Have reports of coal’s demise been greatly exaggerated? It depends which part of the world you look at.

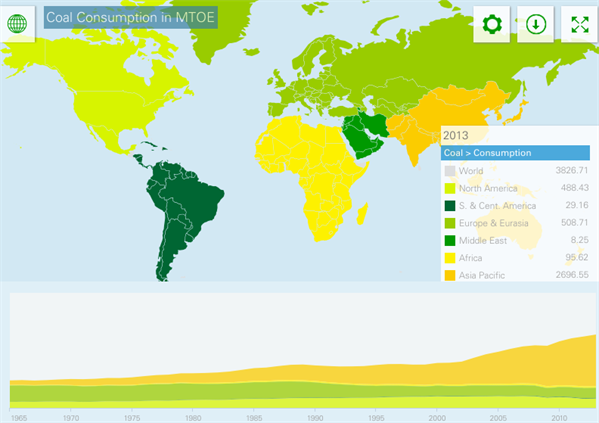

Global coal use has grown significantly over the last decade, with global demand increasing 60 per cent between 1990 and 2011, according to research body the International Energy Agency (IEA). With some countries implementing climate policies to limit the use of polluting fuels, some commentators are predicting coal’s imminent demise.

BP Global Coal Consumption. Source: BP Statistical Review of World Energy.

That’s probably premature. While some European countries are ramping up renewables, shutting coal plants and closing mines, other parts of the world are planning an extraction frenzy to feed emerging economies’ seemingly insatiable energy demand.

Here’s a quick guide to coal’s prospects around the world.

China: Coal is dominating the market

China is the world’s largest coal user, producer and importer. Motivated by air quality concers, China is making some efforts to reduce use of coal power, but the country still uses a huge amount of coal – 4.2 billion tonnes in 2012, according to the Energy Information Administration.

That’s about four times as much as the whole of Europe consumed the same year.

Last September, the government prohibited the building of new coal power plants in three populated areas around Beijing, Shanghai, and Guangzhou as part of the country’s national action plan. That should help curb coal power generation. But the World Resources Institute, an environmental thinktank, says further national policies will be needed if the country is to make significant steps to reduce power sector emissions.

Chinese Coal Miner. Credit: ZHart.

The IEA expects China to continue to be a major industrial coal consumer. Aside from the power sector, the iron, steel and cement industries all rely on the fuel for heat and power. As such, coal is set to continue as China’s main energy source all the way up to 2035, and possibly beyond, according to the IEA. And China will continue to ramp up coal production to meet demand, the IEA says.

India: Coal boom

India is currently the world’s third largest coal consumer, and demand for the fuel is set to grow in coming decades. PwC, a consultancy, projects India’s coal demand will grow by about seven per cent each year for the next decade. The IEA expects India to more than double its coal consumption by 2035.

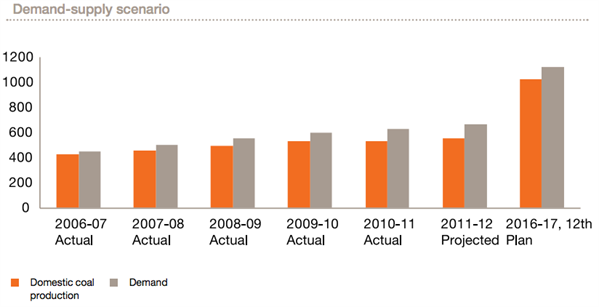

Commercial, technical and legal difficulties – alongside a series of major political scandals – have held up the expansion of India’s mining industry. That means that while India produces a lot of coal, it’s unlikely to be able to increase production quickly enough to meet rocketing demand – creating an ever-largening gap between production and demand, as this chart shows:

Source: PwC – The Indian coal sector: Challenges and future outlook.

That means India is likely to become increasingly depend on imports, and is set to become the world’s largest coal importer by around 2020, according to the IEA.

Australia: Relying on exports

While some have argued that a solar power boom means the Australian coal industry is no longer economically viable, the country remains the world’s second-largest coal exporter.

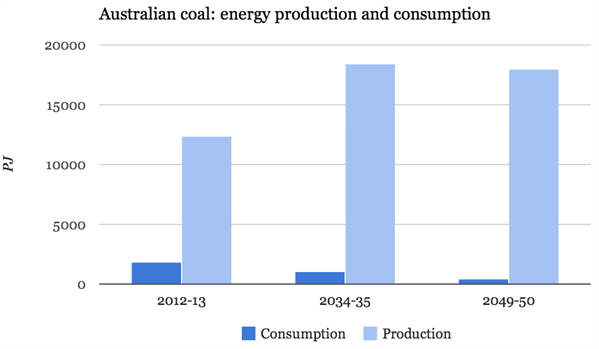

While domestic consumption is expected to reduce in coming years, the Australian Bureau of Resources and Energy Economics (BREE), an Australian government economic research unit, still thinks coal has a future.

Electricity consumption from coal is expected to get squeezed in the coming decades as renewable energy – particularly small scale solar – starts to become more competitive, the BREE predicts. Likewise, domestic energy consumption from coal is expected to tail off (the dark blue bars on the chart below).

In contrast, BREE expects coal production (the light blue bars on the chart above) to increase up to 2035, before falling slightly.

BREE predicts that coal production will be at a higher level in 2050 than it was in 2013, with most of the coal likely to be exported to Asia’s emerging economies, as China’s demand drops.

USA: Coal going strong despite shale gas

The US uses the most coal of any developed economy, according to the IEA – with the country accounting for 45 per cent of the OECD’s total coal consumption.

Powder River Basin. Credit: Doc Searle.

Coal is primarily used for power generation. Despite the country’s well publicised shale gas boom, coal remains the main fuel used for electricity generation, generating about 40 per cent of the US’s power in 2013, with gas producing about 29 per cent, according to the Energy Information Administration (EIA), the energy statistics department of the US government.

The EIA doesn’t expect this to change much in the next two decades. It projects coal providing about 40 per cent of the US’s power in 2035, despite the President’s much lauded plans to curb coal power generation.

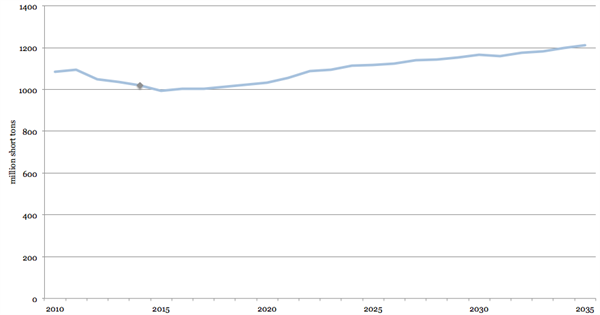

Similarly, the US is likely to keep producing a lot of coal. The EIA expects coal production to increase gradually to 2035, with most of the fuel exported.

US Coal Production EIA. Source: US Energy Information Administration. Graph by Carbon Brief.

EU: Long term squeeze

It’s a very different picture on the other side of the Atlantic, where the EU’s long term commitment to addressing climate change should see coal increasingly squeezed out of the energy mix.

The European Commission expects energy consumption from coal to halve by 2050, from 16 per cent to 8 per cent. As renewables increase their share of electricity generation, much less coal is expected to be used to fuel the region’s power stations. The commission projects coal generation will account for 12 per cent of the EU’s electricity in 2030, and 7 per cent in 2050 – down from 24 per cent in 2010.

Although the EU’s coal consumption has dropped significantly over the last two decades, there has been a slight uptick in recent years, as the graph below shows. That’s partly down to countries using cheap coal imports for power generation instead of less-polluting gas, in part as a consequence of the US shale gas boom.

Eurostats Solid Fuel Consumption. Source: Eurostats, Inland energy consumption by fuel: solid fuels, by 1,000 tonnes of oil equivalent.

In the long term, the downward trend in coal use is likely to resume. Policies such as the large combustion plant directive and industrial emissions directive which limit air pollution are expected to force many coal plants to reduce the amount they operate, and eventually shut.

Officials hope the EU’s energy efficiency policies and renewable energy goals will also see the region use less energy and switch to less polluting power sources.

UK: A coal minnow

The EU trends are expected to be reflected in the UK.

A new report from the network operator National Grid looks at four ways the government could decarbonise the UK’s energy sector. Unsurprisingly, coal has a limited role in each of them.

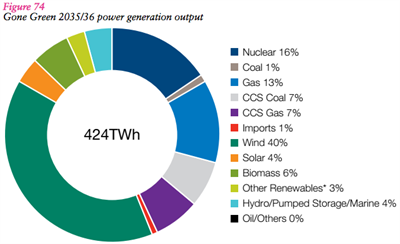

The scenarions show coal’s share of the UK’s power generation falling to between one and nine per cent by 2035, down from around 40 per cent today.

Gas could be expected to take over as the primary fossil fuel used to generate electricity, with perhaps as much as 47 per cent of our electricity coming from gas in 2035, National Grid suggests.

National Grid Future Generation. Source: National Grid, ‘Going Green’ scenario in the Future Energy Scenarios 2014.

Coal and the UK’s climate legislation are basically incompatible, barring large-scale carbon capture and storage. The UK has a legally binding commitment to reduce emissions by 80 per cent by 2050. As the power sector currently accounts for about 30 per cent of the country’s emissions, a lot of the cuts will have to be made by switching to cleaner sources, like nuclear or renewables. EU legislation also requires the UK to ramp up renewables and phase out old coal power plants.

But as the data we’ve just discussed suggests, without international efforts to decarbonise, it’s likely the coal that the UK or Europe would have used will still get burned somewhere. Coal’s global future ultimately depends on whether policymakers implement stringent climate policy.

In summary, a range of projections suggest coal is not dead and is probably not going to die any time soon. For now, assessments of the coal industry’s health rather depend on which part of the world is under the microscope.