In-depth Q&A: How does the UK’s ‘energy white paper’ aim to tackle climate change?

Josh Gabbatiss

12.16.20Josh Gabbatiss

16.12.2020 | 4:55pmAfter months of delays, the UK government has launched a white paper setting out the government’s agenda for the energy sector and its role in tackling climate change.

The document, which is the first of its kind for 13 years, comes as the nation attempts to recover from the Covid-19 pandemic and set a course for net-zero emissions by 2050.

Many of the big announcements were first revealed in the prime minister Boris Johnson’s recent 10-point plan, which laid a foundation for the government’s climate strategy.

However, the long-awaited energy white paper sets the wider stage for the net-zero target and marks the start of a critical period that will see the government launch numerous consultations and strategies ahead of hosting the COP26 climate summit later next year.

Even with the wealth of additional detail in the white paper, there remains a significant gap between proposed emissions cuts and those required under the UK’s climate targets.

In this Q&A, Carbon Brief addresses the big questions arising from the white paper and places it into the wider context of the UK’s effort to address climate change.

- Does the energy white paper set the UK on a course for net-zero?

- What are the UK’s plans for a post-Brexit emissions trading system?

- Will the UK build more nuclear power?

- What are the plans for renewables?

- How does the government see the electricity system changing?

- What are the plans for homes, heating and hydrogen?

- What are the white paper’s other key points?

Does the energy white paper set the UK on a course for net-zero?

The last time the government released an energy white paper was in 2007. Tony Blair was prime minister and the UK was still a year away from implementing the landmark Climate Change Act that would legislate an 80% cut in emissions by 2050.

A lot has changed in the intervening years – and this is very evident from some of the language used in the 2007 paper.

Among other things, the document contains a whole section on “cleaner coal” and says “fossil fuels will continue to be the predominant source of energy for decades to come”. It targets 20% renewables in the grid by 2020.

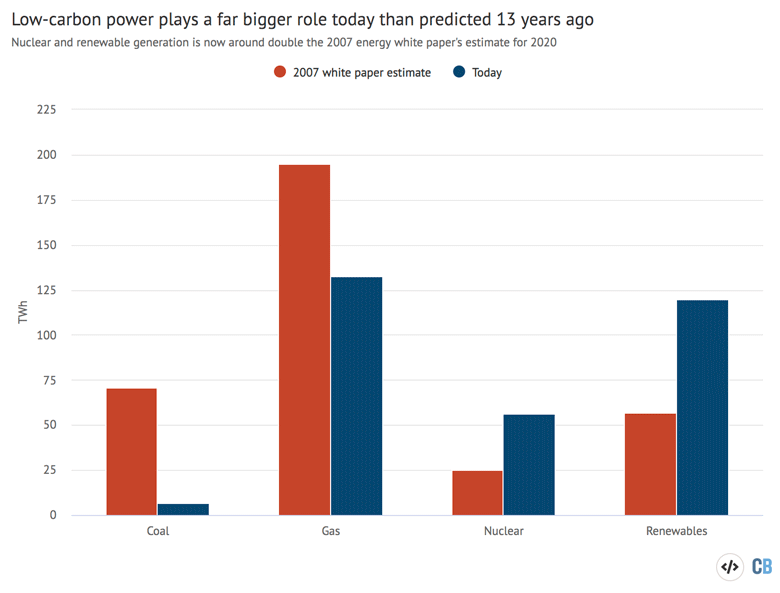

Today, more than a third of the UK’s power generation comes from renewables and this year the nation went 67 days without using coal-fired power. The difference between the 2007 white paper’s estimates for 2020 and the reality today can be seen in the chart below.

The new white paper was first announced in 2018 by the then-business secretary Greg Clark. Since then, the UK has significantly ramped up its climate ambition with its net-zero target set last year.

This ambition is reflected in the new document, which is titled “powering our net-zero future” and repeatedly describes the UK as a “world leader” in various areas of climate and energy policy.

Across the paper’s 165 pages it lays out a plan that the government says will “transform energy”, provide people with a “fair deal” and drive a “green recovery” while supporting up to 220,000 jobs over the next decade.

Business secretary Alok Sharma described the paper as “a decisive and permanent shift away from our dependence on fossil fuels, towards cleaner energy sources”.

Prof Rebecca Willis, an energy and climate governance researcher at Lancaster University, tells Carbon Brief the white paper is evidence of “less complacency” about the task ahead:

“This is a very different energy white paper from one that might have come 10 years ago or even five years ago. I think that the commitment to the net-zero target runs all the way through it…I think there is now much more of a recognition of the job that has to be done.”

Due to the “drip-feeding” of energy and climate policy in recent months, including the prime minister’s recent “10-point plan”, most of the big policy announcements have already been reported.

These include an end to the sale of new petrol and diesel cars by 2030, support for an extra 40 gigawatts (40GW) of new offshore wind and £3bn in funding for home energy improvements.

Much further detail is expected in the coming months as various sector-specific strategies and consultations emerge, as well as plans for the sixth carbon budget, which government advisers at the Climate Change Committee (CCC) advised on last week. (See Carbon Brief’s in-depth summary.) There will also be an overarching net-zero strategy.

But, as it stands, there is a “policy gap” between what the government has announced and where it needs its emissions trajectory to be heading. While the UK is on course to hit its third “carbon budget”, which ends in 2022, it is not on track for the next two five-year budgets, or for the 2050 net-zero goal.

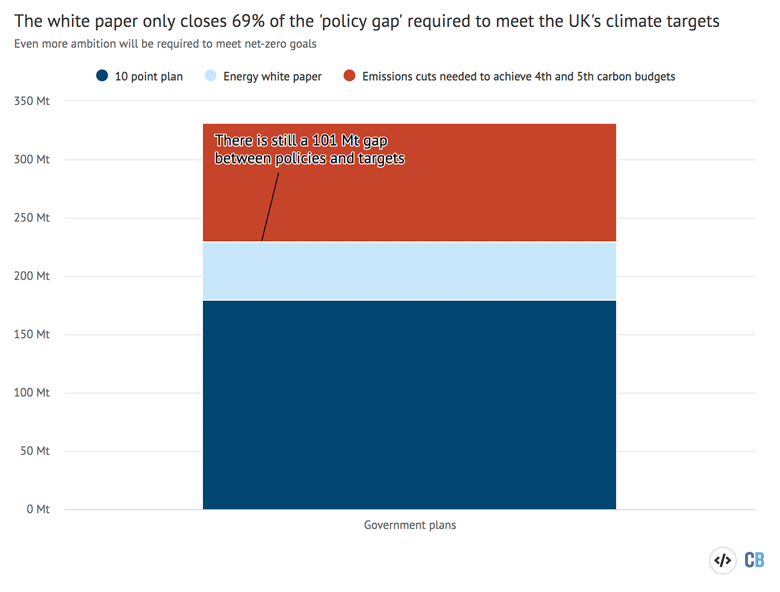

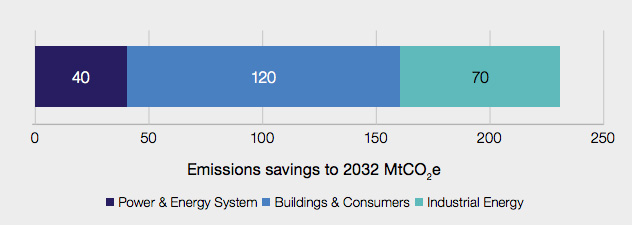

The government said the measures in its 10-point plan would cut 180m tonnes of CO2 equivalent (MtCO2e) by the end of the fifth carbon budget in 2032. Carbon Brief estimated this would close 55% of the gap to achieving its upcoming budgets.

Accounting for the policies in the new white paper the government has increased that estimate to 230MtCO2, plus “further savings in other sectors such as transport”.

This would bring the government closer to delivering its upcoming budgets, but would still leave a gap of 101MtCO2e, as the chart below shows. This does not take into consideration the longer term net-zero target which will require more substantial cuts.

In the white paper, the government states:

“We recognise that more will need to be done to meet key milestones on the journey to net-zero, including our ambition for carbon budget 6, which we will set next year, taking into account the latest advice from the Climate Change Committee.”

In an article published after the white paper’s release, Dr Jonathan Marshall, head of analysis at the Energy and Climate Intelligence Unit (ECIU), said the white paper was “not short of decisions, implicit and explicit” and that its overall theme was of “notable progression towards net-zero”.

He also said that the Department for Business, Energy and Industrial Strategy (BEIS) was “almost definitely short-selling” its emissions cuts, given that they are “based on the existence of targets alone, with few policies to deliver them”.

Marshall pointed out that recent modelling by Cambridge Econometrics found that the 10-point plan alone would save more than 420MtCO2e by 2032, as government models assume a slower uptake of clean technology. (However, that analysis did note that the plan still did not align with the UK’s net zero goal.)

As the government fleshes out some of its targets with policies in the coming months, it is therefore likely that the estimates for emissions savings will increase.

What are the UK’s plans for a post-Brexit emissions trading system?

One of the most significant new announcements from the white paper is the confirmation that the UK will have its own emissions trading scheme (UK ETS) from 1 January 2021 to replace the current EU ETS.

This is significant given the looming end of the Brexit transition period and the resulting uncertainty about how – or even whether – the UK exits the EU ETS.

An ETS involves high-emitting actors, such as power plants, heavy industry and domestic airlines, being allocated a set amount of credits to emit greenhouse gases, and then being forced to purchase more if they go over their threshold.

Previously there was some debate around whether the UK would directly replace the existing system or instead implement a carbon tax, with the Treasury thought to prefer the latter and BEIS the former.

The government is promoting its new system as “the world’s first net zero carbon cap and trade market”. From day one, it says the cap on emissions allowed will be reduced by 5% compared to the EU system.

It also says that having implemented this system it will “consult in due course on how to align the cap with an appropriate net-zero trajectory” and plans to explore expanding the ETS to the two-thirds of emissions it does not cover.

Regulations for the UK ETS, including a cap on emissions each year up to 2030, have already been published and more details are expected in the coming days.

The International Emissions Trading Association (IETA) has welcomed the plan, which its EU policy director Adam Berman saying it would “ensure both flexibility for industry and environmental certainty for policymakers”.

However, there are concerns that the UK ETS, announced just two weeks before it is meant to take effect, is a long way from being the world-leading scheme the government has pledged.

In mid-November, after energy minister Kwasi Kwarteng was questioned by the BEIS committee about the UK’s future carbon pricing regime, the committee admonished him for a lack of clarity around the future scheme.

Prof Caroline Kuzemko, who specialises in the political economy of sustainable energy transitions at the University of Warwick, tells Carbon Brief that the announcement contained a lot of “bluster”:

“It’s one thing announcing something and it’s another thing it actually taking effect…No other country has managed to come up with an emissions trading scheme within the space of a couple of weeks – it takes years.”

She adds that a key concern is the lack of international linkage, which is widely seen as necessary for the system to be effective in tackling emissions.

“It has to be linked internationally because otherwise it’s just going to be too small fry to really make sense for companies to get involved,” Kuzemko tells Carbon Brief.

Prior to the announcement, there was talk of the UK instating an ETS that was directly linked to the EU’s system. IETA’s Berman told Energy Monitor in November that “everyone wants a linked ETS”.

While this is no longer going ahead, the government says it is “open to linking the UK ETS internationally…but no decision on our preferred linking partners has yet been made”. Despite this vagueness, the EU seems to be the most likely and, perhaps, only viable partner.

The line from the UK government saying “no decision yet on our preferred linking partners” is funny. As if there’s lots of ETS options all over the world. Who would they link with, China?

— Dave Keating (@DaveKeating) December 14, 2020

There’s only one possible linking partner that would make a difference – the EU. pic.twitter.com/HPxNlpYh8S

The climate thinktank Ember, which has been advocating for a carbon tax, warns that a UK-only scheme could result in “dysfunctional climate policy”.

Phil MacDonald, an analyst at Ember, tells Carbon Brief that, even if it were 5% lower, the UK’s cap would be “very much higher than emissions”, resulting in a large surplus and the risk of low prices.

If this were to happen, Ember warns that UK risks making the same mistakes as the EU ETS in its first decade of operation, when its price was set too low rendering it “environmentally meaningless”.

Will the UK build more nuclear power?

Another big announcement – and one that has attracted the most headlines – is the government stating its intention to “bring at least one large scale nuclear to the point of final investment decision by the end of this parliament”.

While it does not mention it by name, the white paper’s release was accompanied by the news that ministers will enter negotiations with French energy company EDF over the Sizewell C nuclear plant on Suffolk’s coast.

There has been a long-running debate and plenty of controversy around the construction of the £20bn new facility at Sizewell, as with other proposed nuclear infrastructure in the UK.

The discussion largely hinges on how to fund such developments. The only nuclear power plant currently under construction, Hinkley Point C in Somerset, is expected to run £2.9bn over budget. The white paper notes that “raising enough private capital to finance a nuclear power station is challenging”.

Nevertheless, the government has repeatedly made it clear that it does plan to develop more nuclear power, most recently in its National Infrastructure Strategy.

In the white paper, the government says that, with most of the UK’s nuclear fleet retiring over the next decade, “our analysis suggests additional nuclear beyond Hinkley Point C will be needed in a low-cost 2050 electricity system of very low emissions”.

A government consultation last year concluded that additional new nuclear would be “required” to meet the net-zero goal. However, the National Infrastructure Commision has suggested that no more than one new nuclear plant should be agreed before 2025.

Prof Robert Gross, director of the UK Energy Research Centre, tells Carbon Brief that it is difficult to say definitively whether the UK “needs” new nuclear:

“It is possible to make a range of assumptions about future costs of technology X or technology Y and run a model of the power system to tell you which is ‘best’. The problem is that these assumptions usually turn out to be wrong.”

He says, in practice, it is more helpful to ask how the government can “make best use of competitive mechanisms to deliver net-zero at least cost” and to ensure “maximum transparency” if it does pursue a major new nuclear project.

To support its plans, the government says it is “continuing to explore a range of financing options for new nuclear with developers”.

These include using public money “provided there is clear value for money for consumers and taxpayers”, as well as exploring a new funding model known as regulated asset base (RAB).

The RAB model has been the subject of a lot of media coverage. The Financial Times described it as a mechanism that “could see consumers charged years before it has started generating electricity”, which has “attracted fierce criticism from opponents of nuclear power as it could leave energy bill payers on the hook for cost overruns”.

Among the various documents published alongside the white paper was a consultation outcome on RAB, which it says showed support from industry as well as from members of the public “who were not in principle opposed to nuclear”.

Environmental groups responding to the consultation said RAB could potentially provide preferential treatment to nuclear over renewables.

RAB effectively transfers some construction risk from the private sector to consumers and it could reduce the cost of capital and, therefore, electricity prices from that generator. Gross tells Carbon Brief:

“The question then is whether it is right to do this. If a clear case can be made on national interest terms then it is legitimate to do so. It is a very significant intervention in the energy market and a clear rationale needs to be provided for giving particular technologies special status.”

Separately, the white paper says the UK “continues to be a leader in the development of nuclear technologies” and reiterates a £385m funding commitment from the 10-point plan for “the next generation of nuclear technology”.

Finally, the paper also announces a strategy to build “a commercially viable fusion power plant by 2040”.

Nuclear fusion, which involves binding atomic nuclei to release large amounts of energy, is still a very early stage technology, despite having been researched for many decades.

The 2040 target, which first appeared in the Conservative election manifesto last year, has been widely viewed as overly ambitious and even a “fantasy”.

What are the plans for renewables?

At the heart of the energy white paper is a commitment to significantly scale up electrification.

This includes “an overwhelmingly decarbonised power system in the 2030s”. Last week, the Climate Change Committee recommended a 2035 date for decarbonisation to help put the UK on a net-zero pathway.

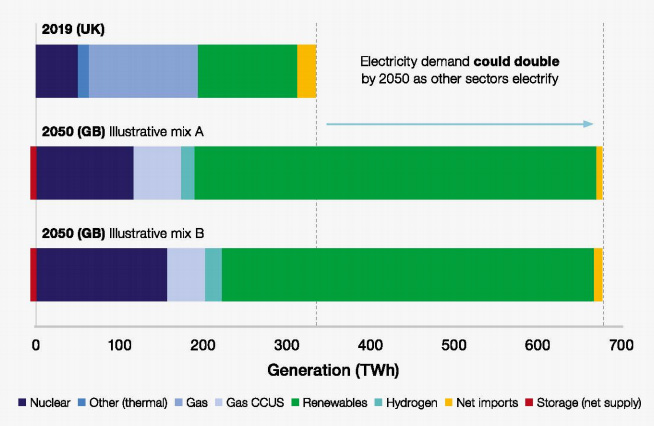

The switch to electric vehicles and the increased use of clean power for heating mean demand is expected to double by 2050.

This will require a significant scaling-up of low-carbon power as nuclear and coal plants come offline. As “a signal of our further ambition” the white paper even announces a consultation into bringing the coal phaseout date forward from 2025 to 2024.

The government says it is “not targeting a particular generation mix for 2050, nor would it be advisable to do so”.

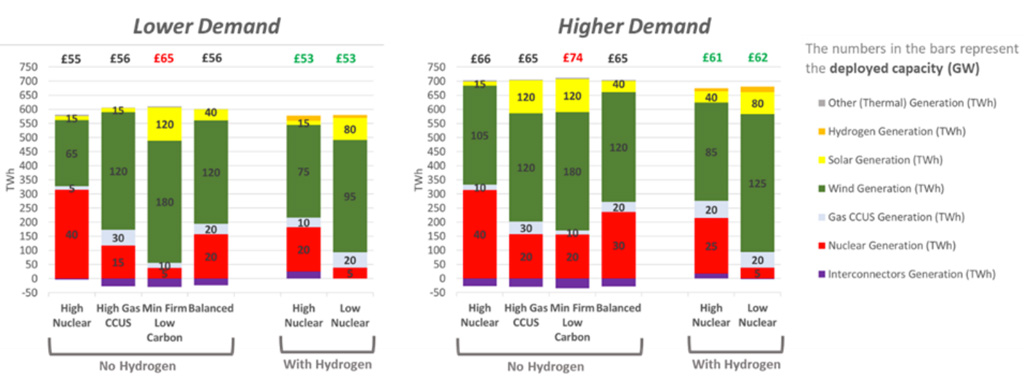

Nevertheless, it has concluded that a “low-cost, net zero consistent system is likely to be composed predominantly of wind and solar”, based on modelling of more than 700,000 unique scenarios. (BEIS has released the “modelling methodology” of its electricity system analysis alongside the white paper.)

The chart below shows how renewables, in particular, will need to expand to meet the increase in demand expected by 2050.

UK electricity mix today (top) compared to two illustrative potential electricity mixes for Great Britain in 2050. Source: BEIS analysis.

After a long period of excluding onshore wind and solar from competing in the government’s contracts for difference (CfD) auctions used to finance new renewable projects, the white paper confirms that the next auction in late 2021 will be open to both of these technologies.

Overall, the next CfD auction will aim to “deploy around 12GW of low-cost renewable generation”, on top of the 16GW of renewables supported by the system since its inception five years ago.

At the same time, the government has issued a consultation to establish how CfDs should develop in the longer term, indicating a move away from this system as the price of renewables falls.

The consultation document states that creating a market structure to enable the deployment of low-carbon technologies without government intervention “has obvious potential benefits”:

“Market forces can foster innovation that can’t be predicted and find solutions that reduce the overall cost of transitioning to a low-carbon power system for consumers.”

There have been suggestions that allowing such market forces to play out could encourage the development of technologies that address the variability of renewables as the UK moves to an ever more renewable-based system.

Despite this potential benefit, Gross tells Carbon Brief it is right that the government is taking a “gradual approach” to moving away from CfDs:

“At the same time, we need to consider whether, ultimately, a different sort of energy market can be created that is better at combining the low-risk conditions that investors welcome in the CfDs – very important to keeping costs down – with doing more to ensure that renewables schemes can play a role in system balancing.”

The government also says it will support “at least one” carbon capture and storage (CCS) power plant to be operational by 2030, to provide flexible capacity that can complement high levels of renewables.

It states it will introduce a business model based on the existing CfD framework to incentivise the use of CCS in power generation.

The chart below shows a range of potential “low-cost, low-carbon generation mixes” for 2050 from the electricity modelling document released by BEIS to accompany the white paper. It indicates a sizable role for gas power plants with CCS in most scenarios.

Some of the scenarios also include hydrogen to provide additional flexibility. The white paper itself says the government sees clean hydrogen and long-duration storage satisfying the “need for peaking capacity” and ensuring “security of supply at low cost” by 2050 (more on hydrogen in the section below).

Finally, the white paper announces the creation of a “ministerial delivery group” to work across departments and address any remaining barriers to renewable deployment.

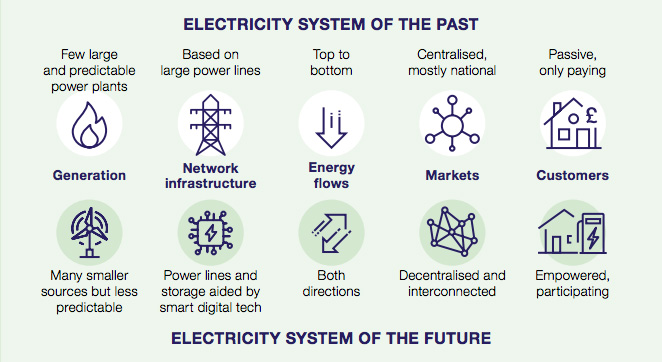

How does the government see the electricity system changing?

The government acknowledges that getting to a net-zero electricity system will likely require more than just constructing large amounts of renewables.

The white paper states that, as it becomes more decentralised, the “previously one-directional system is transforming into something more dynamic”.

It references fundamental changes in the power system as it takes on an increasing share of intermittent renewables and consumer habits change.

As it stands, the energy market involves simply selling people units of electricity and gas.

Much of the white paper is still focused on this model and keeping electricity and gas bills low, with much of the first chapter on “consumers” dedicated to this. (Indeed, some of the white paper’s early press coverage highlighted plans such as automatically switching customers to cheaper tariffs, rather than the broad focus of decarbonising energy.)

But the paper also acknowledges a potential shift in this model, with a reference to “assessing what market framework changes may be required” to drive the rollout of “tariffs and products that work for consumers and contribute to net-zero”.

With the current model, it is difficult to construct a market for demand response – such as choosing to charge electric vehicles when power demand is low – or self-supply for people with their own solar panels.

“If we are going to create an electricity system that is much more responsive and smooths out and reduces demand, we’re going to have to sell energy in a really different way,” Willis tells Carbon Brief.

The white paper also discusses the importance of smart technology and the contribution it could make to flexibility. Government analysis estimates that “a smarter, more flexible system could unlock savings of up to £12bn per year by 2050”.

To manage the envisaged shift in the energy system, the paper states that the role of energy regulator Ofgem and the operators of electricity, gas and network operators “still largely reflect the model from 30 years ago and need to be updated”.

(3) Take back control: While the market must drive down prices further through changes to CfD etc, clearly need greater coordination. Great to see changes to energy system governance critical to net zero, with more detail to come (and hint of a potential new body). pic.twitter.com/VCycwcXMSf

— Josh Buckland (@jbuckland13) December 14, 2020

There is even a reference to the potential for “an entirely new body” to replace Ofgem as it plans for a net-zero future.

This is something that Willis has previously proposed along with colleagues, as she tells Carbon Brief:

“It’s an almost impossible job for Ofgem to be creating the future market at the same time as regulating the current one, not least because they talk to the incumbents all the time and those incumbents have, obviously, vested interests.”

What are the plans for homes, heating and hydrogen?

The biggest chunk of emissions savings from the measures laid out in the white paper is expected to come from buildings, as the chart below shows.

Estimated emissions savings to 2032 from the energy white paper. Source: BEIS analysis.

It says that, by the mid-2030s, “we expect all newly installed heating systems to be low-carbon or to be appliances that we are confident can be converted to a clean fuel supply”.

Cutting emissions from heating is a considerable challenge and one to which the government says there is no single answer. It highlights electrically powered heat pumps, hydrogen, green gas and shared heat networks as potential options.

According to the white paper, with these alternatives in mind the government is also consulting on whether it is appropriate to end gas grid connections to new homes entirely from 2025, in favour of clean alternatives.

In all seriousness a 2025 end date for new gas connections is potentially much more exciting. Explicitly halting the spread of the gas grid, not nonsense about “hydrogen ready”.

— Clem Cowton (@ClemCowton) December 14, 2020

The plan reiterates an ambitious goal from the 10-point plan to increase heat pump installation from 30,000 per year to 600,000 per year by 2028. There are currently 26m fossil fuel boilers in UK buildings.

It says the government will launch a new clean heat grant to encourage households to switch from fossil fuel heating to heat pumps, with details expected next year.

This will build on the £3bn green homes grant, launched this year as part of the government’s “green recovery” plans and help pay for home upgrades including heat pumps, insulation and solar panels.

A survey for the Environmental Audit Committee revealed a “poor experience” for many homeowners taking advantage of the green homes grant. One of the issues highlighted by the committee was a lack of tradespeople with the necessary skills.

The government hopes to address this shortfall with a new strategy for upskilling through the “green jobs taskforce”, which will mainly focus on “installers to retrofit existing buildings with energy efficiency and clean heat measures”.

It also published a report to accompany the white paper on heat pumps, which government energy policy adviser Dr Matthew Aylott said shows the government target “is achievable and there are significant opportunities for the UK supply chain”.

The CCC has recommended a higher target of over 1m heat pumps installed per year by 2030 to achieve the UK’s climate targets, but the government report found most manufacturers did not think this was “likely materialise in practice”.

Barriers to increasing demand include the dominance of gas boilers “caused by historically poor energy efficiency of UK housing stock”, high electricity prices compared to gas, the high cost of heat pumps and the “highly disruptive nature of heat pump installation”.

According to a tweet from Richard Howard, research director at Aurora, questions still remain over convincing people to make the switch from fossil fuels to heat pumps.

In heating – the white paper sets out proposals to kickstart delivery of heat pumps and hydrogen to around 2030. But this is all grant led and doesn’t really tackle deeper questions about how to incentivise low carbon shift. Do we need a carbon price on domestic gas?

— Richard Howard (@UKenergywonk) December 14, 2020

Hydrogen is another pillar of the government’s efforts to decarbonise building heat, with a proposal for a pilot hydrogen-heated town before the end of the decade.

References to hydrogen are found throughout the energy whiite paper, reflecting its potential to be applied in a range of sectors. (Carbon Brief recently published a detailed explainer on the applications of hydrogen.)

A full hydrogen strategy is expected from the government in spring next year, but, in the meantime, the white paper reiterates previous commitments, such as boosting the production capacity of hydrogen to 5GW by 2030 supported by a £240m net-zero hydrogen fund.

The paper states the UK is “already a world leader in investigating the use of hydrogen for heating”, but many experts do not see hydrogen as playing an important role in heat due to its low efficiency compared to heat pumps.

Others point to the value in using existing gas infrastructure to distribute and use hydrogen, something the government appears to have in mind with its plan to consult on the role of “hydrogen-ready” boilers next year.

The government also emphasises a commitment to energy efficiency in homes, which it says it will expand on soon with a dedicated heat and buildings strategy.

It says it will set out a roadmap to its future homes standard “as soon as possible” to ensure new homes are “zero carbon ready”. Beyond the green homes grant, there are also other future commitments to improve the energy efficiency of homes and other buildings.

Prof Kuzemko tells Carbon Brief that compared to other European nations, such as Germany, the UK has not had enough of a consistent energy efficiency framework to cut emissions from buildings.

“Here, because energy efficiency policy has come and gone…companies have been in business and gone bankrupt,” she says.

What are the white paper’s other key points?

Beyond its headline announcements and measures to roll out renewables or decarbonise homes, the energy white paper contains other details about how the government wants the energy system to develop in the coming years.

There is a shorter “explainer” section on transport which reiterates the government’s flagship announcements about ending the sale of petrol and diesel vehicles by 2030, and spending billions on charging infrastructure and supporting car electrification.

However, it states that the full plan to set the UK’s transport system on a course for net-zero will come from the Department for Transport in spring 2021.

Other important points for the UK’s climate targets that are mentioned in the white paper include:

- Carbon capture and storage: The government repeated its plans to create four carbon capture clusters by 2030, with carbon capture and storage (CCS) to be deployed at two clusters by the mid 2020s and two by 2030. This includes an investment of £1bn up to 2025 (this figure was originally proposed by the government in 2010, but later abandoned).

- Biomass: Describing biomass as “one of our most valuable tools for reaching net zero emissions”, the paper says, by 2022, the government will establish the role which bioenergy with carbon capture and storage (BECCS) can play in reducing carbon emissions.

- Industry: Aim for four low-carbon industrial clusters by 2030 and at least one fully net zero cluster by 2040, with an industrial decarbonisation strategy in spring 2021.

- Oil and gas extraction: The white paper includes a plan to make the UK’s continental shelf a “net-zero basin by 2050”, by cutting emissions from19MtCO2e to 0.5MtCO2e, with a “special focus” on methane. Later in the paper, it mentions maintaining “a secure and resilient supply of fossil fuels during the transition to net-zero emissions”.

- ‘North Sea transition deal’: The government says it will establish a deal with the oil and gas industry during the first half of 2021 that will enable it to repurpose its existing infrastructure for new applications, such as CCS, hydrogen production and offshore wind, as well as securing “new low-carbon export opportunities in overseas markets”.

and for my final but – there’s some warm words about getting to net zero in oil & gas fields in terms of the way they operate, but silence in terms of the UK’s continuing focus on digging the stuff out of the ground. This debate ain’t going away. 6/7

— Rebecca Willis (@Bankfieldbecky) December 15, 2020

- Interconnectors: Alongside the white paper, a separate report into the impact of interconnectors on decarbonisation finds that more of these links could cut cumulative emissions in the island of Great Britain by up to 199MtCO2 by 2050, as well as cutting costs.

- Energy storage: The paper commits to legislating to define electricity storage in law, “removing another barrier to flexibility”.

- Digital infrastructure: There is a pledge to create “world-leading digital infrastructure for our energy system”, and publish the UK’s first energy data strategy in spring 2021, in partnership with Ofgem.

- Carbon content: The paper says the government will “ensure consumers are provided with more transparent and accurate information on carbon content when they are choosing their energy services and products”, with a consultation on reforms planned for next year.

- Energy modelling: The government pledges to implement a new modelling strategy that will “increase transparency and collaboration”.

It’s not the main thing in this by a long chalk but all you energy geeks will be thrilled by the stuff about BEIS finally publishing their models an opening access up to energy researchers…

— Emma Pinchbeck (@ELPinchbeck) December 14, 2020

Throughout the white paper, the government references numerous strategies, plans and consultations that it says will help get the nation on the path to net-zero. Carbon Brief has compiled some of white paper’s key forthcoming dates into a timeline.

| Date | Event |

|---|---|

| Early 2021 | Heat and Building Strategy |

| Spring 2021 | Hydrogen Strategy |

| Spring 2021 | Smart Systems Plan |

| Spring 2021 | Final Net Zero Economic Review |

| Spring 2021 | Launch competition for energy storage and flexibility innovation |

| Spring 2021 | Decarbonisation of Transport Plan |

| Spring 2021 | Consultation on Heat Networks and Local Authorities |

| Spring 2021 | Green Jobs Taskforce's Action Plan |

| Spring 2021 | Industrial Decarbonisation Strategy |

| June 2021 | Deadline for legislating sixth carbon budget |

| November 2021 | COP26 climate summit |

| 2021 | Consultation on ending gas grid connections for new builds from 2025 |

| 2021 | Consultation on regulatory measures to improve the energy performance of homes |

| 2021 | Consultation on providing customers with information on carbon content on energy service |

| 2021 | Consultation on a strategic policy statement for Ofgem |

| 2021 | Consultation on regulatory measures to improve the energy performance of homes |

| 2022 | Biomass Strategy |

-

In-depth Q&A: How does the UK’s ‘energy white paper’ aim to tackle climate change?

-

In-depth Q&A: Does the ‘energy white paper’ put the UK on course for net-zero emissions?