IEA: Coronavirus impact on CO2 emissions six times larger than 2008 financial crisis

Josh Gabbatiss

04.30.20Josh Gabbatiss

30.04.2020 | 5:00amThe world’s CO2 emissions are expected to fall by 8% this year as the coronavirus pandemic shuts down much of the global economy, according to the International Energy Agency (IEA).

Such a drop would be the largest ever recorded in terms of tonnes of CO2, some six times greater than the impact of the 2008 financial crisis.

The agency’s new Global Energy Review is based on extensive data from the year so far and is intended to provide close to a real-time estimate of energy usage and emissions.

Its projections for the whole of 2020 are based on a series of assumptions including that the lockdowns, curfews and closure of schools and businesses currently in place are gradually eased over the coming months.

- IEA: ‘Green’ coronavirus recovery would keep global emissions below 2019 peak

- Coronavirus: Tracking how the world’s ‘green recovery’ plans aim to cut emissions

- Webinar: What impact is Covid-19 having on global CO2 emissions?

- Q&A: Could climate change and biodiversity loss raise the risk of pandemics?

- Analysis: Coronavirus set to cause largest ever annual fall in CO2 emissions

- Coronavirus: What could lifestyle changes mean for tackling climate change?

- Analysis: Coronavirus temporarily reduced China’s CO2 emissions by a quarter

However, as the pandemic spreads and its devastating impacts continue to unfold, the agency makes clear that there are still “major uncertainties” about how it will play out.

The IEA’s central figure of 8% is even higher than previous estimates, including analysis conducted by Carbon Brief and published earlier this month, which was based on a less comprehensive dataset and less recent data.

An 8% cut is roughly equivalent to the annual emissions reductions needed to limit warming to less than 1.5C above pre-industrial temperatures. However, the stretch target laid out in the Paris Agreement would require similar reductions every year this decade.

The agency is clear that the expected decline in emissions due to a pandemic is “absolutely nothing to cheer”. Moreover, it emphasises the importance of prioritising clean energy in economic recovery plans in order to avoid a sharp rebound in emissions.

Unprecedented shock

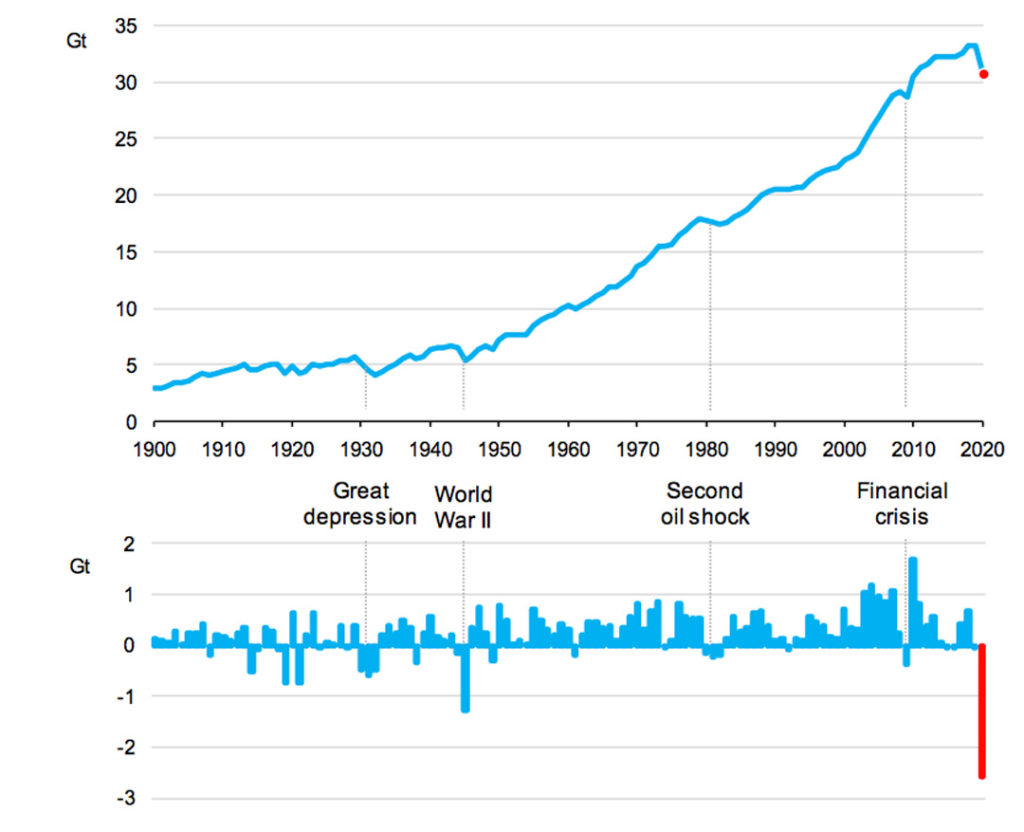

Describing the pandemic as a “a macroeconomic shock that is unprecedented in peacetime”, the IEA draws comparisons with the impact that wars and other recent crises have had on the global energy system. Some of these events can be seen in the figure below.

The report compares the covid-19 pandemic with the last financial crisis, when growth in China and India “was able to largely offset reductions elsewhere”. This time around, both nations are also feeling the effects of the disease and such an offset is unlikely.

As it spreads to virtually every nation on the planet, the impact of coronavirus is being felt in all walks of life, but different sectors are being affected in very different ways.

Energy use for residential gas heating or electricity use for server farms and digital equipment may even show a significant increase in the coming months, the IEA says, whereas other sectors such as aviation have collapsed.

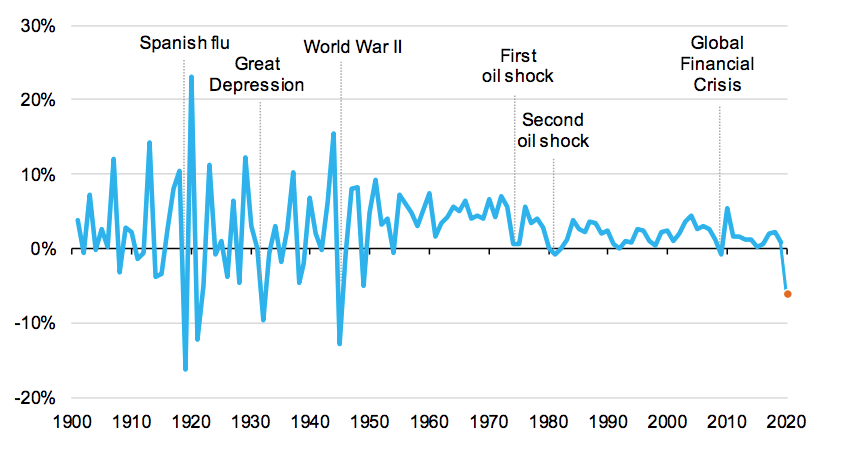

Global energy demand was 3.8% lower in the first quarter of 2020 than last year, the IEA says, and it expects the annual total to drop by 6% year-on-year in 2020.

Such a decline has not been seen for decades, as the chart below shows, and will effectively wipe out five years of demand growth.

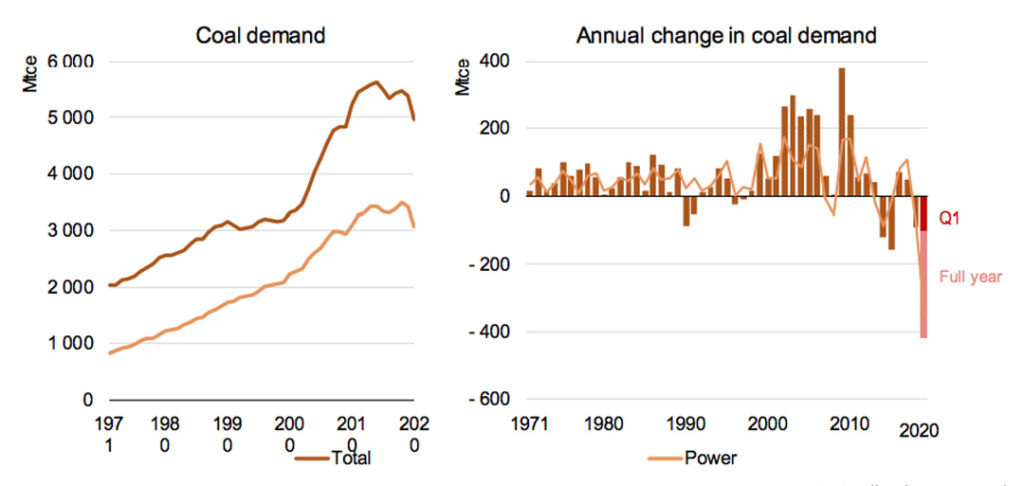

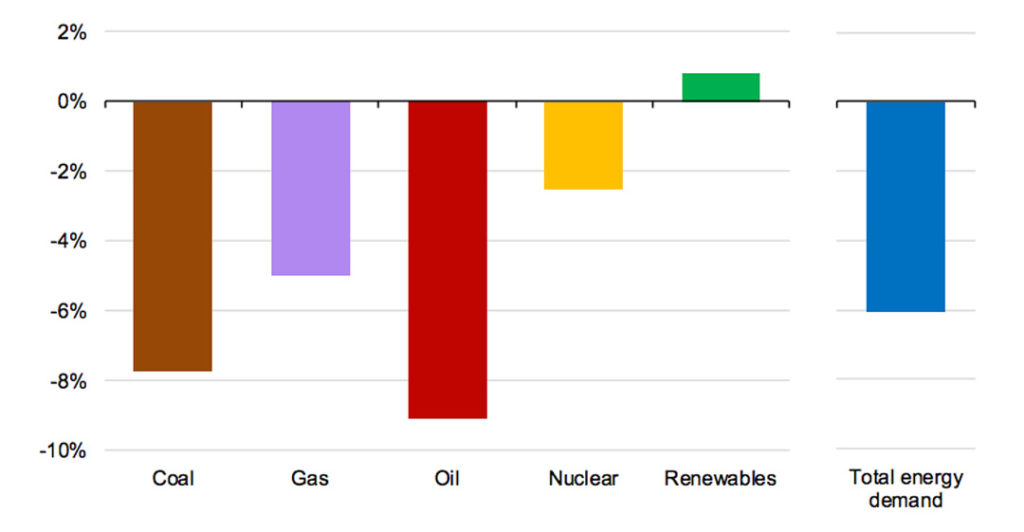

CO2 emissions are expected to fall to 30.6bn tonnes of CO2 (GtCO2) this year, an 8% drop from last year, with declining coal use the most significant factor.

The drop in coal combustion is being driven mainly by the power sector, the IEA says, together with competition from cheap natural gas and industrial slowdown. Coal demand is expected to fall 8%, but as China’s industrial sector starts up again, it is expected to go some way to offsetting larger declines.

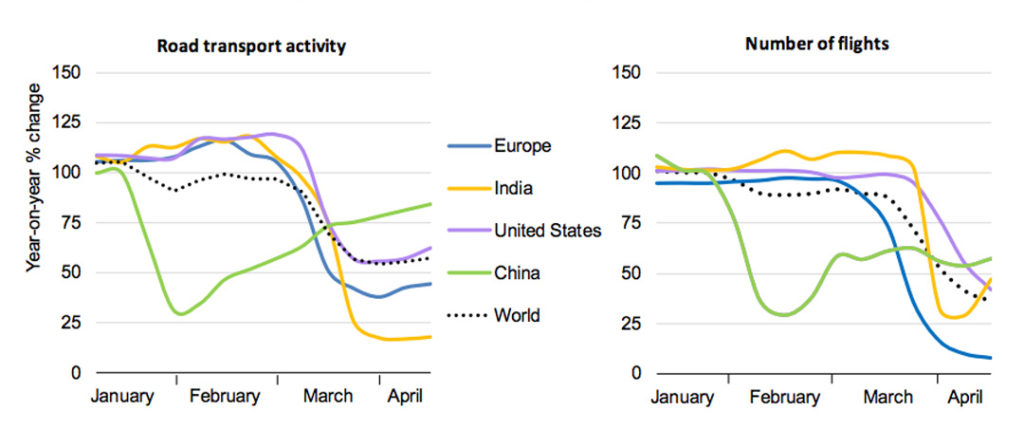

Due to the global lockdown’s impact on transport, illustrated in the charts below, demand for oil has fallen at an “unprecedented scale” in the first four months of the year.

This is particularly true for fuels used in passenger transport, namely petrol and kerosene. Meanwhile demand for diesel, a substantial portion of which is used to power vehicles that transport goods, is expected to remain stronger. Overall, oil demand is expected to drop by 9% across the year after a 29% drop in the month of April.

As a side-effect of declining transport activity, car sales are expected to decline. In March, EU sales were 55% lower than 2019 levels, and if this trend plays out in nations with fuel economy standards in place, improvements in energy efficiency will be slower, the IEA notes.

Gas demand is expected to fall less than oil or coal as it is less vulnerable to changes in transportation demand, although the IEA says it could still fall by 5%. Gas will be particularly susceptible if countries in the Middle East and North Africa enter long lockdowns, the agency says, due to their reliance on the fuel for power.

In general, nuclear power is expected to fare better than fossil fuels, with lockdowns expected to reduce global output by 3% due to falling demand and disrupted construction. Already, delays have been announced to projects in China and Finland, and more are expected in the UK, US and France.

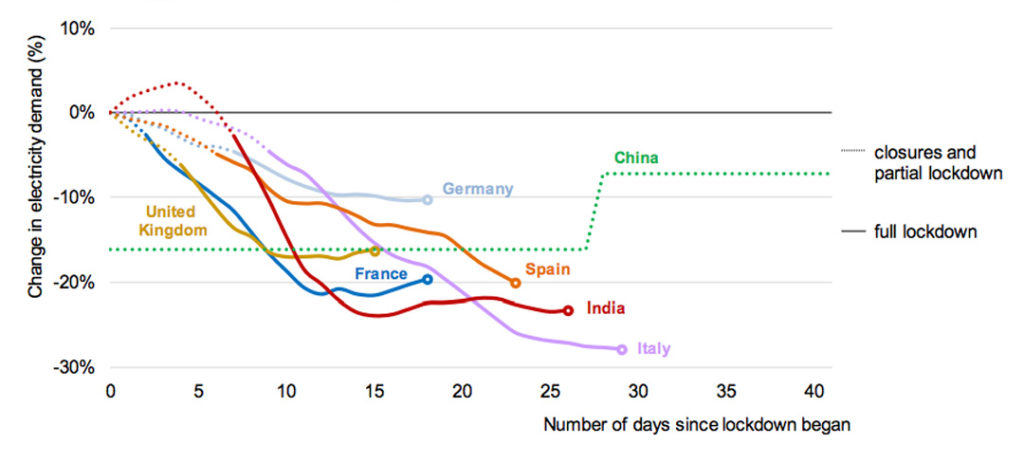

As the figure below shows, lockdowns in recent months have pushed down electricity demand significantly, with the strongest impacts found in nations with service-based economies and the strictest lockdowns, such as Italy.

It is worth noting that as pointed out in Carbon Brief’s recent analysis, it is difficult to assign effects specifically to coronavirus as many other factors will influence energy demand and emissions over the course of the year.

As an example, the IEA points to “milder than average” weather throughout most of the northern hemisphere in the first quarter of the year, which played a part in pushing down energy demand due to less gas being used for heating.

Renewables ascend

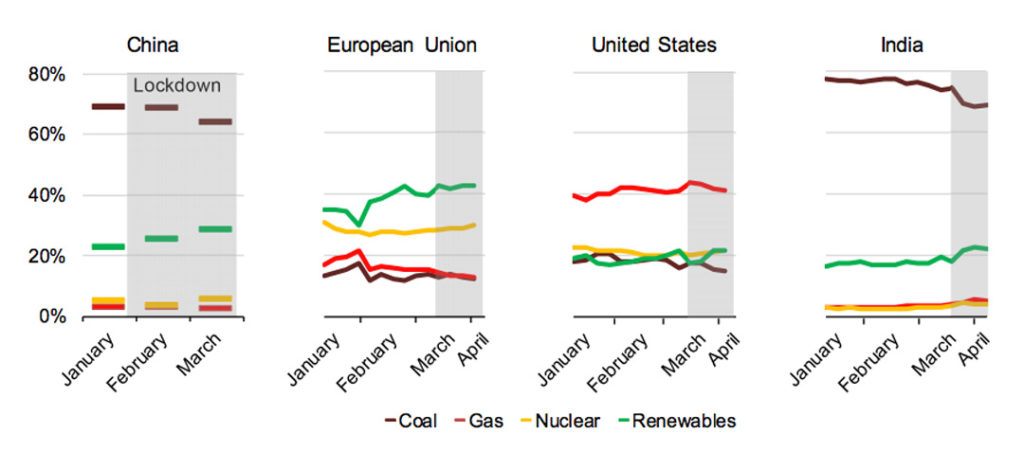

As fossil fuel use sank in the first few months of 2020, renewables remained stable, as in general they are given priority access to electricity grids and are not required to adjust their output based on demand.

Combined with rising capacity as new wind and solar facilities are built, this means that renewable electricity generation rose by almost 3% in the first quarter of the year.

As a result, renewables achieved record-high hourly shares in Belgium, Italy, Germany, Hungary and parts of the US. Analysis just published by Carbon Brief shows a similar trend, with wind and solar reaching a record-high share of generation across Europe over the past 30 days.

These records reflect a rising renewable share of the electricity mix of countries around the world – where demand has declined during lockdowns – as shown in the chart, below.

In fact, renewables are also the only energy sources expected to grow this year “regardless of the length of lockdown or strength of recovery”, the report states. This can be seen in the figure below.

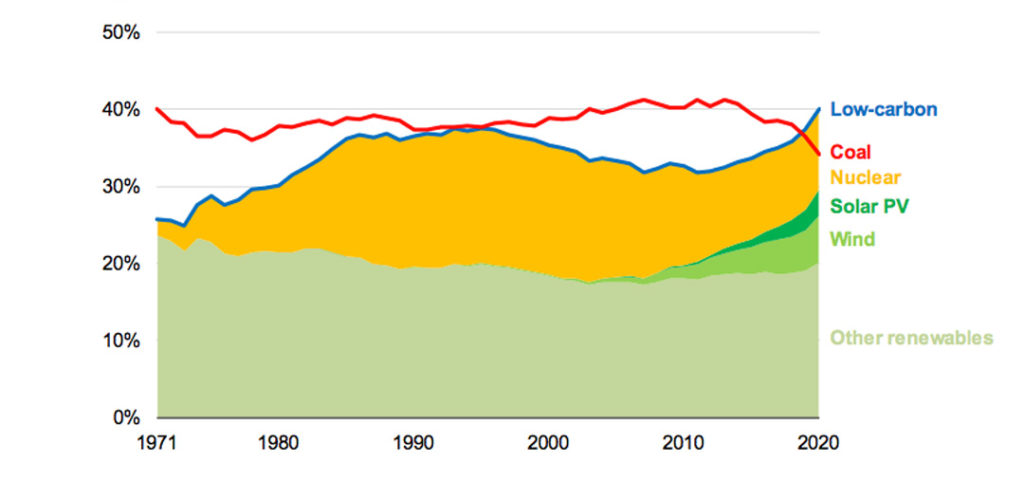

The chart below shows how a pandemic recovery, in which restrictions are gradually loosened over the course of the year, is expected to push low-carbon electricity sources to 40% of power generation in 2020, extending the slight lead on coal achieved last year. This would be the highest level on record, albeit due in part to a 5% dip in total electricity demand.

New projects coming online this year are expected to increase wind and solar’s share of global electricity generation up to 9%, twice as high as levels seen just five years ago.

The IEA estimates total renewable energy use, including for heat and transport, will rise by about 1% in 2020, and there will still be an increase even if economic recovery is slow.

However, despite being more resilient than other industries, the renewable sector has still faced challenges. The end of 2020 marks an important deadline for new wind projects in the US and China to receive tax credits and subsidies, but progress on these projects is now highly uncertain.

In a recent blog post, IEA analyst Heymi Bahar writes that what was meant to be “an outstanding year for renewables” has been hindered by supply chain and labour disruptions linked to the pandemic.

Wind turbine manufacture has been hit particularly hard due to a very global supply chain compared with solar panels, which are largely manufactured in China.

Methods and discrepancies

When Carbon Brief attempted to calculate a figure for total CO2 emissions decline this year due to coronavirus, it reached a slightly more modest figure of 5.5%, compared to the IEA’s 8%.

This analysis was based on five key datasets that cover roughly three-quarters of the world’s annual CO2 emissions, with the expectation that the elements not covered would have added to the final total.

The IEA has access to a much larger array of detailed information, and its analysis was based on data available up until mid-April including country submissions to the IEA, other statistical releases from national administrations and estimates by the agency itself when official data was missing.

Besides the wider array of information available, the work was also undertaken more recently than Carbon Brief’s analysis. Given the fast-moving and unprecedented nature of the coronavirus pandemic, newer information has tended to paint an ever-gloomier picture of its impacts over time.

Uncertain future

The report works on the assumption that global GDP will decline by 6% in 2020, in line with an International Monetary Fund scenario released this month.

It assumes the economic recovery is “U-shaped“, with locked down economies and social activities resuming “only gradually”.

While the report focuses on this as its “one base case scenario”, it also acknowledges that recovery could follow a quicker, “V-shaped” trajectory, or be hampered by further spikes of infection and longer or additional lockdowns.

The IEA notes that much remains unknown and states that the stimulus packages being hastily assembled by governments will have profound and long-term impacts.

After weeks of plummeting oil prices and electricity market prices dipping below zero in many parts of the world, the report states:

“The energy sector that emerges from the covid-19 crisis may look significantly different from what came before. Low prices and low demand in all subsectors will leave energy companies with weakened financial positions and often strained balance sheets.”

Businesses that are more insulated from market signals, notably those with renewable energy projects, are likely to emerge in the best position, the IEA says.

The report also warns about the pressure the pandemic and tumultuous oil markets are having on energy security, as well as highlighting the importance of such security in a time when functioning health infrastructure is vital and many are working remotely online:

“In some parts of the world, however, a reliable supply cannot be taken for granted. In Africa, several thousand hospitals and health care facilities have no access to electricity. In both Africa and South Asia, electricity reliability problems limit social distancing.”

The emissions drop in 2020 estimated by the IEA is consistent with the cuts that would be required every year this decade to meet the Paris Agreement temperature goals, as laid out in last year’s UN Environment Programme (UNEP) emissions gap report.

However, Robbie Andrew, senior researcher in climate economics at the CICERO Center for International Climate Research in Norway, points out there are important caveats to this observation. He tells Carbon Brief:

“Cutting emissions by severely cutting economic activity is clearly far from being the medicine we need: the suffering resulting from this pandemic, both in health and economic terms, is something that we must avoid.”

IEA executive director Fatih Birol echoed this point in a statement released to accompany the report:

“Resulting from premature deaths and economic trauma around the world, the historic decline in global emissions is absolutely nothing to cheer.”

However, while the 2008 financial crisis was followed by a sharp rebound in emissions, Birol also stated that this slump provides global leaders with an opportunity to learn from past mistakes.

The IEA has joined calls from UN secretary-general António Guterres and various world leaders to place clean energy technologies at the forefront of their economic recovery strategies.

Andrew also notes that while 2020 should not be seen as a model for cutting emissions, “it might yet spur unforeseen changes” as the dramatic shifts in people’s lifestyles gives way to changes in societal demands.

-

IEA: Coronavirus impact on CO2 emissions six times larger than financial crisis