IEA: China’s new coal plants make ‘no economic sense’

Simon Evans

12.12.16China already has enough coal-fired power stations, says the International Energy Agency (IEA) and there is “no real economic sense in building more”.

The many new coal plants it is building are unnecessary, says the IEA’s medium term coal market report, published today, because Chinese coal demand has already peaked. These new plants are frequently cited by those trying to cast doubt on climate action.

Global coal demand growth will slow to a crawl over the next five years, the report adds, as steep falls in rich nations are offset by a rise in India and southeast Asia. Carbon Brief has a summary.

China central

The story of coal is set to remain centred on China, the IEA says. By 2021, the country will still burn around half the global total, as it does now. This is why China is the focus of the IEA report.

Below the surface, however, there are significant changes afoot. The IEA has now definitively accepted that Chinese coal demand peaked in 2013, a prospect it deemed almost unthinkable as recently as last November.

(In December 2015, just after the Paris climate summit, the IEA published its 2015 coal outlook, to which it had at the last minute added a scenario saying it was “feasible” that China had peaked. The central scenario in the report said Chinese demand would continue to increase.)

Keisuke Sadamori, IEA director for energy markets and security, told a conference call for journalists: “It is clear that the golden decade of coal is over in China…We see the coal demand in China in structural and slow decline.”

Sadamori added that the agency “did not anticipate” this shift. Significant improvements in energy efficiency, the growth of low-carbon alternatives and rebalancing of the economy from industry towards consumption have all contributed to the change, he said.

Despite reaching peak coal, however, China continues to invest in new plant. As of July this year, some 205 gigawatts (GW) of coal capacity was under construction, which would add to around 950GW already operating. The central government has set a cap of 1,100GW by 2020.

Existing plants are operating less than half the time. Running hours keep falling and China has ambitious targets to expand nuclear and renewables, while power demand growth is weakening.

Wasting money

The IEA is hardly the first to point to wasted investment in Chinese coal. Its voice does add significant weight to the debate, however. Its market report was supported by China’s Shenhua Group, the world’s largest coal firm. The report also thanks a who’s who of the global coal industry, including representatives of mining giants Glencore, Peabody and Anglo American.

The Carbon Tracker Initiative (CTI), a financial thinktank, reported last week that demand for coal power in China could fall by 8% between 2016 and 2020 and running hours could fall from 47% to 37%.

The profitability of existing coal power could be cut in half, CTI says, as a result of China’s forthcoming national carbon market, electricity market reforms and low-carbon expansion. This situation would only be exacerbated if new coal plants are built.

Given the obvious economic waste in building extra capacity that is not needed, “Chinese authorities will somehow dissuade or stop construction of new coal power plants in the near future,” the IEA report says.

This view was echoed at a 7 December Chatham House roundtable in London with senior Chinese officials, where one participant said: “[China] has a problem of overcapacity in coal-using plants…[It is] very determined to optimise and phase out those overcapacities.”

Asia rising?

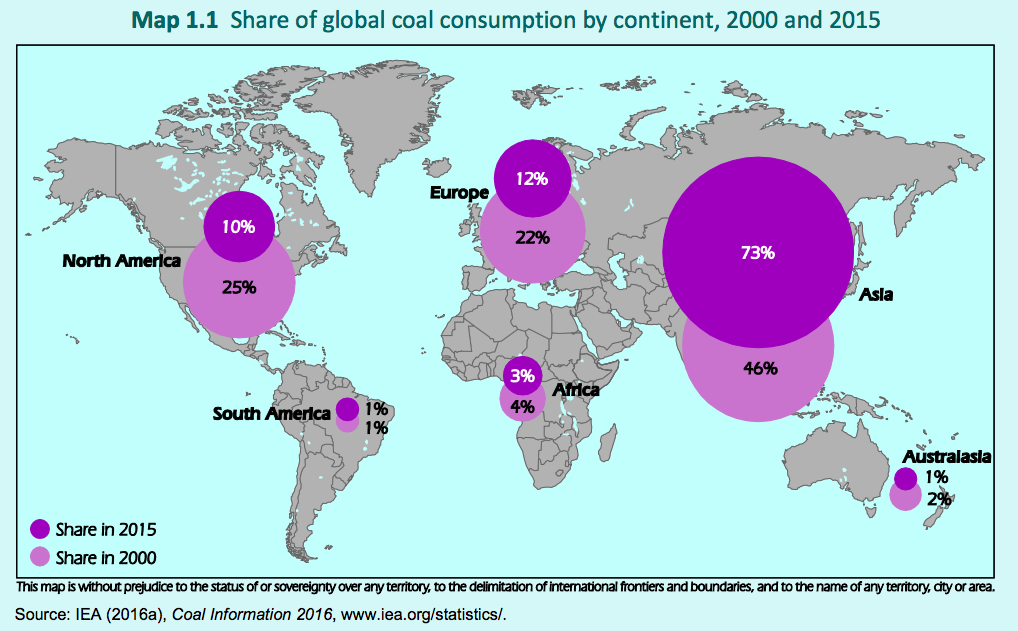

Though China’s coal use is on the wane, demand elsewhere in Asia will continue to rise, the IEA says. It sees the region using 76% of global coal demand in 2021, up from 73% in 2015 and just 46% in 2000.

The hopes of the coal industry rest with India and southeast Asia, which the IEA sees as the only regions with strong demand growth over the next five years. Even so, the IEA’s Sadamori says India “will not be the new China”.

The IEA says that total coal demand across India and the ASEAN group of southeast Asian countries will reach 990 million tonnes of coal equivalent (Mtce) in 2021. This would be an 18% share of the global total, compared to 50% for China alone.

Even these growth prospects are not assured, however. Some prominent ASEAN members, including the Philippines and Vietnam, are also part of the Climate Vulnerable Forum, which recently pledged to reach 100% renewable energy.

As for India, one third of coal plants are thought to be operating at a loss, says Matthew Gray, senior analyst at CTI. In addition, some 37 half-built coal units totalling 16GW remain unfinished, largely because of financial constraints, according to a government report.

Gray tells Carbon Brief:

“Given the declining utilisation of the existing fleet, the 15GW of capacity halted in a state of partial construction, the growing competitiveness of solar PV, as well as the ongoing water and land issues, the likelihood of India replicating China’s spectacular growth in coal power seems increasingly unlikely.”

Industrial evolution

In the cradle of the industrial revolution, meanwhile, the IEA says precipitous recent declines in coal demand will continue. In the EU, coal use will fall nearly 20% in five years, it says, while US demand will drop a further 10%.

Beyond the timeframe of this IEA report, these declines will be cemented as a growing list of countries commit to phase out unabated coal. France has set a 2023 deadline, the UK a 2025 deadline, and Finland, Canada and Denmark have until 2030.

The US decline is subject to a significant caveat following the election of Donald Trump, who has vowed to resurrect the coal industry. However, even without president Obama’s signature Clean Power Plan, the IEA expects US coal use to fall, because gas and wind are cheaper than coal.

Conclusion

The IEA presents a mixed picture for the next five years of global coal use. It sees demand in rich nations plummeting and China in structural decline, with strong growth in India and southeast Asia.

Overall, it expects coal demand to increase by 0.6% per year, or around 3% in total by 2021 compared to 2015 levels. This follows last year’s record drop in global coal demand.

This modest growth is in stark contrast with the preceding “golden decade” of strong global coal demand growth, driven by China’s rapid industrialisation. Yet it would push the world ever-further from the path to avoiding 2C: the IEA’s 2C scenario includes an 8% drop in coal use by 2021.

As the IEA notes: “Without CCS [carbon capture and storage] or technological innovation to use captured CO2 for commercial purposes, coal must be virtually eliminated if Paris targets are to be met.”

-

China already has enough coal-fired power stations, says the International Energy Agency