Guest post: Why hydrogen cars are being outsold by Ferraris

Multiple Authors

04.22.25Multiple Authors

22.04.2025 | 4:00pmHydrogen has long been hyped as the “Swiss army knife” of the energy transition, but today – despite billions in investment – it largely remains limited to niche industrial applications.

In a new review article, published in Nature Reviews Clean Technology, we look at where hydrogen could plausibly become competitive – and the applications where it is unlikely to ever be a viable solution.

For each use case, the review looks at the cost and carbon emissions of using hydrogen relative to alternative solutions, identifying the barriers which stand in the way of uptake.

For example, high-profile applications, such as home heating and fuelling cars, are still widely promoted, but are failing to take off.

Fundamentally, this is because hydrogen is an inefficient and costly option in these cases, with Ferraris globally outselling all makes of hydrogen fuel-cell cars combined.

Finally, the review looks at the current state of government hydrogen policy around the world, plus the ways that its potential could be maximised in the future.

Stuck in the starting blocks

Hydrogen’s versatility means it has been proposed for many applications, from laptops to aeroplanes, along with a succession of bizarre novelties, such as the hydrogen-powered ride-on robotic horse.

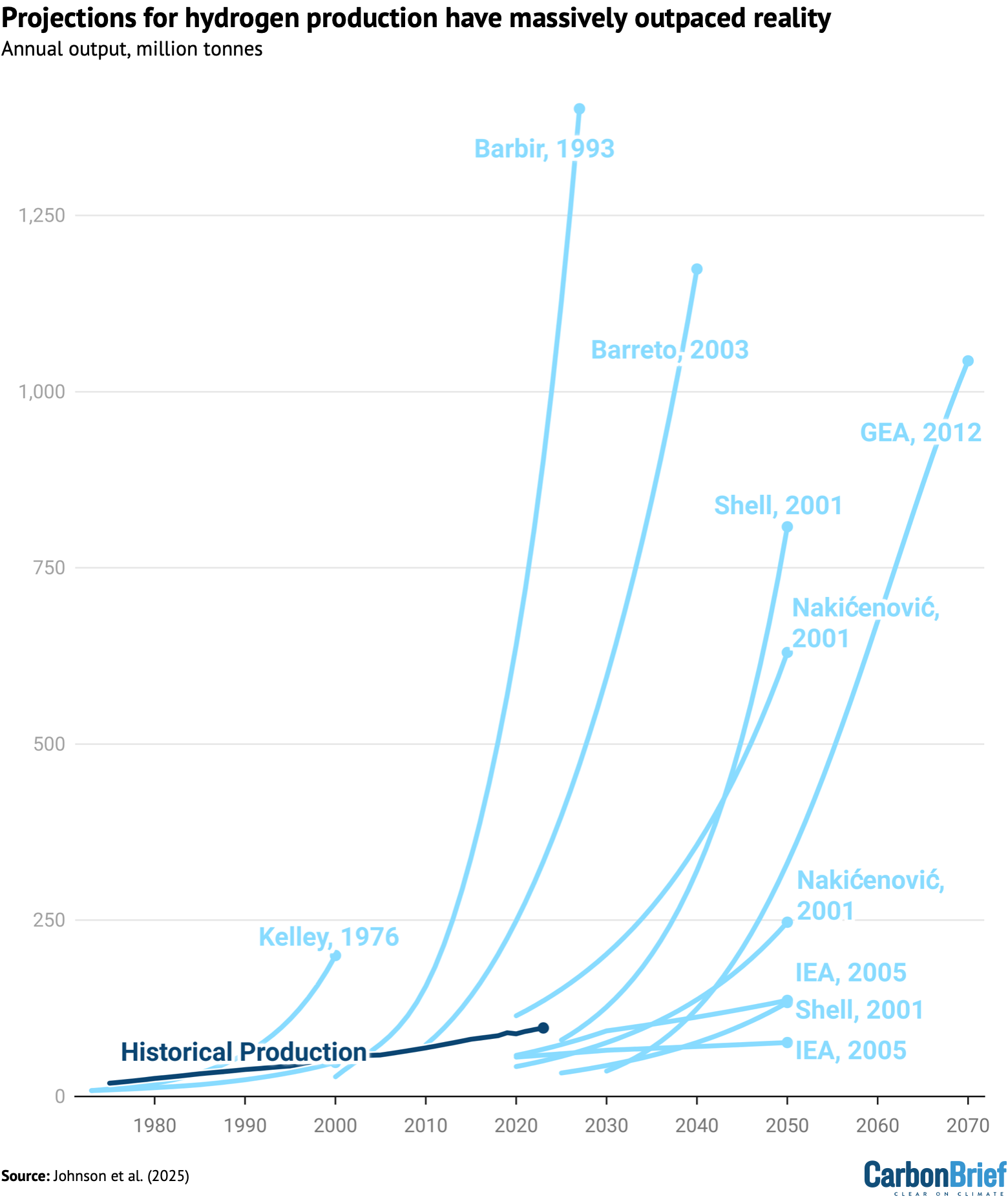

However, global production has grown more slowly than was projected by oil companies, NGOs and academics over the last 50 years. As shown in the chart below, production has only grown by around 3% per year since the 1970s – far short of expectations.

Hydrogen is not always the best option for decarbonising and several high-profile use cases are struggling to gain traction, despite decades of investment.

Many of these, such as home heating and cars, are now being electrified at an extremely rapid rate, with hydrogen unlikely to ever catch up.

For example, electric heat pumps have outsold gas-fired boilers in the US since 2022. In the UK, the then-Conservative government cancelled what would have been the world’s largest hydrogen heating pilot. And oil-and-gas giant Shell has closed all of its hydrogen filling stations in the UK and the US.

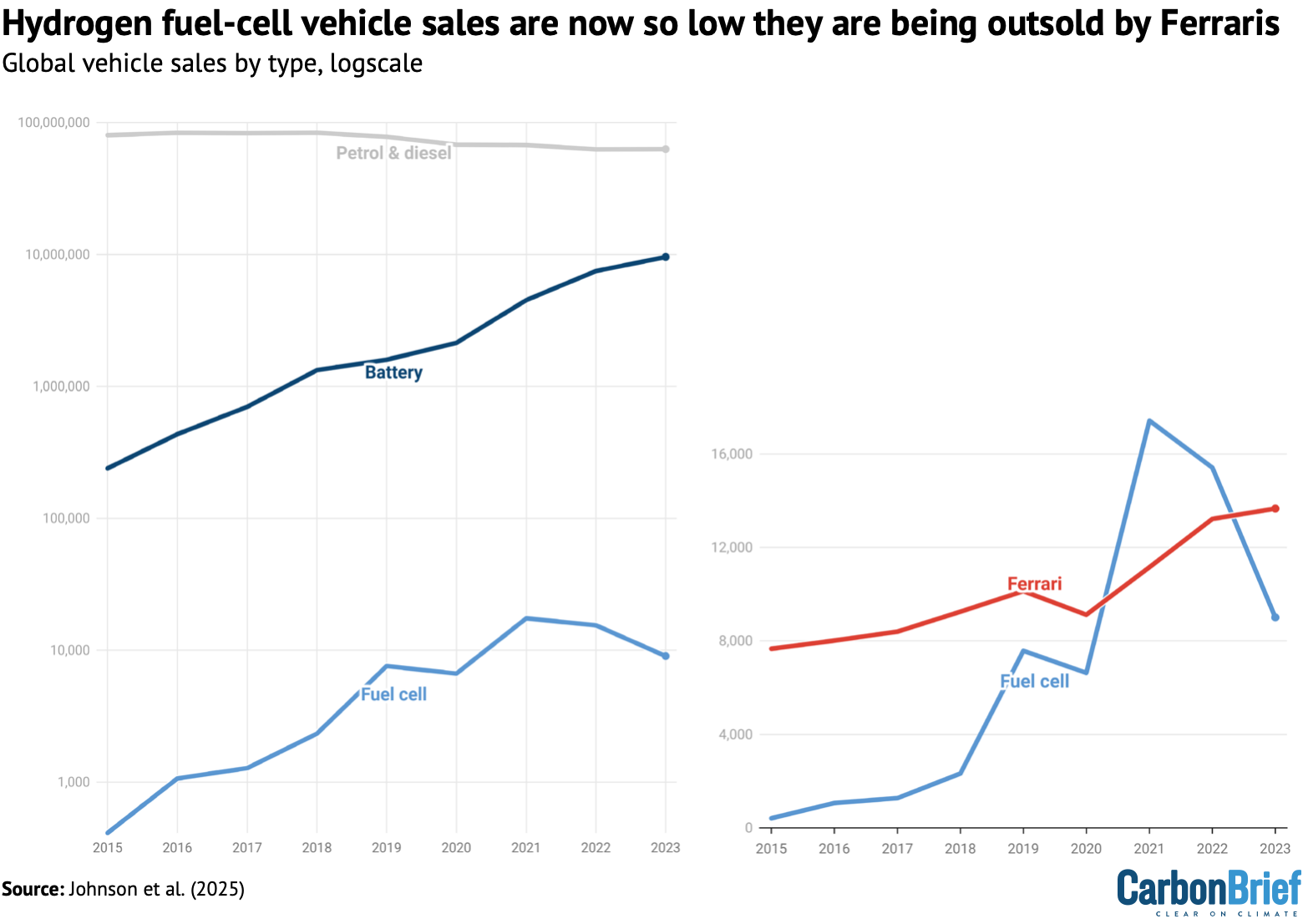

Similarly, one-fifth of all cars bought last year were electric, with sales growing quickly in the first part of 2025. Only a handful of hydrogen car models are on the road worldwide.

Moreover, hydrogen fuel-cell vehicle sales tanked in 2023, dropping 40%, with customers put off by lack of choice, minimal options for refuelling and the high cost of both the car and its fuel.

Clearly, decades of research and development from the major US, German and Japanese automakers has failed to deliver a fuel-cell vehicle with mass-market appeal.

The chart below shows that battery electric vehicles outsell hydrogen fuel-cell models by 1,000-to-1 and that more Ferraris are now sold each year than all makes and models of fuel-cell vehicle combined – despite the iconic Italian sports cars costing upwards of $350,000 each.

Hope from heavy applications

It is not all doom and gloom for the hydrogen sector. The gas, or its derivatives such as methanol and ammonia, are among the very few options for decarbonising sectors that are difficult or impossible to electrify, such as steelmaking, fertilisers, petrochemicals and shipping.

As countries move beyond “low-hanging fruit” in the energy transition, such as renewables, electric vehicles and heat pumps, decarbonisation will become more expensive and technically challenging.

Petroleum refining, fertiliser and methanol production currently rely on hydrogen sourced from fossil fuels. Our research shows that switching these to clean hydrogen produced from renewables, or with carbon capture, could cut global carbon dioxide (CO2) emissions by 2%, more than double the UK’s total CO2 emissions.

Steelmaking is another promising area. The main alternative of adding carbon capture to existing blast furnaces is failing to take off. Hydrogen-based steelmaking is still at pilot scale, but the first commercial plant is expected to start production in Sweden next year.

Hydrogen also attracts interest in heavy-duty transport, where batteries face challenges due to vehicle range, weight and refuelling constraints.

Trucks, ships and aeroplanes could be powered by fuel cells or by burning hydrogen in combustion engines, though both technologies are still prohibitively expensive.

Airbus recently announced it was delaying the development of a hydrogen-powered commercial aircraft, citing the slower-than-expected expansion of the wider hydrogen ecosystem.

A fourth promising area is long-duration energy storage. As power systems worldwide build more wind and solar, issues related to their variable output increase in prominence.

The UK is grappling with how to replace the gas-fired power stations that currently ensure security of supply when the wind does not blow. At the same time, it spent £393m last year shutting off wind turbines when the grid was unable to carry their output.

Hydrogen is one of the few ways to store surplus renewable electricity for weeks or months, without resorting to fossil fuels. Converting it back to power when demand – and prices – are high might help countries completely decarbonise power generation, with benefits across the board.

Complications with cost

High costs are arguably hydrogen’s biggest hurdle, both compared to fossil fuels and to clean alternatives such as electrification.

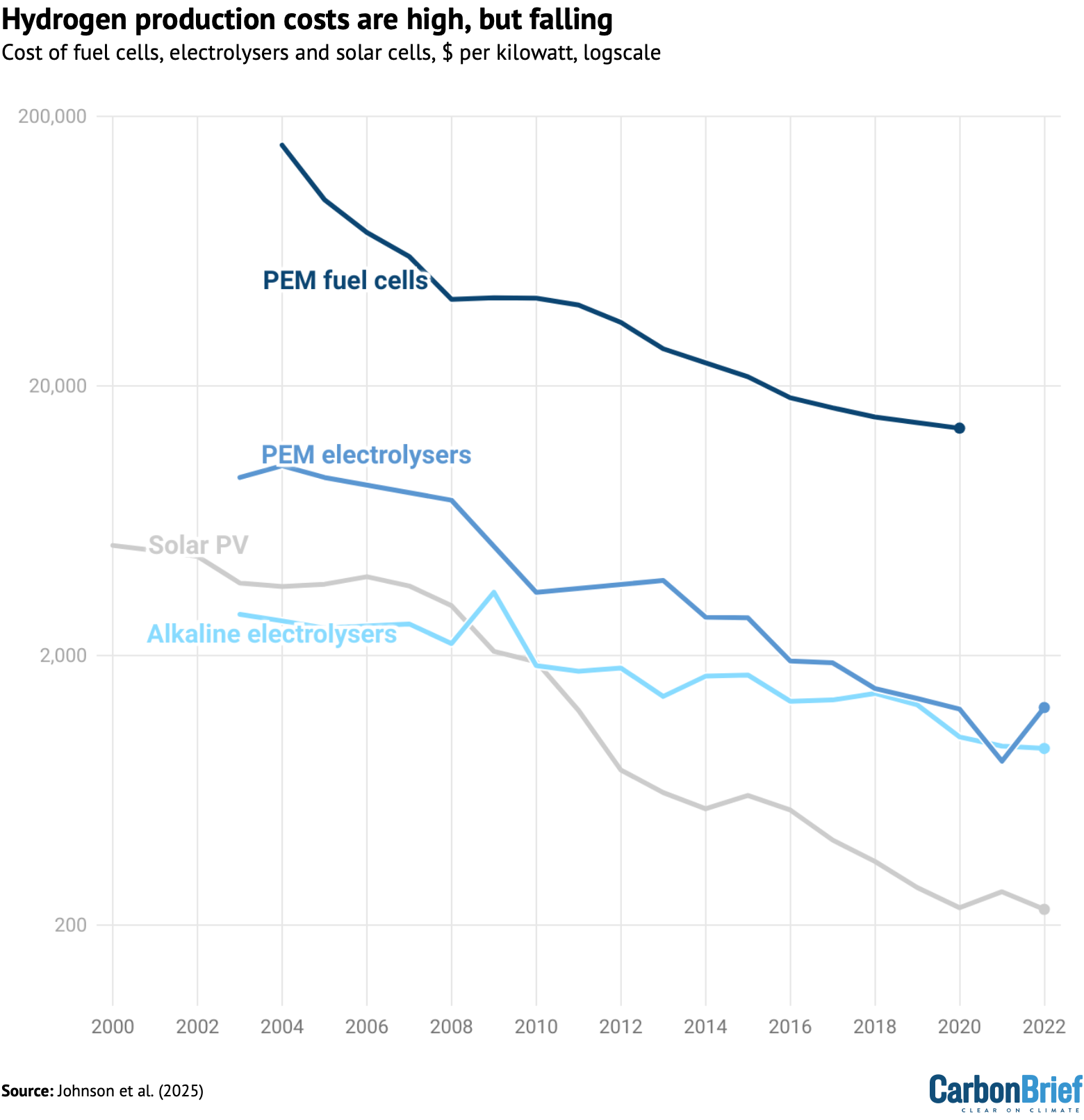

Electrolysers – the machines which use electricity to split water into hydrogen – are rapidly becoming cheaper, as happened with solar panels in recent years, driven by innovation and the scaling of production, as manufacturing has shifted to China.

As the chart below shows, while the cost of fuel cells and electrolysers are falling over time, they are falling more slowly and from a higher starting point than solar panels.

Hydrogen from current projects is still many times more expensive than analyst projections, but as electrolyser costs fall, so too will the cost of fuel production.

However, the machine is only part of the cost. So-called “soft costs” are substantial, including project administration, engineering and installation, as well as the electricity to power electrolysers.

Producing “green” hydrogen – created using renewable energy – still costs the equivalent of several hundred dollars per barrel of oil equivalent, compared to the 2024 average for oil itself of $75. There is a limit to how much hydrogen costs can fall.

Blue hydrogen – made from methane gas with carbon capture – is cheaper than green hydrogen today, but will always cost more than burning gas directly, unless the resulting CO2 emissions are subject to a carbon price. This route also ties hydrogen’s fortunes to volatile global gas markets, which have caused household energy bills to surge over the past few years.

Is ‘clean’ hydrogen really clean?

Green hydrogen can be produced with very low emissions across much of the world, but our research shows it still has a substantial upstream carbon footprint from manufacturing renewable generators (wind and solar farms) and hydrogen generators (electrolysers).

Even if green hydrogen could be produced with zero emissions, every megawatt-hour of clean electricity used to make hydrogen is one less that could replace coal or gas on the power grid, or go into powering electric vehicles or heat pumps. These direct uses of low-carbon power can deliver several times greater emissions savings per unit of electricity than hydrogen can.

Until there is a genuine surplus of renewable power, our research suggests that using the electricity directly to displace fossil fuels results in greater emissions savings.

The climate impact of blue hydrogen is hotly contested, with leading academics arguing over what assumptions and data to use when assessing its potential emissions, given that there are not any blue hydrogen plants operating, from which to get real-world data.

Producing blue hydrogen with low emissions would require eliminating nearly all methane leaks from upstream extraction and transport, as well as capturing more than 95% of the CO2 from the process of turning methane into hydrogen. Both are possible, but not what is practised today.

Only Norway and a handful of other countries can feasibly produce consistently low-carbon blue hydrogen.

Carbon is not the only issue to consider in terms of the wider sustainability of hydrogen production. For example, the water needed to make green hydrogen could affect arid regions, where renewable resources are greatest.

As with wind, solar and batteries, hydrogen also depends on metal catalysts and other critical minerals, potentially intensifying strain on these resources and the communities who extract them.

Hydrogen technologies also rely critically on “forever chemicals”, which are linked to cancers, liver damage and other chronic illnesses. This is only starting to be understood, raising questions about long-term supply risks and pollution.

Governments have huge support packages

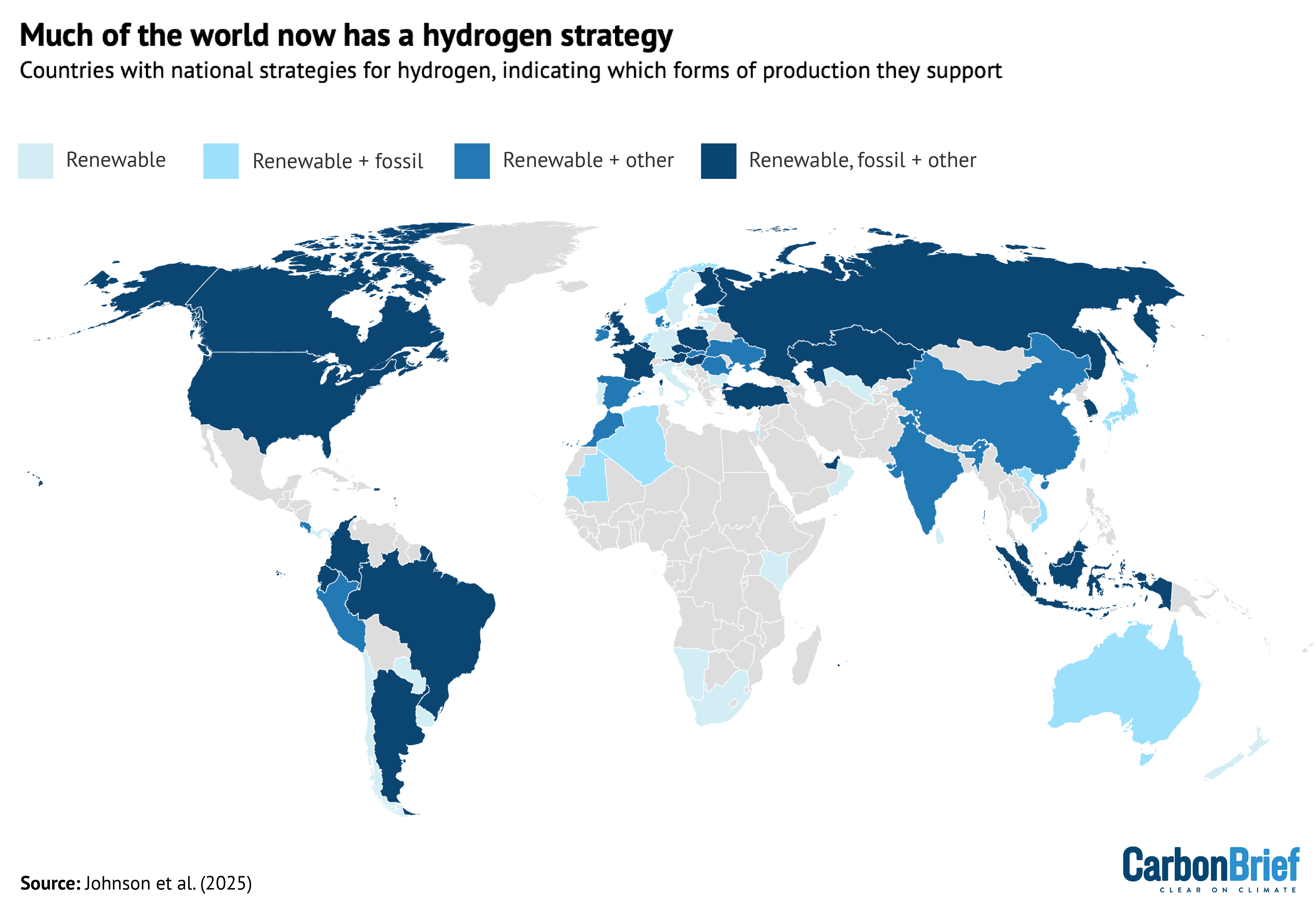

Governments around the world are launching hydrogen strategies, but the outlook is mixed.

Clean hydrogen requires three things – production, dedicated infrastructure and reliable demand – all of which must scale up at the same time. This “three-sided chicken and egg problem” requires careful coordination to avoid stranded assets.

The US Inflation Reduction Act initially offered generous production tax credits, bringing billions of dollars of announced investments and optimism that clean hydrogen could soon become cost-competitive. However, under the Trump administration, these credits are now on pause, leaving project developers uncertain.

European policy leans towards renewable green hydrogen, with auctions and subsidies available, though uptake will remain modest until costs fall further.

Our research shows that of the 60-plus countries that have launched national hydrogen strategies, 58 plan to become exporters. Who will want to import all their hydrogen remains to be seen.

Only Japan, Israel and a handful of European countries actively plan to import clean hydrogen, yet the cost, inefficiency and climate impacts of hydrogen transportation present a formidable barrier to international trade.

Much of the world now has a national hydrogen strategy in place, as shown in the figure below, with most countries taking an inclusive approach to the source of hydrogen production.

A new direction for hydrogen

Hydrogen can be part of the energy transition, if used where it offers clear advantages over alternatives, our research shows.

However, many past attempts to develop mass-market hydrogen use cases, including in home-heating pilots and for fuel-cell vehicles, have struggled to demonstrate that advantage.

Instead, these hydrogen-based technologies have been outsold by cheaper and more efficient electrified solutions, such as heat pumps and battery electric vehicles.

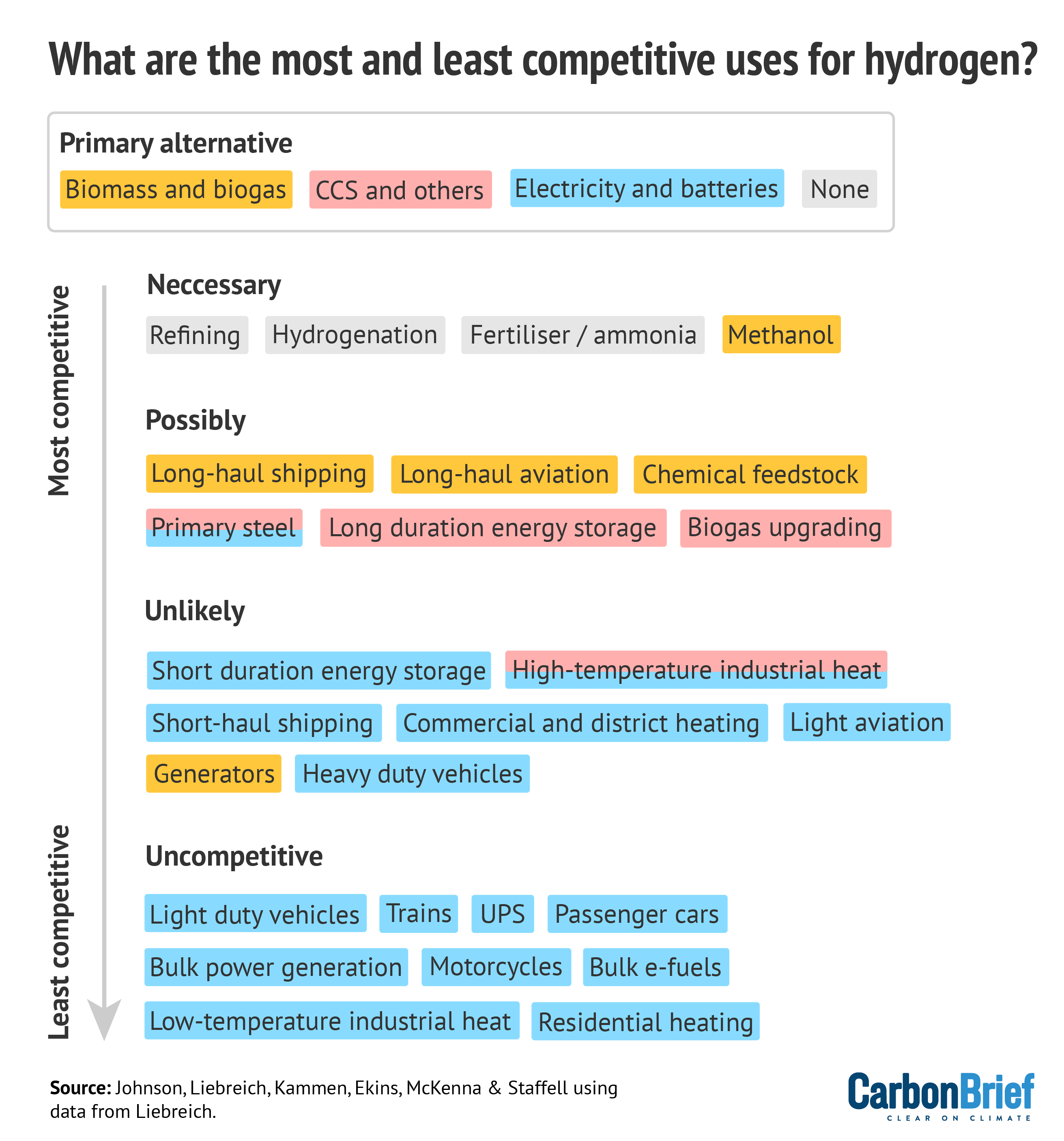

Policymakers and investors face tough choices. The review indicates that hydrogen’s highest-value use cases are in industry, heavy transport, steel and energy storage, where alternative technologies are either expensive, inconvenient or non-existent.

These more competitive use cases are near the top of the “ladder” for hydrogen competitiveness, illustrated in the figure below. In contrast, heating and light vehicles are at the bottom.

The evidence suggests that supporting hydrogen in areas with clear competitive advantages could help avoid past pitfalls, which have included:

- Supporting hydrogen where cheaper and more convenient alternatives already exist.

- Underinvesting in hydrogen’s most competitive – and unavoidable – use cases.

Put another way, policymakers can avoid these pitfalls by comparing proposals to use clean hydrogen to decarbonise different sectors with the alternatives, in terms of costs and emissions.

If clean hydrogen is prioritised for the most advantageous use cases, which better justify subsidies and infrastructure investments, then policymakers are more likely to avoid a repeat of historical “hype cycles” of boom and bust, our research suggests.

Ultimately, hydrogen’s role will hinge on delivering meaningful emissions cuts at competitive costs, rather than substituting for simpler, more direct routes to cutting fossil fuel use.

Johnson, N, et al. (2025) Realistic roles for hydrogen in the future energy transition, Nature Reviews Clean Technology, doi:10.1038/s44359-025-00050-4