price into their investment decisions.

And most expect to pay much more than current prices, a new report shows.

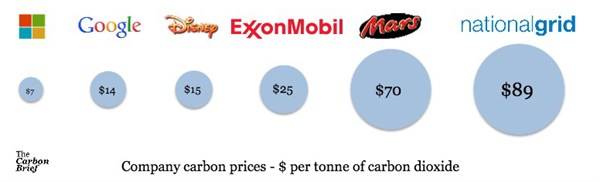

Not-for-profit organisation CDP asked companies whether they consider carbon pricing in their investment decisions. 150 companies, including global giants like ExxonMobil and Mars, say they do. Of the 27 companies that divulged their internal carbon price, all but two set it at a higher level than current carbon markets.

We explore which companies have their own carbon price, and why they differ.

Higher carbon price

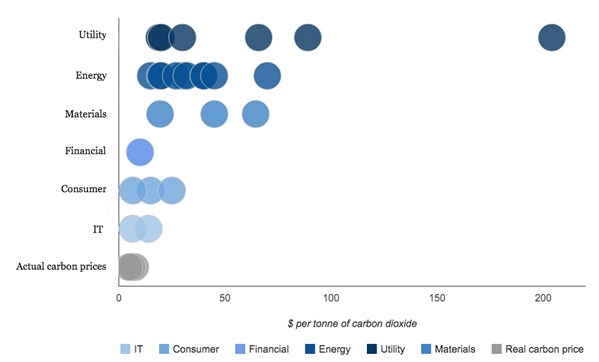

Companies from across six sectors revealed their internal carbon prices to CDP.

The graph below shows the wide range of carbon prices companies use to work out which projects to invest in. The further to the right a bubble is, the higher the carbon price.

As you can see, utility companies that invest in things like electrical grids and water systems, the energy sector, and companies that trade in materials like metals and chemicals generally have the highest internal carbon prices:

Source: Data from CDP’s Global corporate use of carbon pricing report. Graph by Carbon Brief.

The EU’s carbon price is currently around $7 per tonne of carbon dioxide. The average carbon price across China’s seven pilot carbon markets is $6. A regional US market, the Regional Greenhouse Gas Initiative, recently auctioned permits for a little over $4 per tonne.

Only Microsoft and Brazilian food company BRF SA had prices lower than the EU’s current price, at around $6 each. UK water and recycling company the Pennon Group had the highest carbon price by far, at around $204. Most cluster around the $10 to $45 mark. See the full list here.

That means almost all of the companies willing to tell CDP what carbon price they used assume the cost of emitting carbon dioxide will rise. In some cases, quite sharply.

Carbon intensive hedging

So why do companies use such different prices? It largely depends on how long-term their investments are.

The graph above shows that carbon intensive sectors such as energy, materials and utilities seem to work on the basis of a higher carbon price. That’s because the investment decisions a company like ExxonMobil make now are likely to affect the company’s operations for many years.

For instance, it has to decide where to drill, which can take many years. Then it has to extract the resource and sell it, hopefully for many more years. That means the project’s profits are not only affected by today’s carbon price, but what it could be in several years or even a decade.

So ExxonMobil and similar companies use a high internal carbon price to test whether such projects would still be profitable if polluting became expensive. Because the projects have long lifespans and carbon prices look set to rise, they use a much higher price than today’s market rate.

The same isn’t necessarily true for companies that make shorter-term investments. The IT and consumer goods sectors produce and sell their products on a much shorter timeframe. It’s now common for a new iPhone to come out every year, for instance. So they can use a carbon price that is much closer to today’s market rate when modelling their product’s profitability.

That would explain why energy companies like ExxonMobil seem to bet on higher carbon prices than Google.

Infographic created using Piktochart.

Price adjustments

So what’s the ‘correct’ carbon price? It’s hard to say, as it depends on a lot of variables and what the ultimate goal is.

Economic models estimate what today’s carbon price should be by calculating the ‘social cost of carbon’: the cost to future generations of emitting an additional tonne of carbon dioxide today.

Most economic models suggest today’s carbon price should be set somewhere between $15 and $150 per tonne. The US government uses a carbon price of $38 for today’s policy decisions, potentially rising to as much as $55 in 2030. The UK government uses an internal carbon price of around $6, rising to $70 in 2030.

The majority of the companies that told CDP their carbon price fall into that range.

If companies’ carbon price estimates turn out to have been too high, they’ll still reap the rewards from low risk investments but may have missed out on some high carbon opportunities. In contrast, those that have set prices too low are committing the world to a high carbon path while putting themselves at risk if carbon prices rise.

Only time will tell whether those that hedged their bets and planned for a carbon constrained future turn out to be market winners.