Investigation: Does the UK’s biomass burning help solve climate change?

Simon Evans

05.11.15Simon Evans

11.05.2015 | 12:00pmIn the name of tackling climate change, the UK has become the largest importer of wood pellets in the world in just five years.

The UK’s demand for wood pellets is set to break five million tonnes this year and perhaps 10 million within a few years, fuelling a growing global trade and vociferous debate between energy firms and NGOs.

Accounting methods mandated by government show burning wood in place of coal is shaving millions of tonnes off UK emissions, yet NGOs say separate government research shows the opposite.

So, does the UK’s growing use of biomass for power generation help solve climate change or not? Carbon Brief guides you through the dense thicket of debate in search of answers.

Biomass Britain

Ten years ago, just 1% of the UK’s energy came from renewable sources. In 2007, Tony Blair signed up to an EU-wide 20% by 2020 goal, having reportedly mistaken the target for energy as one that covered electricity only. After Blair left office this EU target was divided up among member states, with the UK agreeing to a 15% by 2020 domestic goal for renewables.

The government set out its approach to meeting this challenging goal in its 2009 UK Renewable Energy Strategy. This said the UK would “ramp up the supply and use of biomass for heat, power and transport while ensuring sustainability and protecting the environment”.

By 2013, the UK was getting 5% of its energy needs from renewables, of which bioenergy supplied about a third. Some of this comes from landfill gas and waste incineration, but a large part comes from biomass electricity, where wood pellets are burnt to generate power. It is quick and relatively cheap to convert existing coal-fired power stations to burn biomass with or instead of coal. These plants can also run around the clock, unlike wind turbines or solar panels.

The potential for further biomass expansion remains large, potentially providing 14-21% of the green energy needed to meet the UK’s 2020 target, according to the UK’s Renewable Energy Roadmap, which sets out the contributions that could be made by different sources.

Imports fuel the UK’s biomass needs

The problem with ramping up UK biomass electricity generation is that the UK’s forests don’t produce enough wood to meet demand. Official figures show UK woodlands produce around six million dry tonnes of sawn logs, wood panels and wood pulp or paper each year. The UK produces only 0.3 million tonnes of wood pellets and briquettes.

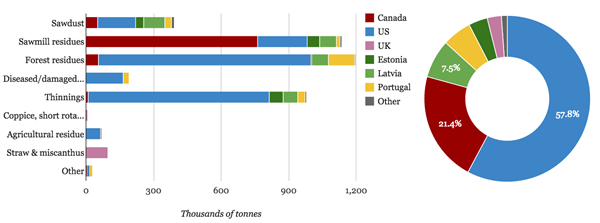

The UK’s power plants burnt 3.4 million tonnes of wood pellets in the 2013/14 financial year, up from less than 0.2 million tonnes in 2009/10. That’s why the majority of the UK’s biomass for electricity is being imported. The world’s top three wood pellet exporters in 2013 were the US, Canada and Latvia (graphic below, top left).

This rapid scaling up of UK biomass burning has been the driving force behind a growing global trade in wood pellets, particularly exports from the US. The UK was responsible for 58% of the increase between 2012 and 2013 (graphic below, top right).

As a result, the UK has become the world’s largest wood pellet importer, with a 28% share of the global market (graphic, top centre). It imported 3.9 million tonnes in 2013, an estimated 4.6 million tonnes in 2014 and is expected to import 5.5 million tonnes this year.

The UK is the world’s largest wood pellet importer and its increasing demand is fuelling a growing global trade in pellets. Drax power station, the largest UK user of these pellets, says most of its biomass comes from thinnings and residues. Source: Drax biomass supply report 2014, Ofgem figures and Carbon Brief analysis of UN Food and Agriculture Organization figures. Credit: Biomass in Britain. Rosamund Pearce, Carbon Brief.

The graphic shows other EU countries, notably Italy and Denmark, are also importing wood pellets to burn for power. In total, some 57% of the EU’s 2020 target is expected to be supplied by bioenergy, though most of this will be in the form of heat and transport biofuels rather than biomass electricity.

It is the UK that has led the way on biomass power, however. Just three UK power stations – Ironbridge in Shropshire, Tilbury in Essex and Drax in Yorkshire – burnt almost all the UK’s imported pellets during 2013/14 (chart, bottom right). Ironbridge suffered a fire last year and is expected to close permanently during 2015. Tilbury is hoping to extend its life for another decade.

More biomass power plants are in the pipeline. The 420 megawatt Lynemouth coal-fired power station in Northumberland has secured a government contract to convert to 100% biomass, with an estimated start date of 1 March 2017. The contract would run until 2027 and Lynemouth would require 1.5 million tonnes of wood pellets per year.

The Lynemouth deal is subject to approval from the European Commission, which it is expected to receive subject to some changes. A 300 megawatt biomass plant at Teesside in North Yorkshire has secured commission approval and is expected to start operating in July 2018.

Biomass at Drax

However, the UK’s largest biomass user by far is and will remain Drax, the four gigawatt power plant in Yorkshire which has converted two of its six units to use 100% wood pellets instead of coal.

Andrew Brown, Drax head of communications, tells Carbon Brief the company expects to convert a third unit to use 90% biomass by quarter three 2015, and then 100% biomass by 1 February 2016. If this goes ahead as planned, Drax would need to source around 7.5 million tonnes of biomass per year – more than half of the global trade in wood pellets in 2013.

Drax would, ultimately, like to convert a fourth unit to biomass before 2019. This would increase biomass capacity at Drax to around 2.5 gigawatts and wood pellet requirements to around 10 million tonnes per year. Add in Lynemouth and Teesside and UK demand could reach 13 million tonnes or more.

In summary, Drax is the largest user of imported wood pellets in the UK, its needs are growing fast and the UK, in turn, is the largest importer of pellets in the world.

The Drax biomass conversion is part of the reason the UK’s coal use fell below 50 million tonnes in 2014 to a level not seen since the 1850s. This contributed to a 9.7% reduction in UK carbon emissions in 2014, a record for a year with a growing economy.

Drax’s pivotal position in the global wood pellet sector explains why it has become a focal point for debate about biomass sustainability. For instance, it is the target of the ‘Axe Drax’ campaign organised by NGO Biofuelwatch . In a 22 April open letter to DECC, Biofuelwatch and other NGOs called for an end to the subsidies Drax receives for burning biomass.

Drax biomass sustainability

In February, Drax published a biomass sustainability report for the first time. This says it burnt 1.6 million tonnes in 2013 and four million tonnes in 2014. This means that in 2013 Drax was the fourth-largest pellet importer in the world after Denmark, Italy and the rest of the UK. As noted above, this requirement will increase again in 2015, if Drax proceeds as planned.

Where does all this biomass come from? Mirroring the global wood pellet export leaders in the graphic above, some 58% of Drax’s 2014 crop came from the US (light blue area, below), another 22% from Canada (brick red) and 7.5% from Latvia.

The sources of biomass burnt by Drax in 2014, according to the company’s first ever biomass sustainability report. Charts by Carbon Brief.

The chart above shows that the large majority of the wood pellets burnt by Drax last year came from sawmill residues, forest residues and thinnings, making up 81% of the total. We’ll explore what those categories actually mean in a moment.

Drax says its use of this wood reduced its coal burn by a third and reduced its emissions by six million tonnes of carbon dioxide, equivalent to 1.5% of total UK emissions. It says 122 kilogrammes of carbon dioxide was emitted for each megawatt hour of electricity generated in its biomass units.

This can be compared to coal emissions of around 1,018 kgCO2/MWh and gas at around 437kg. The government has set limits for biomass emissions per megawatt hour of 285kg from 2020, 200kg from 2025 and 180kg from 2030. On this measure, Drax is clearly meeting the limits and also benefitting the climate by increasingly burning biomass instead of coal.

Carbon stocks

The biomass emissions methodology being used by Drax is mandated under UK and EU rules. It includes lifecycle emissions from the cultivation, harvest, processing and transport of wood pellets from the forest to Drax’s plant. But it ignores potentially large changes in forest carbon stocks and indirect effects caused by increased demand for wood products.

In an attempt to fully account for these aspects of biomass harvest, the Department for Energy and Climate Change’s (DECC’s) then-chief scientist Professor David MacKay created the Biomass Emissions and Counterfactual model, or BEaC for short.

Carbon Brief looked at the results of BEaC when it was published last year. The model poses a series of “what if?” questions to explore plausible scenarios for the consequences of increase biomass demand. For example, will demand for wood pellets cause foresters to harvest their trees more frequently? Will pulp be diverted away from paper mills towards pellet plants?

The BEaC report concludes that it is “possible to produce electricity with significant greenhouse gas savingsâ?¦ However, other scenarios can result in greenhouse gas intensities greater than electricity from fossil fuels”.

Good for the climate?

Where does the Drax fall on this spectrum between good wood, and wood that is worse than coal for the climate?

Carbon Brief attempted a basic comparison between Drax sourcing categories and the BEaC scenarios. Sawdust and sawmill residues (chippings and off-cuts) account for 37% of Drax supplies and are, on the face of it, relatively uncontroversial and low-emission sources. BEaC puts emissions at no more than 121 kgCO2/MWh.

If demand from Drax diverts these products from other end uses, however, BEaC says the associated emissions can “vary greatly”. Emissions can be low, at 127 kgCO2/MWh, but, in certain scenarios where displaced demand has knock-on impacts in Brazil can lead to emissions higher than coal of up to 1,761 kgCO2/MWh.

Forest residues, accounting for another 29% of Drax supplies, are a little more complicated. These include branch wood, tree tops and “other low grade wood”, says Drax. Emissions in the BEaC scenarios range from below zero up to 536 kgCO2/MWh, higher than for gas.

The below-zero emissions scenarios are where fine, narrow-diameter woody materials are burnt in a power station instead of being left on the forest floor, where they would rapidly rot and release methane.

Less climate-friendly, according to BEaC, is the use of larger diameter wood that could store its carbon on the forest floor for many years. The Drax sustainability report does not provide enough information to make this distinction.

Most controversial of all, however, is what Drax calls “thinnings”. Matt Willey, head of public affairs for Drax and the firm’s former communications manager, tells Carbon Brief: “A thinning is a whole tree in layman’s terms”, but the reality is more nuanced, he says. It might include misshapen or other low-value timber, he says, such as pulpwood used to produce paper.

NGOs frequently accuse Drax of using whole trees and the term has become an emotive symbol of the alleged ills of the biomass power industry. Drax is at pains to clarify that it isn’t only “some quite large trees”, as it puts it.

In fact, the label is relatively unimportant. Adam Macon, a campaign director for US NGO Dogwood Alliance, tells Carbon Brief: “If biomass policies accurately accounted for carbon impacts of burning wood and set a diameter limit then this definition war would not be an issue”.

More important, according to the BEaC model, is where the wood comes from and what would have happened without increased demand for pellets.

In a briefing paper on Drax and BEaC, Friends of the Earth says the thinnings used by Drax correspond to a set of BEaC scenarios in which harvest rates in naturally regenerating southern US forests are increased, in order to supply increased demand for pellets. Nearly 90% of productive forests in the US are naturally regenerating.

In these BEaC scenarios, the associated emissions are at least three times higher than for coal. The BEaC report scenario assumes increased demand for pellets that would see these forests harvested every 60 years, instead of every 70 years.

Alternatively, they might be harvested every 70 years where the rotation would have increased to every 80 years without the higher pellet demand. Either way, the average amount of carbon locked in the forests is reduced, the BEaC reports says, as increases in the amount of biomass extracted outweigh a boost to forest growth rates.

A fools errand

Willey insists harvest rotation lengths are unaffected by Drax’s demand for biomass. He tells Carbon Brief: “You don’t change rotation for biomassâ?¦ the lowest value product doesn’t dictate the actions of a forester. Ring up one of the big foresters and ask if biomass would affect rotation rates. That would be an insane proposition.”

He also says attempting to calculate the emissions from Drax’s biomass with the BEaC model is a “fools errand”. Willey says many assumptions in the model would need to be adjusted: “If you just change one variable you can get a completely different answer”.

A source close to DECC’s biomass modelling tells Carbon Brief:

“I believe DECC published BEaC hoping that industry would use it. So I think we hoped that Drax would actually map their sources onto BEaC themselves. I think a reasonable question to ask Drax is why won’t you [use BEaC]? What are you trying to hide?”

Drax has not and is not planning to use the BEaC to model emissions associated with the biomass it uses, Willey tells Carbon Brief. He says the BEaC model is “not a very accurate way of measuring carbon changes” in forests and its scenarios are “hypothetical”.

Drax argues it is more important to look at landscape-level forest carbon inventories. In a factsheet provided to Carbon Brief, it says forest areas and standing wood volumes are increasing in the US, partly as a result of “active management” by loggers. It says “forests are growing, not shrinking, in all of the US states that Drax sources from”.

For example, Drax’s Morehouse pellet plant is taking waste wood that used to go to a paper mill, Willey says. The mill closed three years ago and the waste wood had not been going anywhere since then, Willey says: “In many markets, no-one is buying the waste wood.”

He says the local forest “basket” adds 22 million tonnes of biomass each year through new growth, while demand is only 15 million tonnes. This leaves plenty of surplus biomass that can be harvested without reducing forest stocks, he says.

Country-scale forest stocks

This landscape-scale view of forest stocks has an attractive simplicity. Surely, if the amount of carbon locked in US forests is increasing, despite harvest for the likes of Drax, then all must be well for the climate?

US pellet exports to the UK are large, perhaps 3.5 million tonnes this year, according to a January 2015 report from the US Department of Agriculture Foreign Agricultural Service. But they remain small compared to the 320 million tonnes of wood harvested from US forests each year. This total is, in turn, around 30% below harvest levels seen in the 1990s, the report says, while 98 pulp or paper plants closed in the US between 1998 and 2003.

A December 2014 report from the US Forest Service offers partial support for this argument. It says forest hardwood inventories are expected to continue increasing out to 2020, even as bioenergy demand increases.

Crucially, however, the report says forest carbon stocks are expected to grow more slowly as a result of EU demand for biomass. It is precisely this sort of relative change in carbon stocks that the BEaC model attempts to capture.

The forest service report says:

“Even assuming full utilisation of mill residues and increased utilisation of logging residues, harvest of pine and hardwood non-sawtimber feedstock increasesâ?¦ hardwood inventories continue to increase [but] end at lower levels thanâ?¦ without new bioenergy demand”.

The report says pellet feedstock prices and forest harvests have already increased in response to the “key driver” of rising demand from EU biomass electricity plants. Increased harvests of naturally regenerating forest correspond to the BEaC scenario most often highlighted by NGOs, where biomass emissions are three times worse than coal.

Genuine carbon reductions?

How likely are these high-emissions scenarios? After all, if true they would totally undermine the reason for paying for Drax and others to burn biomass. As we’ve seen, this is a complex question that seems insufficiently answered by information that’s publicly available.

This is unsatisfactory, given that UK bill-payers are spending hundreds of millions on biomass subsidies. So, DECC is paying £134,000 to consultancy Ricardo AEA to investigate further. The firm will assess the likelihood of the BEaC biomass scenarios, where emissions are worse than coal or gas in a year-long, three-phase project that started in March.

DECC’s specification for the research says:

“UK government is committed to the principle that bioenergy should deliver genuine carbon reductionsâ?¦ This involves on-going monitoringâ?¦ The BEaC model and accompanying report and this projectâ?¦ form part of this”.

It says that Ricardo AEA will be expected to contact existing biomass electricity generators, environmental groups and relevant trade bodies, so they can provide “any evidence that any of the [high-emissions] scenarios are currently happening”.

The project is expected to ask what factors determine harvest rates and whether rotation lengths have, in fact, changed recently. For instance, DECC’s specification asks if the relative price of different forest products is the limiting factor, as Drax argues.

The project also asks if UK demand for biomass might divert pulpwood, thinnings or sawmill residues from other users. It asks whether harvest of southern US pine plantations might occur less frequently without UK pellet demand, and whether “whole trees are used in pellet manufacture [and], if so, what are the carbon stock impacts”.

Conclusion

This DECC research project will report initial findings later this year. Meanwhile, the government is introducing mandatory sustainable sourcing requirements later this year. These won’t please everyone. Richter tells Carbon Brief: “There’s a lot of concerns about how clear the [sustainability] reporting is going to be.”

The European Commission says it will publish a new policy on sustainable biomass during 2016-17. Environmental groups want the commission to cap biomass use, to introduce strong sustainability standards, and to account for emissions from biomass burning within its emissions trading system (EU ETS).

Whatever happens over the next few years, the party for biomass power in the UK will not last forever. At an event in March, Ed Davey, the UK’s energy and climate secretary, questioned whether the UK should be adding more biomass electricity. He said the best research showed there was “good biomass and bad biomass” and that we had be “a bit more careful than people thought a few years ago”. He added that biomass was only a “transitional” green power source.

As Drax’s Willey explains, the firm has to recover its investments by 2027, when biomass power subsidies are due to end. Until then, we need to know how much of the UK’s burning biomass is helping the climate. If most of it isn’t, the experiment should be cut short.

Here’s what we know so far: Good biomass includes fine woody residues taken from forests instead of burning it at the roadside, or leaving it to rot. Burning sawdust and sawmill residues is good for the climate, too, unless rising pellet demand indirectly drives deforestation in countries like Brazil.

Bad biomass includes extracting larger pieces of woody residue rather than leaving them to decompose slowly on the forest floor, which might be no better for the climate than gas.

The worst biomass of all would be if the surge in UK demand for wood pellets sees US forests harvested more frequently than they would have been otherwise. Evidence from the US government suggests this is already happening, and the climate impacts could be worse than coal.

Drax has taken the commendable decision to publish its sourcing data. Yet its refusal to use the BEaC calculator, along with grey areas between pellet sourcing definitions, make it impossible to decide if the weight of biomass burning is good wood for the climate, or bad.