IEA: India is on ‘cusp of a solar-powered revolution’

Josh Gabbatiss

02.09.21India is entering a “solar-powered revolution” that will see it edge out coal as the nation’s top electricity source, according to the International Energy Agency (IEA).

Solar power currently makes up just 4% of the nation’s power supply, but it is set to grow 18-fold and become the new “king of India’s generation fleet” by at least 2040.

The IEA’s India Energy Outlook 2021 finds that the energy demand of the world’s third-largest emitter will expand more than any other nation over the next two decades, edging out the EU to make it the third largest consumer.

Under existing policies, India’s emissions are also expected to grow by 50% during this period, offsetting all the cuts in European emissions.

Even then, its per-capita emissions will still be “well below” the global average, the IEA says, given that India has the world’s second largest populace with an estimated 1.39bn people.

The report also considers how a combination of coal shutdowns and new technologies, such as hydrogen and carbon capture, could get India on a path to net-zero emissions for its energy sector by the mid-2060s.

As the nation continues to industrialise and expand its cities, IEA executive director Dr Fatih Birol says that “all roads to successful global clean energy transitions go via India”.

Below, Carbon Brief summarises the IEA report’s key findings and forecasts.

- Energy futures

- Net-zero

- ‘Solar-powered revolution’

- Coal ‘loosens its hold’

- Transport continues to grow

- Building, cooling and cooking

Energy futures

The new report lays out a selection of possible “energy futures” for India following the impact of the Covid-19 pandemic.

It states that India’s energy system is “characterised by the co‐existence of shortage and abundance”.

The nation has the world’s fifth-largest coal reserves and is a major centre for oil refining. But is also heavily reliant on imported coal and oil. Meanwhile, it has a surplus of electricity generation, as many people still face an unreliable supply.

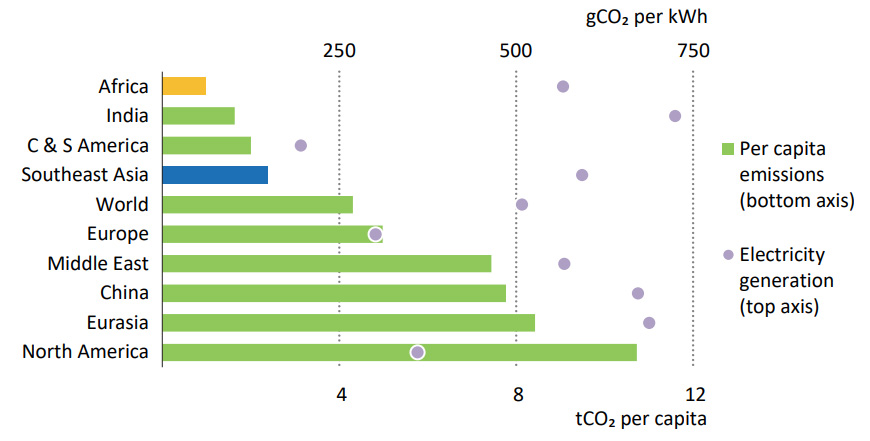

On a per-capita basis, India’s energy use and emissions are less than half the global average. The contrast between India’s per-capita emissions and its dirty power sector can be seen in the chart below.

India has also contributed far less historically to climate change than developed nations in Europe and North America and, yet, as the report notes, it is “already feeling [the] effects”.

At the same time, India’s status as a major global economy and the world’s third largest emitter means cleaning up its energy supply will be essential for global climate targets to be met.

Energy use in India has doubled over the past two decades, with 80% of demand met by coal, oil and solid biomass. The IEA expects it to see the largest increase in energy demand of any country up to 2040.

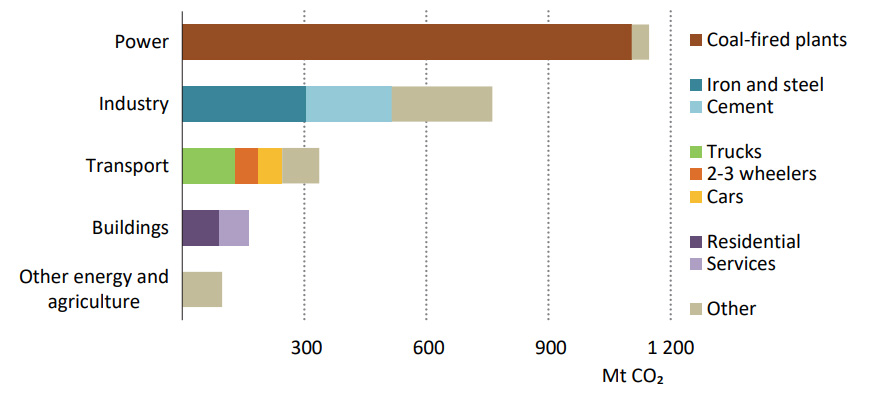

While the nation’s coal dependence is showing signs of diminishing, coal-fired power remains the biggest single contributor to Indian emissions.

The agency also notes that, under current policies, 60% of India’s CO2 emissions in the late 2030s will be from infrastructure and machines that do not exist today, meaning there is a “huge opening” for green policies to curb these future emissions.

The report states that India is in “a unique position to pioneer a new model for low-carbon, inclusive growth” that is already “evident” in some aspects of the government’s plans:

“If this can be done, it will show the way for a whole group of energy-hungry developing economies, by demonstrating that robust economic expansion is fully compatible with an increasing pace of emissions reductions and the achievement of other development goals.”

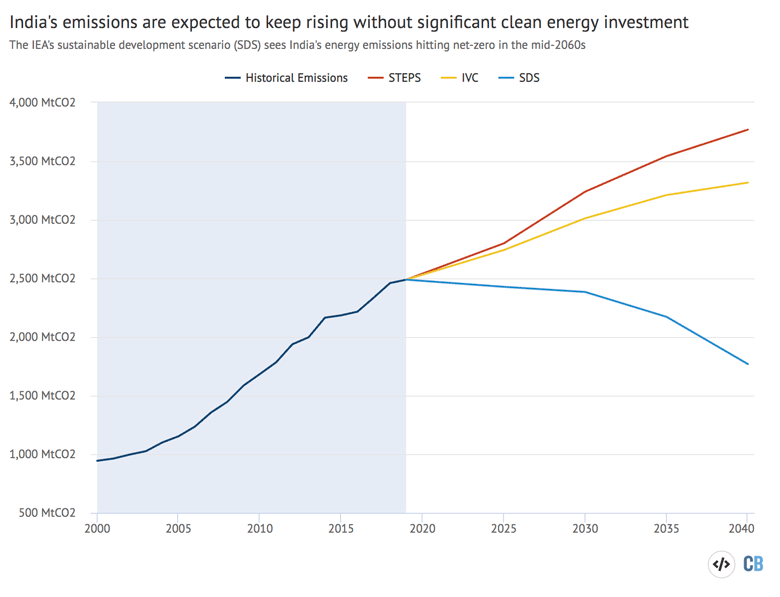

The report includes a selection of different IEA scenarios for India, including its “stated policies scenario” (STEPS, formerly NPS) which takes into account existing policies and sees emissions steadily rising so they are 50% higher in 2040 than in 2019.

Energy and climate twitter, we have something very exciting coming up! (And also important, if I can say so myself).

— Siddharth Singh (@siddharth3) February 4, 2021

Working with a large group of interdisciplinary experts over the past year, we have worked on the possible energy futures of India. It will be out next Tuesday. https://t.co/vY88CPUsXz

There is also a “delayed recovery scenario” (DRS) which shows the effects of a lingering Covid-19 pandemic on the economy.

The report also has a special “Indian vision case” (IVC), which is based on a “more complete realisation of India’s stated energy policy objectives”, as well as a faster pace of economic growth than STEPS (achieving a GDP of $9.8tn by 2040 compared to $8.6tn in STEPS).

Finally, the report considers the IEA’s “sustainable development scenario” (SDS), in which the same economic growth as STEPS is achieved, but with “an additional surge in clean energy investment” that means emissions peak and decline earlier. The emissions pathways tracked by the STEPS, SDS and IVC can be seen below.

Net-zero

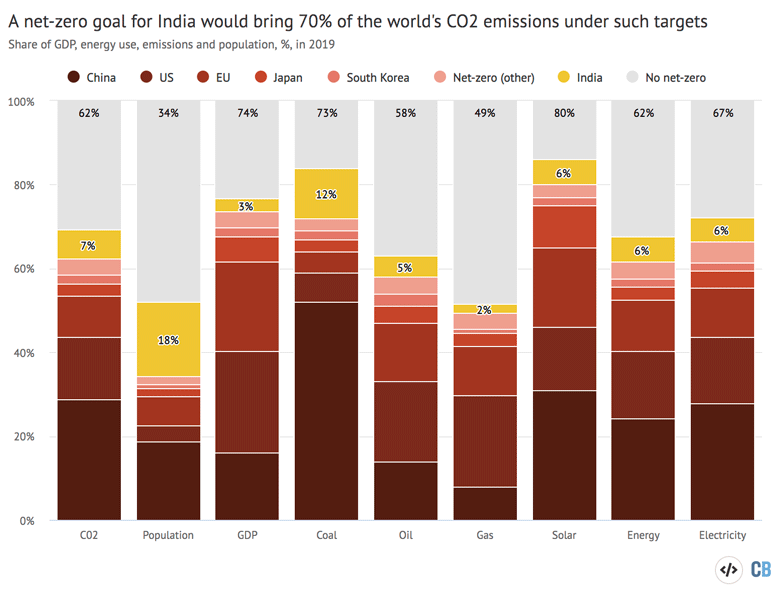

After major economies, including China, the EU and Japan, all came forward with net-zero emission plans at the end of last year, the SDS is also highlighted as a pathway that could take India’s energy sector to a similar target.

The SDS is “consistent with a longer-term drive to net-zero” for India’s energy-related CO2 emissions, arriving at the target by around the mid-2060s. (The IEA is also working on a net-zero by 2050 report, due later this year, that will cover India among other countries.)

If a net-zero goal were to be implemented in India, it would bring 70% of CO2 emissions and more than half the world’s population under such targets, as the Carbon Brief chart below shows.

The IEA estimates spending on clean energy technologies would need to be 70% higher in the SDS than in STEPS, meaning an additional $1.4tn over the next 20 years. However, it notes this would come with “huge” savings, too, including on oil import bills which would cancel out the spending altogether.

According to the IEA, India is already on track to exceed the commitments made in its nationally determined contribution (NDC) under the Paris Agreement.

Under STEPS, the Indian economy’s emissions intensity improves by 40% from 2005 to 2030, compared to the NDC’s 33‐35% target, and its renewables generation capacity reaches nearly 60%, well above the 40% target.

However, India has yet to come forward with a new, more ambitious target, as required by the end of last year under the terms of the Paris Agreement.

Elements of what will be required for India to push further can be found in the IVC and even more so in the SDS, the report’s lead author Tim Gould tells Carbon Brief:

“The one thing that is clear moving ahead very quickly is the addition of renewables in the power sector…that explosive growth of solar in power, it deals to a large extent with the implications of rapid growth in electricity demand.

He says, when considering the growth in energy demand from industry, there are various options, including hydrogen, energy-efficiency improvements and carbon capture and storage (CCS):

“All of the elements of that technology discussion are in the mix in India’s current policy debate. It’s really a question in the SDS of pushing all the levers to mitigate some of the rise in emissions that we have in the STEPS scenario.”

The report adds that, “much more so than in advanced economies, India’s future emissions profile depends heavily on infrastructure that has yet to be built or bought – especially in industry and transport”.

Yet, unlike other pathways, the SDS not only avoids new sources of emissions wherever possible, it also tackles existing sources. This includes India’s young and inefficient coal plants, which would need to be retired or retrofitted to follow this pathway.

Regional experts tell Carbon Brief that with economic growth likely to remain the priority, they are sceptical about the introduction of any economy-wide net-zero target. India’s post-coronavirus stimulus package focused heavily on fossil fuels.

According to Sunil Dahiya, an analyst at the Centre for Research on Energy and Clean Air (CREA):

“From the current events that are happening in India around economic revival, it seems very unlikely that India would commit to anything substantial and actually mean it.”

He adds that shorter term targets seem more feasible, noting that it is “very likely that India might reach peak coal consumption in this decade” (see below).

Bharath Jairaj, energy director at the World Resources Institute India, agrees that while some sectors may head towards net-zero, others, such as industry, are unlikely to be aligned with these ambitions:

“India has always preferred to under-commit and over-perform. We have seen this with the 2030 NDC targets. Things could change quickly, of course.”

‘Solar-powered revolution’

The report describes the rise of solar power in India as “spectacular” and says India is on the “cusp of a solar‐powered revolution”.

Renewables deployment has already been picking up pace in recent years, with the nation adding nearly five times as much solar capacity in 2019 as it did in 2015.

As it stands, solar accounts for less than 4% of India’s electricity generation and coal stands at around 70%.

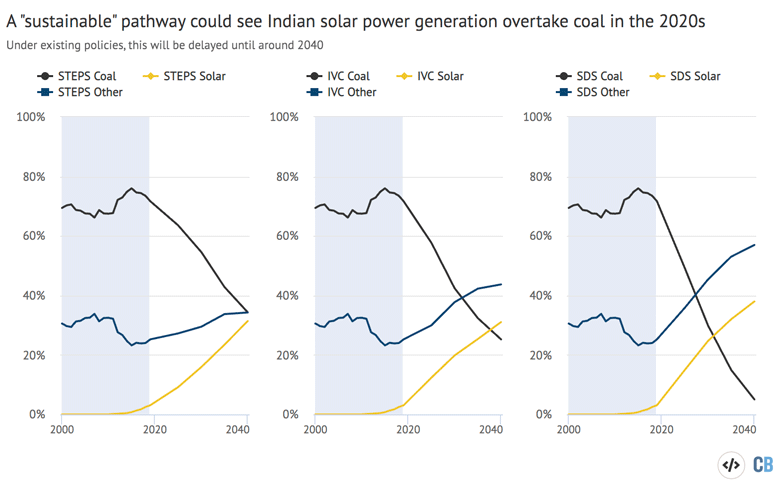

Under current policies, solar is set to overtake coal around 2040 with both technologies at around 30% of generation. In the SDS, this switchover will happen even sooner, as the chart below shows.

This shift is being driven in part by the nation’s policy ambitions. Prime minister Narendra Modi has said the nation will reach 450GW of renewable generation by 2030.

Under STEPS, India will add 900GW of renewable capacity over the period to 2040, with large, utility-scale solar projects “lead[ing] the charge”, the report notes. Wind is also expected to play a role, making up 200GW of this growth.

Overall, in this scenario, India will add power capacity the size of the EU’s over the next two decades, with solar and wind accounting for more than three-quarters of this growth, the report states. There will also be an extra 25GW of nuclear power and 50GW of hydro.

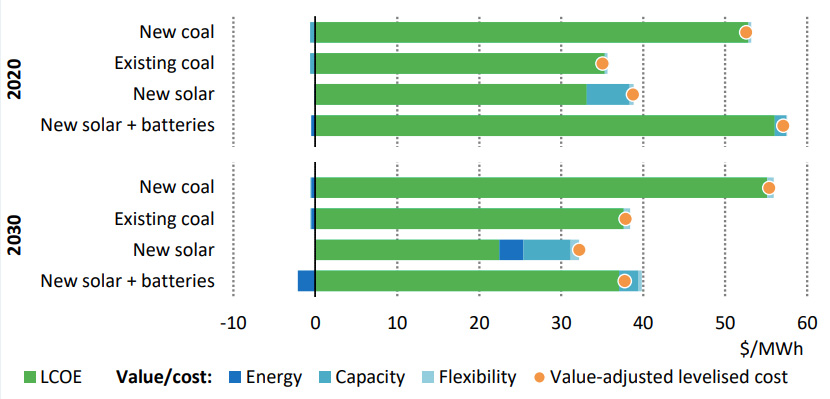

The IEA’s last World Energy Outlook described the best solar power projects as offering the “cheapest…electricity in history” and this “extraordinary cost-competitiveness” is highlighted once again in the new report.

Current trajectories would result in solar being cost-competitive against most existing coal capacity in India by 2030. New solar is already more competitive than new coal-fired power plants.

The report also notes that this addition of renewable generation “has to be accompanied by a transformation of the power system in order to accommodate this growth”, as solar power generation fluctuates with the changing levels of sunshine.

It lists the flexible operation of coal plants and “robust grids” as possibilities for dealing with this. Wind power can also complement solar during the monsoon season when solar resources are relatively low.

However, batteries are highlighted as a particularly appealing solution, with the report noting that solar is expected to compete on costs with coal by 2030, even when paired with battery storage which can increase the initial costs. This can be seen in the chart below.

In both STEPS, IVC and SDS, the IEA concludes that India is set to become the world’s largest market for batteries.

In STEPS, the market for batteries, solar panels and wind turbines develops to more than $40bn per year, meaning one in every seven dollars spent in the world on these technologies will be in India, compared to one in every 20 today.

A key feature of IVC and SDS is even more solar power, with 1,200GW and 1,330GW respectively.

However, while in the SDS power-sector emissions drop by 80% from 2019 by 2040 – and approach net-zero by 2050 – in the IVC they remain almost the same.

This is because, while solar accounts for the large expansion in demand, it does not eat into existing demand or displace coal-fired power in IVC.

Coal ‘loosens its hold’

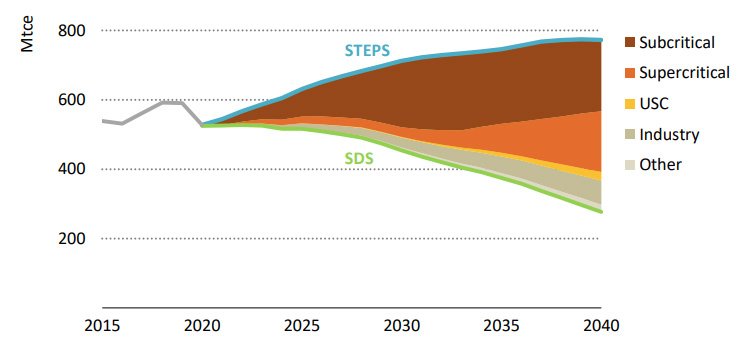

After 60 years of growth, the report concludes that “coal’s hold over India’s power sector is loosening”.

There is currently a 100GW pipeline of approved coal‐fired power plants, including those under construction, but, according to the report, “it is difficult to see many of these being built”.

Coal‐fired power was most exposed to the decline in electricity consumption last year due to Covid-19, but the report notes the industry’s challenges pre-dated the pandemic. The utilisation of coal plants fell from more than 70% in 2010 to 55% in 2019.

Efforts to tackle air pollution, diversify the energy mix and take advantage of the plummeting costs of renewables have all contributed to lower expectations for coal in India.

Coal demand in STEPS is a third lower in 2040 than the IEA projected in 2019, with net capacity growth across this period of 25GW compared to an additional 690GW of solar. This “major revision” was already evident in the IEA’s World Energy Outlook last year.

Nevertheless, in STEPS, the total coal-fired capacity does not begin to decline until the 2030s. In SDS, the peak for coal comes much sooner in the 2020s, as existing plants are retired early, retrofitted with CCS to cut emissions or repurposed to provide system flexibility.

The report identifies addressing CO2 emissions from these existing coal plants as “the single most important way of bending the emissions curve for India”. Taking these actions closes 75% of the emissions gap between STEPS and SDS.

This can be seen in the chart below, which shows that a reduced role for coal plants, indicated by the brown, orange and yellow areas, takes coal into decline in the SDS.

Dahiya says at least some of these measures are under consideration in India at the moment:

“CCS may be very unlikely due to cost, but system flexibility and retirement of power plants are currently being discussed at various levels. Co-firing [with biomass] is limited to few plants, it’s not a main discussion point.”

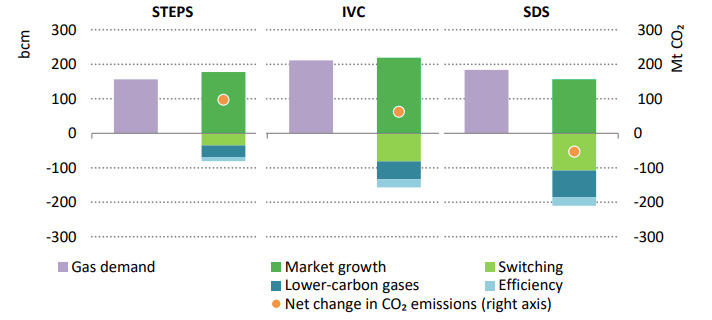

With the Indian government aiming to become a “gas-based economy” and scale up its use of gas in general, the report also considers the role this fossil fuel could have in replacing coal power.

In the IVC, around 40Mtoe of coal power – 10% of total demand as of 2019 – is displaced by gas in 2040. By comparison, in STEPS, gas is confined to industrial uses and city distribution.

The report notes that gas is “not in itself a solution to climate change: it is a source of emissions in its own right, and new gas infrastructure can lock in these emissions for the future”.

Nevertheless, it notes that, in SDS, India is the only major country where gas use is higher than in STEPS. As the chart below shows, this results in a 50MtCO2 decrease in emissions as it replaces oil and coal.

The report notes that gas has faced a “perfect storm” in India’s power sector after a wave of new power plants were commissioned in the late 2000s to make use of new offshore gas discoveries, which failed to live up to expectations. It states that India would benefit from exploring biomethane and hydrogen as well as fossil gas.

There is also discussion in the report of expanding India’s bioenergy sector, making use of the “vast quantities of organic waste generated by the agricultural sector”, in part to replace coal in some settings.

Now that coal’s future in the power system looks particularly unstable, suppliers are increasingly looking to industrial sources. India’s industry has been the main source of growth in energy demand since 2000 and around half of this has been met by coal.

Dr Jai Asundi, executive director of Indian thinktank the Centre for Study of Science, Technology and Policy (CSTEP), tells Carbon Brief:

“With steel, cement, etc, production is expected to increase [and] replacing coal will be a real challenge. The answer lies in technology – be it hydrogen, storage, etc – that will allow for cleaner production and distribution, which, in turn, will mean no holding back on GDP growth.”

Asundi says that the government’s recent budget went some way to addressing the need for technology, including the need for hydrogen and the creation of a research fund. However, he says licensing of technologies could be an issue.

“It will be imperative that globally developed technologies are made available for India’s clean energy transition,” says Asundi.

Around 10% of coal consumed in India is used for non-power functions, such as coking coal for steel, but Dahiya says he can still envisage a coal phaseout in the coming decades:

“If we assume that India would phase out thermal coal in the next two to three decades and, during that time, suitable alternatives emerge for coking coal, then its a real possibility.”

Transport continues to grow

Today, India’s per-capita vehicle ownership is still very low. As more Indian’s purchase cars this is set to be one of the biggest areas of growth for fossil fuel demand and emissions.

Over the past three decades, energy use in transport has increased fivefold making it the fastest growing sector by this measure. Virtually all of this demand is met by petroleum products.

In STEPS, India’s combined import bill for fossil fuels triples over the next two decades, with oil by far the largest component.

As the nation’s power mix becomes cleaner, the case for transport electrification will be stronger. At present, the IEA says the carbon intensity of Indian electricity means that there is “no CO2 benefit from switching to an electric car”.

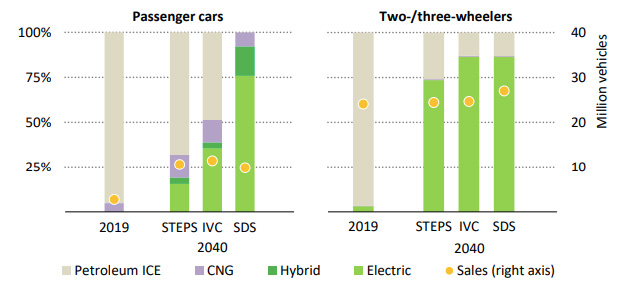

Two or three wheeled vehicles – motorbikes, moped and rickshaws – make up four-fifths of Indian road stock and have shown some progress in electrification. STEPS sees half of these smaller vehicles electrified by 2040.

However, it is important to note that, as it stands, they only account for around a fifth of total fuel consumption.

The SDS sees an ambitious transformation for India’s transportation, with 60% of cars and smaller vehicles electric by 2040. It also includes fewer cars being sold overall.

Lead IEA author Tim Gould tells Carbon Brief that personal transport is only part of the picture:

“One of the things that comes through very strongly on the transport side is the importance of freight and the contributions of trucks to India’s growth in oil demand is really quite significant…One thing we would like to highlight is the possibility to shift more of that freight onto India’s railways.”

There is a target in place for 100% electrification of India’s railways by 2022, up from 51% in 2019.

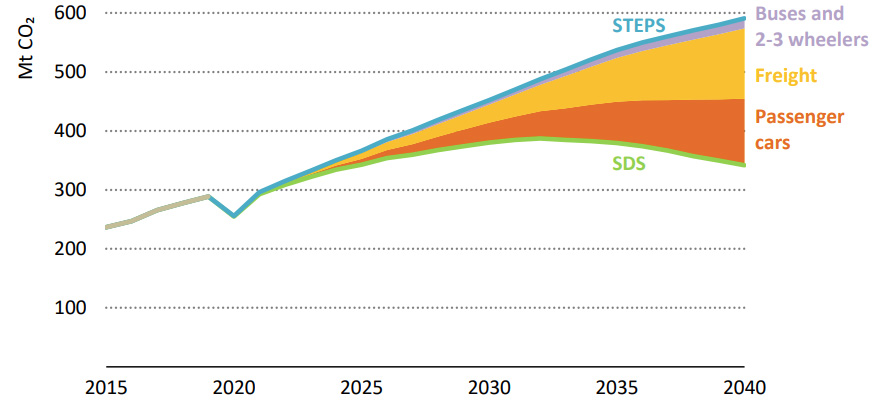

CO2 emissions double in STEPS between 2019 and 2040, with around two-thirds of this coming from freight vehicles. In SDS, road emissions begin to decline in the 2030s, partly due to the use of biofuels.

Building, cooling and cooking

The scale of India’s construction in the coming decades is significant. Under current policy plans, the IEA states that two-thirds of buildings that will exist in 2040 have not yet been constructed.

Of this, 70% of the construction will take place in urban areas. The extent to which energy-efficient building codes are followed will have a significant bearing on the nation’s energy usage for many years to come, the agency says.

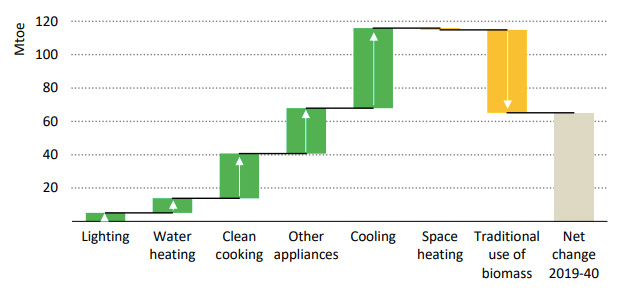

Clean cooking, cooling and appliances are responsible for the “overwhelming majority” of energy demand growth in buildings up to 2040.

In 2019, the nation had what the IEA called a “remarkable achievement” when it reached near-universal household connectivity to electricity. In a similar push, there are plans to phase out much of the use of traditional biomass – mainly firewood – as a cooking and heating fuel across India.

This will also cut emissions as cleaner alternatives, such as electric heaters, are used instead, a trend shown in the chart below.

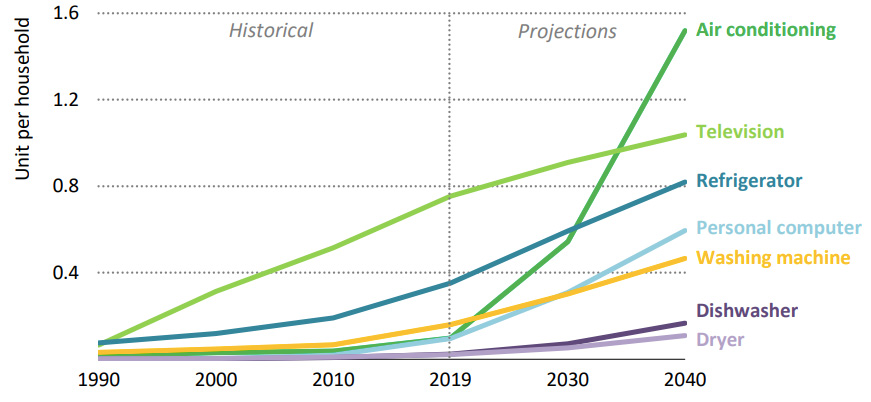

However, the biggest increase in energy demand over this period comes from a significant uptick in air-conditioning usage, as Indians become wealthier and rising temperatures make such appliances more in demand.

In STEPS, India’s electricity consumption for cooling grows sixfold over the next two decades. This increase of 650 terawatt hours (TWh) is more than the entire power consumption of Germany today.

The chart below shows that air conditioning is set to become the most desirable household appliance by the end of the 2030s.

Efforts are underway in India to strengthen minimum performance standards of air conditioners, according to the IEA.

The success of such measures could help curb electricity demand, and also help address the variability in power demand which is set to place strain on India’s power system in the coming years.

-

IEA: India is on ‘cusp of a solar-powered revolution’

-

IEA: Solar power is undergoing ‘explosive growth’ in India