Heat pumps could help cut China’s building CO2 emissions by 75%, says IEA

Anika Patel

08.02.24Anika Patel

02.08.2024 | 11:45amWider adoption of heat pumps could accelerate decarbonisation of heating in China’s carbon-intensive buildings and light industry sectors, a report by the International Energy Agency (IEA) says.

The report, published in collaboration with Tsinghua University, finds that, by using heat pumps as part of China’s strategy to reach carbon neutrality by 2060, direct emissions for heating in buildings could fall by 75% to 70m tonnes of carbon dioxide (MtCO2) in 2050, due to increased electrification and improvements to energy efficiency.

Similarly, using heat pumps could help reduce direct emissions from heating in light industries from more than 110MtCO2 today to less than 10MtCO2 in 2050.

In 2023, China was one of the few nations to see total heat pump sales rise. However, greater policy support is still needed to accelerate uptake and help shift the buildings and light industry sectors towards less-carbon intensive energy sources, the report says.

- How much energy does China consume for heat?

- How can heat pumps help China meet its ‘dual carbon’ goals?

- How effective are heat pumps as a solution for China?

- How can policy support heat pump adoption?

How much energy does China consume for heat?

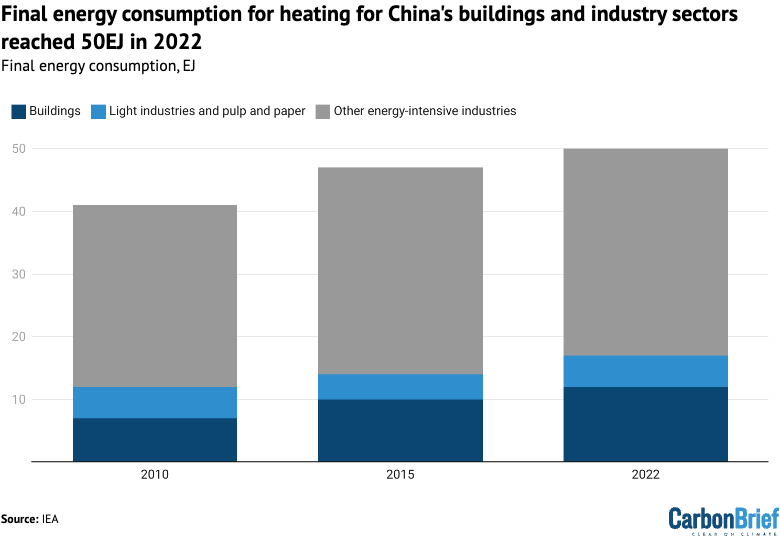

China’s final energy consumption was 107 exajoules (EJ) of energy in 2022. Within this, the IEA report says, heat consumption reached about 50EJ. China’s heat consumption equals “about one-third” of total heat consumption globally.

Around a quarter of China’s heat use is in buildings, with the remainder in industry.

In the buildings sector, heat consumption has grown faster in China than in any other country over the past decade, standing at 12EJ in 2022. This is largely due to growing demand for heat for space and water, which has “nearly tripled” direct and indirect emissions since 2000.

Since 2010, direct coal consumption for heating overall has fallen by 15%. The IEA report attributes this to policy drives beginning in the mid-2010s, initially “to improve air quality, then later to expand clean and low-carbon heating”.

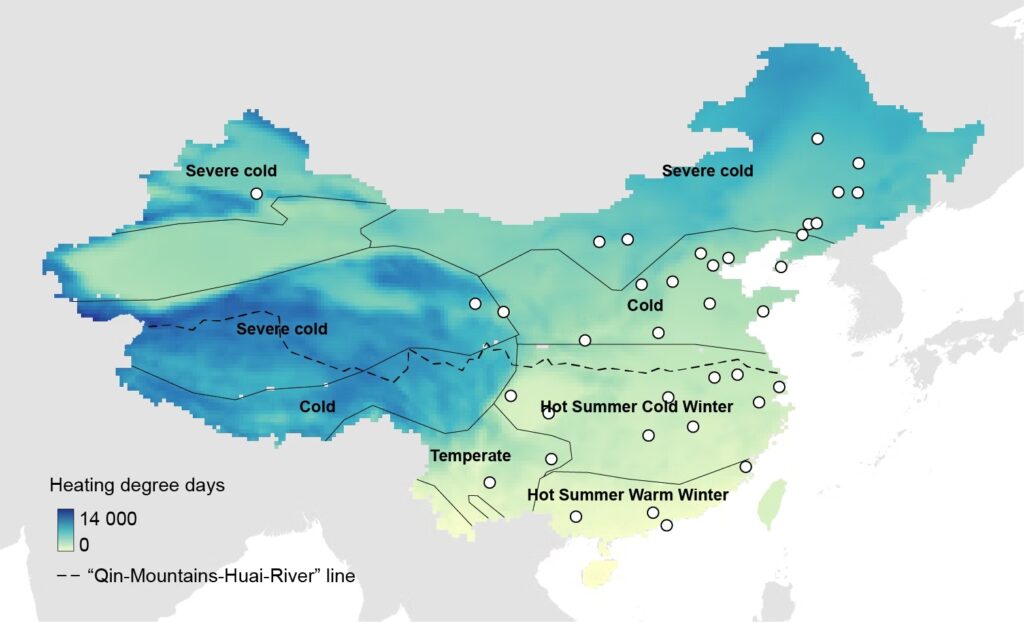

However, an exception to this is district heating, namely, a centralised heating mechanism that is the dominant source of heat for urban areas in northern China. Heat pumps and other decentralised solutions are more common in southern and rural northern China.

District heating networks in northern China rely on coal for more than 80% of their heat production. It is the key driver of coal consumption in building heat provision across the country, according to the IEA.

One 2019 study found that China’s emissions from district heating alone were greater than the total CO2 emissions of the UK.

Dr Chiara Delmastro and Dr Rafael Martinez Gordon, the report’s lead authors, tell Carbon Brief:

“[This] was mostly driven by the expansion of [heat] networks in north urban China, in particular…The length of the district heat network has increased by 250% since 2010, of which the large majority is in the north.”

Delmastro and Martinez Gordon also note, however, that “China has taken action towards cleaner and more efficient heating in recent years” – for example, by shifting from using coal-fired boilers to more efficient combined heat and power plants.

Meanwhile, heat consumption for industry in 2022 totalled 38EJ. Some of this demand is for low- and medium-temperature heat (below 200C), which is generally required for light industries, as well as the pulp and paper sector and some chemical sector processes.

This demand – which could easily be served by existing state-of-the-art heat pump technology – totaled 4.7EJ in 2022 and released more than 110MtCO2 of direct emissions, the report says.

However, more than 80% of industrial demand for heat requires temperatures above 200C, predominantly for iron and steel manufacturing. Other industries that require such high temperatures include non-metallic minerals and non-ferrous metals, as well as some processes in the chemicals and petrochemicals and pulp and paper sectors. These sectors comprised the majority of industrial heat demand, consuming 33EJ in 2022.

How can heat pumps help China meet its ‘dual carbon’ goals?

Heat demand in buildings and industry in China is largely driven by coal and accounts for 40% of both China’s coal consumption and its CO2 emissions.

The IEA does note, however, that the use of coal for heat has reduced slightly, largely due to “policies to improve air quality, reduce CO2 emissions and maximise energy efficiency”.

In 2022, carbon emissions from space and water heating accounted for the vast majority of direct emissions from buildings in China, around 290MtCO2, while direct emissions from heating for light industry totalled 110MtCO2. The IEA places China’s total carbon emissions at 12,135MtCO2 in 2022.

The report provides estimates of the uptake of heat pumps in China under the “announced pledges scenario” (APS), in which governments are given the benefit of the doubt and assumed to meet all of their climate goals on time and in full.

It also looks at uptake under the “stated policies scenario” (STEPS), reflecting the IEA’s own judgement of where government policy is currently heading.

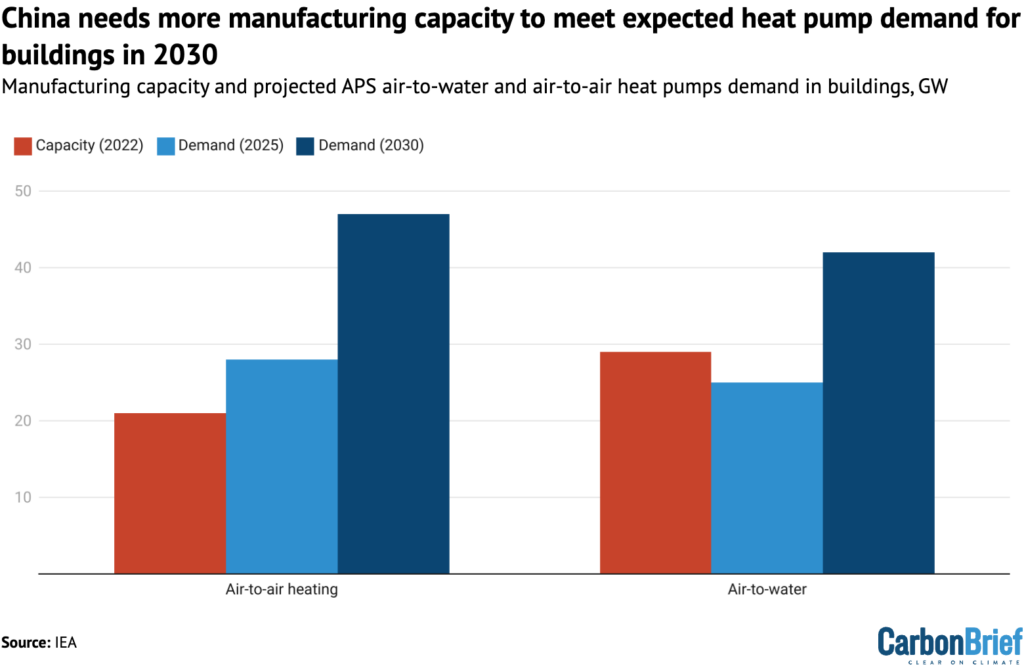

If China upholds its “dual carbon” commitments, in line with the APS, then the IEA estimates that heat pump capacity in buildings would rise to 1,400 gigawatts (GW) in 2050, meeting one-quarter of China’s heat demand for the sector.

Under the APS, China would install 100GW in buildings each year until 2050 – the equivalent of “the capacity deployed in the US, China and the EU in 2022 combined”.

Emissions from buildings heat would fall from 290MtCO2 to 80MtCO2 in 2050, a reduction of 210MtCO2, with heat pumps accounting for 30% of this decrease. The other drivers for building decarbonisation would include greater adoption of electrification, energy efficiency measures and behaviour changes.

For light industry, under the APS, approximately 1.5GW of heat pumps would be installed annually between 2025 and 2050, meeting one-fifth of heat demand in 2050.

This would contribute to “drastically” reducing carbon emissions, which would fall by 95% overall from more than 110MtCO2 to 10MtCO2. Electrification, including through use of heat pumps, would be responsible for 70% of these emissions reductions.

The report adds that two energy-intensive sectors could be well-suited to using heat pumps: the pulp and paper sector, in which around 55% of current heat demand could be provided by industrial heat pumps, and the chemical sector, for which around 18% of demand could be met.

Heat pumps would be unlikely to serve demand for other energy-intensive sectors, however, as “only a few early-stage prototypes exist for temperatures beyond 200C, all of which are far from being ready for the mass market”.

Even under the STEPS, the stock of heat pumps in buildings in China would double, reaching more than 1,100GW by 2050 and contributing to building emissions falling by more than 25%, with fuel-switching options such as coal-to-gas also playing a role.

For light industries, heat pump-led CO2 emissions reductions under STEPs would “remain limited”, as under the current policy settings, heat pumps may be “deployed slowly”. Overall, by 2050 heat-related emissions would only fall by 15%.

Significantly, the policies required to meet climate goals in China – and the rest of the world – under the APS would see some industries “strongly mobilised”, the report says. Sectors such as mining and machinery would need to expand, ramping up clean-energy technology production to meet domestic and global demand.

While this additional industrial activity would raise China’s heat demand by 5% in the APS compared with the STEPS, the associated emissions would be more than offset by the savings enabled by wider deployment of electrification and clean heating technologies.

Moreover, the deployment of heat pumps would allow for a 20% decline in the energy intensity of heat supply by 2050 – the energy demand per unit of heat – compared to today, the report says.

The alignment between expanded heat pump use and decarbonisation of the electricity system could see indirect emissions from power generation for heat drop by more than 40% by 2030 as more renewable and nuclear power comes online, it adds. By 2050, electricity’s share in heat generation could exceed 75%.

For example, the IEA states that the pulp and paper sector could see coal use “almost entirely phased out by 2050”, if China’s climate goals are met. The sector has already cut the share of coal in its energy needs from 43% in 2010 to 10% in 2022, due to electrification and coal-to-gas shifts.

Under the APS, direct coal use for space and water heating in China would fall by 75% by 2030 and would be “almost completely phased out” by 2040, with heat pumps becoming a key technology for heating in urban and rural areas by 2050.

However, significant investment would be needed in this scenario to deploy enough heat pumps to meet demand.

How effective are heat pumps as a solution for China?

With more than 250GW of installed heat pump capacity in buildings in 2023, China accounts for more than 25% of global heat pump sales and was the only major market to see heat pump sales grow in 2023, the report says. In 2022, 8% of all heating equipment sales for buildings in China were heat pumps.

They are “already the norm” for space heating and cooling in buildings in some parts of central and southern China, which do not benefit from centralised district heating. Rural areas are now seeing a growing uptake of heat pumps, due to policy support to encourage rural regions to limit coal consumption, the report adds.

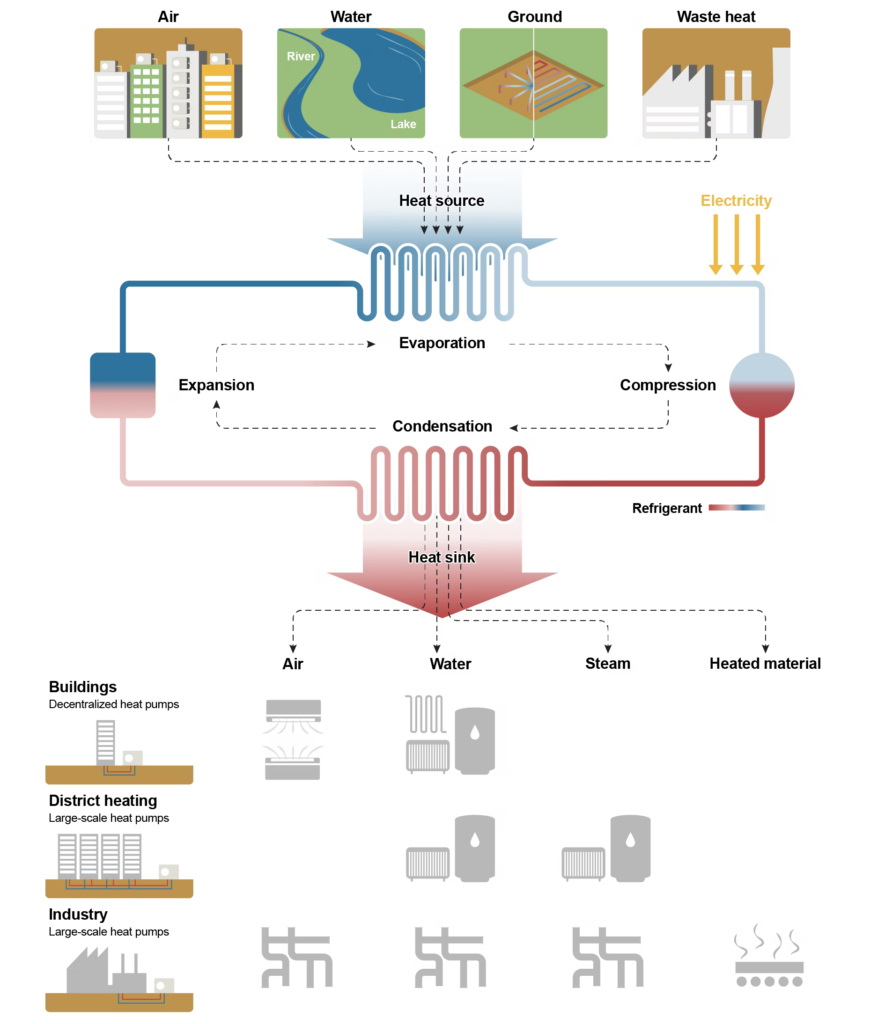

The same is also true for district heating, where network operators are increasingly installing heat pumps. While the majority are “air-source” pumps operating at relatively low temperatures, some networks are beginning to use large-scale heat pumps that recycle waste heat from steel mills, sewage treatment processes and coal chemical plants.

They “offer one of the most efficient options for decarbonising heat in district heating networks, buildings and industry”, according to the report.

In terms of both direct and indirect emissions, annual carbon emissions from a heat pump currently installed in China are more than 30% lower than those from gas boilers. “Shifting from fossil fuel boilers to heat pumps”, the report says, “would reduce CO2 emissions virtually everywhere they are installed”.

Despite high upfront installation costs, heat pumps also help users save money on energy bills over their lifetimes, according to the IEA.

The image below shows the different climate zones across China. Air-to-air heat pumps are more cost-effective than both gas boilers and electric heaters in some colder climates, as well as in regions with hot summers and cold winters.

Air-to-water heat pumps save money over electric heaters, although they are only less expensive than gas boilers in areas with competitive electricity prices compared to gas.

Heat pump use in energy-intensive industries is less viable, as current technologies to generate temperatures above 200C are still largely under development.

However, for light industries, industrial heat pumps are “far cheaper” than gas and electric boilers and nearly cost-competitive with coal boilers over their lifetimes, due to their high efficiency levels, states the report.

Despite this, uptake is not widespread, due to high upfront installation costs and lack of public awareness of the effectiveness of heat pumps.

Delmastro and Martinez Gordon tell Carbon Brief:

“In certain processes alternative technologies [to heat pumps] might be less costly and more appropriate, and – depending on policy decisions – different levels of heat pump deployment may be stimulated. However, to meet China’s carbon neutrality goal, we estimate that heat pumps need to supply at least 20% of heat demand in light industries by 2050.”

The report adds that state-of-the-art heat pumps – heat pump technology that is either newly-released or close to release – are well-placed to meet heat consumption needs in the building sectors and light industry sectors, and could theoretically supply about 40% of demand.

In addition, China currently wastes heat resources that could be redirected via heat pumps. In 2021, it generated 45EJ of waste heat resources – almost equal to the combined heating demand of buildings and industry – from sources such as nuclear power plants, other power plants, industrial activity, data centres and wastewater, according to the report.

How can policy support heat pump adoption?

Heat pumps have “increasingly featured” in China’s national-level energy and climate policy as one aspect of the energy transition. For instance, the 14th “five-year plan” for a modern energy system (2021-2025) calls for the expansion of clean heating provision for end-users as part of its electrification drive.

However, Delmastro and Martinez Gordon explain that the more targeted, practical policy recommendations in the IEA report “should [fall] under the umbrella of a clear national action plan for heating decarbonisation, which is missing now in China”.

This would allow China to set quantitative targets for heat pump use that would provide a clear signal to markets and promote wider investment in R&D, manufacturing and deployment.

Meanwhile, the report suggests that more stringent performance requirements for new buildings, stronger energy performance benchmarks, inclusion of heat pump installation requirements in building codes and extension of the scope of the national emissions trading scheme (ETS) to include industry could all drive heat pump adoption.

Loans, tax credits and other financial support mechanisms could address consumer reluctance to pay high upfront installation costs, adds the report.

The northern city of Tianjin offered grants of 25,000 yuan ($3,700) for air-source heat pump purchases, but this is not a common practice – particularly in urban regions.

Raising awareness of the benefits of industrial heat pumps and reducing electricity costs for industry could accelerate uptake in light industry, the report says.

Electricity pricing incentives have already seen rural residential areas switch from using coal to using gas for heating. Similar incentives for electricity in rural parts of Beijing, as well as subsidies for installing heat pumps, mean that heat pumps are now the cheapest heating option for households in that region, based on IEA calculations.

Expanding this policy nationwide could “further increase the competitiveness of heat pumps in regions where electricity currently costs significantly more than gas”, the report states.

Other measures that could make heat pumps more attractive to consumers include combining heat pumps with solar panels or solar thermal solutions, plus adapting the power system to provide tiered electricity pricing and time-of-use power market measures.

Finally, more recovery of waste energy resources, combined with thermal energy storage technologies, could “optimise heat supply by transforming surplus electricity…into heat and storing it for use during the winter heating”, the report says.

“In northern Hebei, for example”, it adds, “heat recovered by heat pumps from renewable power and waste heat could account for 80% of the district heat supply during winter in 2050”.

-

Heat pumps could help cut China’s building CO2 emissions by 75%, says IEA