Guest post: Why some ‘developing’ countries are already among largest climate-finance contributors

Multiple Authors

12.11.23Multiple Authors

11.12.2023 | 11:49amWith UN climate negotiations underway at COP28 in Dubai, United Arab Emirates (UAE), climate finance has once again been one of the key issues countries have been clashing over.

The recently concluded process to design the new “loss-and-damage fund” highlighted known rifts between developed and developing country parties on finance provision.

One such rift is the lingering question of who should provide climate finance to help developing countries decarbonise their economies and protect themselves from climate hazards.

Traditionally, only a small set of high-income nations have been obliged to provide this finance under the UN system.

Some parties, including the US and the EU, have argued that this list should expand to include relatively wealthy emerging economies, such as China and the Gulf states.

As our analysis demonstrates, many of these nations already provide substantial sums of money that could potentially be described as “climate finance”.

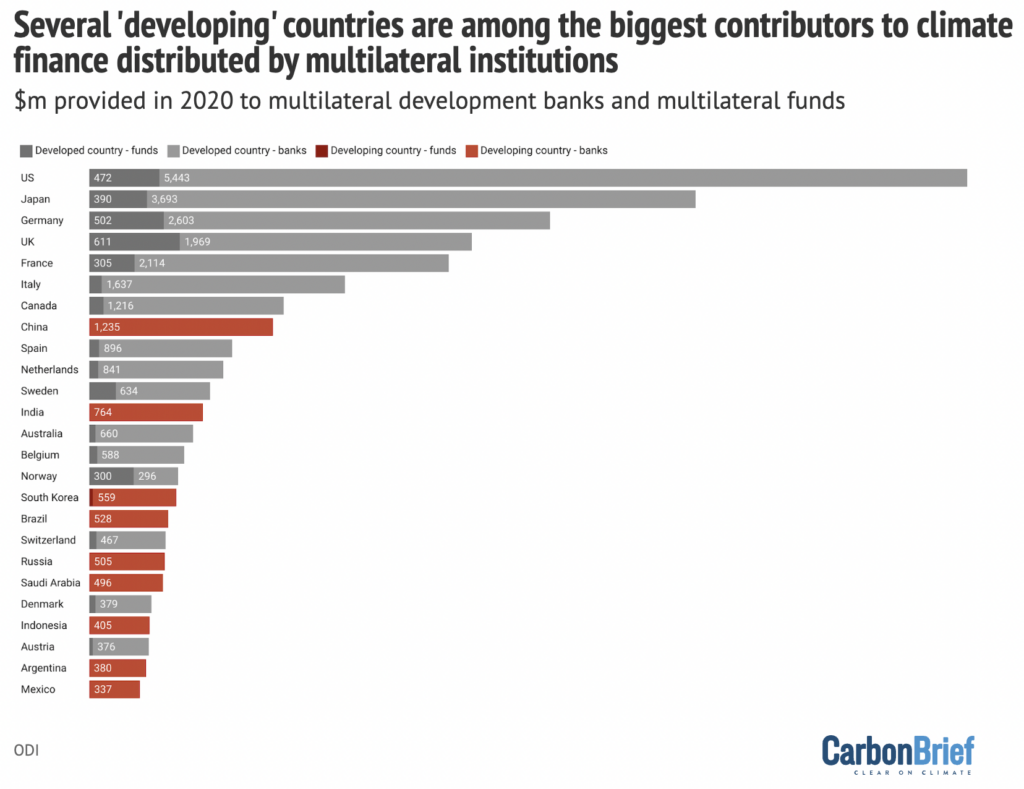

In fact, large nations, such as India, Brazil and Saudi Arabia contribute to more climate-related finance via multilateral development banks (MDBs) than many countries in the global north.

Meanwhile, China could rival the largest developed-country donors even on direct climate funding for developing countries.

Different responsibilities

Current responsibility for climate finance under the UN climate regime lies with Annex II countries – meaning the high-income nations that were members of the Organisation for Economic Co-operation and Development (OECD) when the UN Framework Convention on Climate Change (UNFCCC) was signed in 1992.

These nations – including western Europe, the EU, US, Canada, Australia, New Zealand and Japan – bear the obligation to provide a minimum of $100bn in climate finance annually to developing countries by 2020 – and up to 2025. (Developed countries failed to reach the 2020 target.)

Developing countries do not have such a responsibility, but they are “encouraged” to contribute voluntary climate finance under the Paris Agreement. This voluntary contribution aims to reflect the collective global effort required to combat climate change.

Yet, the heart of the ongoing political disputes lies in the nebulous categorisation of “developed” and “developing” introduced in the Paris Agreement in 2015.

This arrangement was viewed as a necessary compromise to replace the rigid and outdated lists agreed in 1992, which entrusted such financially divergent nations as Qatar and Malawi with the same climate responsibilities.

In theory, it opened the door for countries to self-differentiate their responsibilities and capabilities to reflect their evolving economic weight and influence in the world. To date, no developing country has made use of this possibility and formally pledged to provide climate finance.

As countries negotiate a new climate finance target for 2025 onwards to succeed the £100bn goal, developed countries would like to see the list of contributor countries formally expanded. There has been a similar effort to make countries such as China and Saudi Arabia contribute to the new loss-and-damage fund.

Top donors

Ongoing disputes about expanding the “donor base” for climate finance within the UNFCCC have overlooked the voluntary finance support that developing countries are already providing to other developing countries, in the spirit of solidarity.

Analyses from ODI and E3G have shed light on the magnitude of these contributions.

ODI’s research reveals that virtually all developing country parties are already providing “climate finance” through their contributions to multilateral institutions.

Large, middle-income countries, which are often called upon to assume climate-finance obligations, are already contributing “climate finance” for other developing countries through multilateral development banks (MDBs), such as the World Bank, and climate funds, such as the Green Climate Fund.

Accounting for these financial flows would place BRICS heavyweights – China, India, Brazil and Russia – among the top 20 providers globally.

Saudi Arabia, which alongside other relatively wealthy emerging economies has resisted efforts to broaden the climate finance donor pool, would also make the top 20. This can be seen in the chart below.

The bulk of these contributions are via MDBs. Countries pay into these banks for a range of reasons and their primary intention may not always be to provide climate finance to other developing countries.

However, they are still relevant, especially given that developed countries such as the US rely heavily on such MDB contributions when reporting their own climate finance.

Additionally, Brazil, China, India, Indonesia, Mexico and South Korea have also made specific contributions to multilateral climate funds, which are clearly intended to be used for climate action by developing countries.

Bilateral flows

Crucially, these multilateral figures are likely to be a significant underestimate of the total climate-related finance provided by developing countries.

This is because they do not account for bilateral – or country-to-country – finance flows to other developing countries, such as those distributed via China’s South-South Cooperation Assistance Fund or the Belt and Road Initiative.

There is a lack of official data on these flows, but our analysis shows that they can be significant.

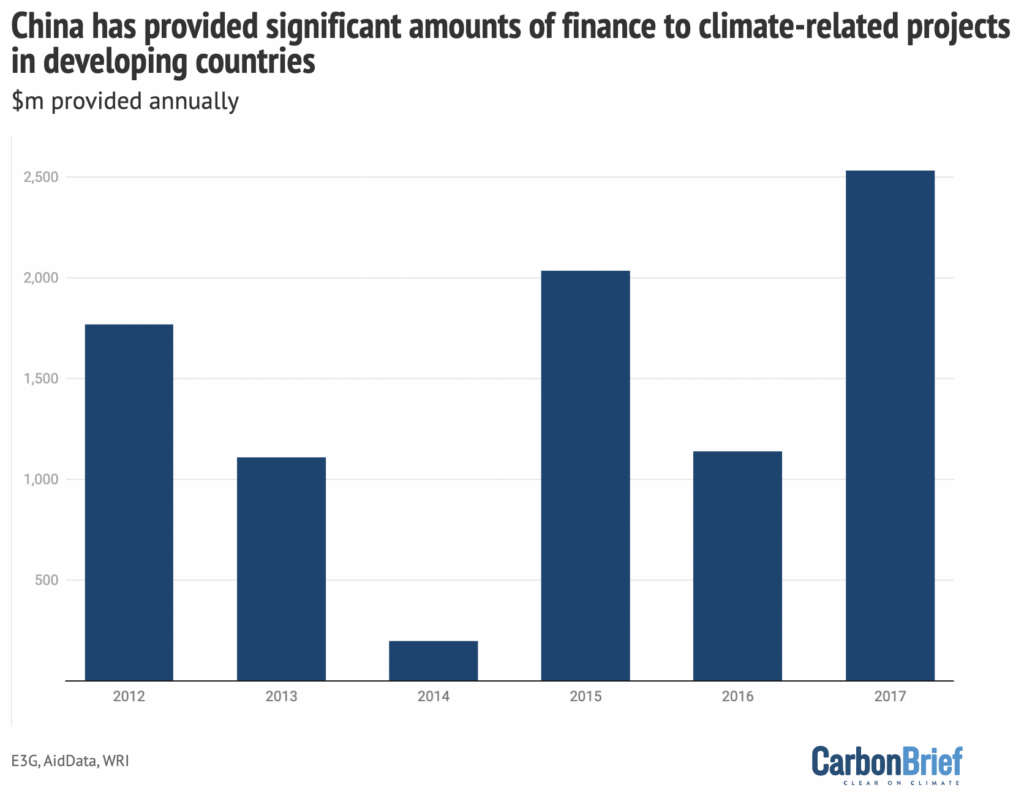

For example, E3G analysis of Chinese bilateral finance data compiled by research institute AidData shows that China has invested, on average, $1.46bn per year worth of climate-related projects between 2012 and 2017. (Data could not be assembled for the years after 2017.)

This includes both public and private bilateral investments, as well as aid in the energy, transport, water and disaster risk reduction sectors that could be described as either reducing emissions or improving climate resilience.

If the public portions of these bilateral financial flows are combined with multilateral flows, China would rank as the seventh largest provider of international climate finance to developing countries in 2017.

The nation’s $2.1bn of contributions place it roughly on a par with Italy and ahead of many developed countries including Canada and Norway in that year.

Reporting challenges

Despite these substantial contributions, the financial support provided by China and other large, middle-income nations to their fellow developing countries are going largely unrecognised by the international system.

One key reason is that developing countries are not obliged to report such contributions.

A fundamental reason for this is that these countries fear potential misinterpretation. Reporting such support voluntarily might lead to geopolitical expectations and pressure to assume “developed country” responsibilities, including taking more drastic actions to reduce emissions, our research suggests.

A change in status in the climate regime could also result in pressure on similar changes in other international regimes such as development finance or trade.

The under-delivery of the $100bn climate finance goal by developed countries also dissuades interested and capable developing countries from enhancing their voluntary support.

Although the $100bn goal is likely to have been met in 2023, it is hard for developing countries to rally the political support to send taxpayers’ money abroad, when rich countries are seen as not paying their “fair share”.

In addition, developing countries often lack the institutional and technical capacity to fully disclose their voluntary financial contributions.

The lack of transparency also extends to underreported commitments by other non-state actors, including corporations and financial institutions. These issues could be addressed collectively in ongoing discussions in the UNFCCC secretariat-led accountability framework for non-state actors.

New goal

Delegates at UN climate negotiations are set to agree on a new international climate finance goal, succeeding the $100bn, by COP29 in 2024. This target will include details on the sources of finance and likely reshape the climate finance landscape for the next decade.

COP28 could build the groundwork for a consensus on the so-called “new collective quantified goal” (NCQG), including an acknowledgement of existing contributions from developing countries.

The NCQG could do this while providing reassurance that the obligations of developed countries in leading the global climate-finance effort will continue, emphasising that voluntary contributions by developing countries will not be conflated with the politics of country categorisation.

It could even enhance voluntary contributions from non-developed country parties by considering the creation of some kind of “sub-goal” for them, while making it clear this would be on the basis of solidarity and not an obligation.

Such language could serve as a political reset, helping to rebuild trust in the international climate finance system.

-

Guest post: Why some ‘developing’ countries are already among the largest climate-finance contributors