Guest post: What would it take to phase out coal in Indonesia?

Seb Kennedy

07.24.23

Seb Kennedy

24.07.2023 | 11:43amIndonesia is heavily reliant on coal, which accounts for two-thirds of its electricity generation, employs a quarter of a million people and is a major export for the country.

Yet, the country has also pledged to reach net-zero emissions by 2060.

Furthermore, developed countries have pledged $20bn to support Indonesia’s transition under a “just energy transition partnership” (JETP).

TransitionZero has used its new Future Energy Outlook (FEO) open-source modelling and data platform to explore how best to spend this money.

Our results show that, if Indonesia uses JETP funds to close around half of its existing coal-fired power plants early, it would not only save money and cut carbon, but could also maintain reliable electricity supplies.

However, the untried nature of JETPs, as well as the failure of developed countries to meet financing pledges historically, mean questions remain around the viability of the scheme – not only for Indonesia, but more widely.

Solar ‘big winner’

The FEO systems model for Indonesia has 34 “nodes” representing each of the archipelago’s island provinces, making it the highest resolution model publicly available for this market.

It builds out the cheapest generation option to meet demand at each node each year while adhering to known constraints (such as an end to newbuild coal plants post-2030 or a strict carbon budget that puts the power sector on a net zero-aligned pathway). It also builds extra grid connections between nodes, if this is cheaper than adding more generation capacity.

The end result is a four-dimensional blueprint for redesigning the power system in the cheapest possible way between now and 2050.

In total, we used FEO to model four scenarios for Indonesia: “early coal retirement”; “net-zero by 2060”; “current policies”; and “least cost”.

The latter – least cost – is a theoretically unconstrained scenario optimised purely around system costs that allows new coal plants to be built post-2030 regardless of the emissions impact.

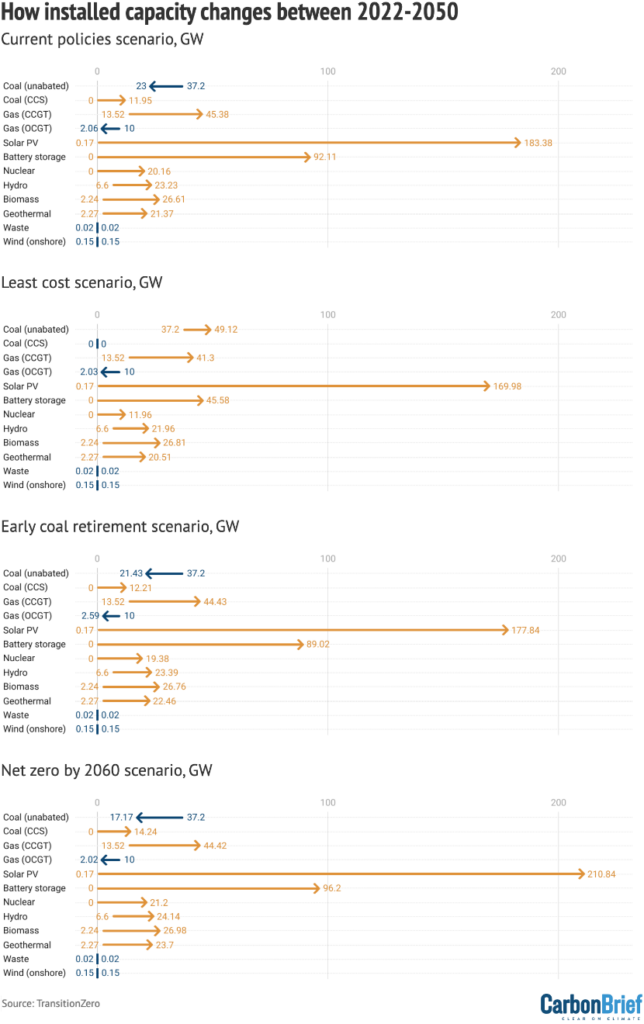

What is striking is that solar PV emerges as the big winner in all scenarios, including least cost, due to anticipated capital cost reductions and Indonesia’s stunning, but underexploited solar resource potential.

By 2050, solar capacity would hit between 170 gigawatts (GW) in “least cost” and 210GW in “net-zero by 2060”. Photovoltaic generation would displace coal as Indonesia’s largest power source under all scenarios, with more than 300 terawatt-hours (TWh) in 2050. This is 30% more than coal generation under “least cost” and 1,044% greater than coal under “net-zero by 2060”.

If Indonesia opts to redesign its power system around least-cost principles then solar will come to dominate the grid, regardless of emissions targets. Compelling economics will be the driving force for this change.

Our modelling shows that biomass, hydro, geothermal, nuclear and batteries will also all play important roles, to varying degrees, alongside some gas for backup.

The chart below illustrates the evolution of capacities by technology under each scenario, with solar’s dominance becoming apparent from 2040 onwards.

Aligning incentives

The FEO model results are particularly instructive with regards to Indonesia’s coal fleet. The government subsidises coal generation in order to keep this core economic engine ticking over and to keep electricity tariffs affordable for households.

Last year, coal burning hit record highs in Indonesia, surging by 33% on 2021 levels, contributing to a 20% increase in carbon emissions, according to data from the Indonesian Ministry of Energy and Mineral Resources and reported by Mongabay.

This was largely driven by efforts to kickstart a recovery following the Covid-19 pandemic, highlighting coal’s central role in the country’s economy.

Coal plants are financed by power purchase agreements (PPAs), which must be paid off before a plant can be retired.

If the JETP cash materialises and is used exclusively to pay down coal PPAs – neither of which are a foregone conclusion – electricity could become both cheaper and cleaner in Indonesia.

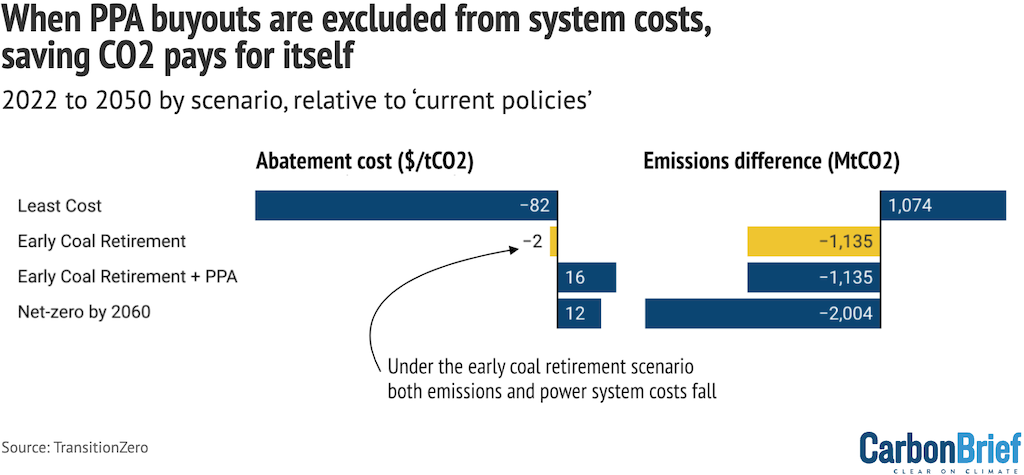

In the “early coal retirement” scenario modelled, where 21.7GW of coal capacity is paid to close, power-sector decarbonisation would initially happen more quickly compared to the “Net-zero by 2060” scenario, and the resultant system would be less costly to run than the “current policies” (baseline) scenario.

Under “early coal retirement”, total power-sector emissions are 1.3bn tonnes of carbon dioxide (GtCO2) lower out to 2050 compared to “current policies” – and the overall cost of operating the power system drops by $2bn compared to the baseline.

In economist-speak, this amounts to a negative cost of abatement: the cost of cutting carbon comes in at minus $2 per tonne of avoided CO2 when JETP funds are used for early coal retirement.

This is a significant finding, because economic and environmental incentives rarely align in this way.

Again, the key enabler for these savings is the JETP. If this money fails to materialise and the $20bn cost of buying out Indonesia’s least profitable coal PPAs is added to the overall system cost, this results in a cost of abatement of $16 per tonne of avoided CO2. Indonesia is highly unlikely to shut coal plants if it has to pay to do so.

The chart below illustrates the overall cumulative cost of running Indonesia’s power system between now and 2050 under each scenario compared to the “current policies” (baseline) scenario, and the difference in greenhouse gases emitted over this period.

When PPA buyout costs are added to the system cost, the cost of abatement can be seen to rise from -$2 to $16 per tonne of avoided CO2.

Driving out inefficiencies

In the “early coal retirement” scenario, the system cost falls as plants are removed because many of them currently receive capacity payments to keep them available on island grids with very high “reserve margins”.

Early closure of plants that are redundant due to overcapacity ends these payments, driving out inefficiencies and making space for renewable energy to meet incremental demand.

The lowest hanging fruit on the coal-retirement tree is to be found on grids with the highest reserve margins – and Indonesia has many isolated grids with huge scope for optimisation.

Reserve margins measure the amount of spare capacity available above peak demand, and are a proxy for overcapacity. Southeast Asia power planners typically target 25-30% reserve margin levels, while the European and global average is around 15%.

The average across Indonesia’s five main grid networks is 49%. In Java-Bali, Indonesia’s largest and most populous island province, reserve margins are almost 60%. This is particularly acute on Java-Bali’s Banten subregional network, where reserve margins are 127%.

Banten is home to 8.8GW of coal plant capacity, of which 7.3GW would be prioritised for closure under the “early coal retirement” scenario. We configured FEO to reduce reserve margins to 35% by 2030 to drive out this excess capacity and improve system efficiency, while ensuring a safe generation margin to meet peak demand in all scenarios.

More money, greater ambition

The FEO model results are clear: all “least cost” pathways lead Indonesia to a future powered by solar and other renewable and low-carbon technologies. But the speed of the transition is less certain. What we do know is that accelerating coal closures now pays dividends later.

Under the “early coal retirement” scenario, power-sector emissions drop rapidly in the first five years as those 21.7GW of underutilised capacity start to come offline, funded by the JETP’s $20bn PPA buyout fund. Power-sector emissions initially fall more quickly in this scenario than under “net-zero by 2060”, because plants are forced offline sooner rather than later.

Indonesia is currently building 13GW of new coal plants this decade, all of which come online as scheduled in all FEO scenarios. But the rate of closures under “early coal retirement” exceeds the rate of new additions, meaning that Indonesia could save 87m tonnes of CO2 between now and 2028 compared to the “net-zero by 2060” scenario.

However, those early emissions gains are at risk of being lost. The FEO model shows that the JETP money runs out in 2028 and, thereafter, emissions start to rise again.

This suggests the need for a new climate finance mechanism to replace the JETP after the $20bn is spent, if decarbonisation of the energy sector in Indonesia is to continue.

Additionally, the model suggests a combination of ongoing international support for PPA buyouts and binding power sector emissions targets to ensure climate finance could deliver the biggest possible carbon abatement “bang per buck”.

As can be seen in the chart below, emissions initially rise more slowly under the “early coal retirement” scenario, but they then shoot up again post-2028 when the JETP money runs out.

Quantifying the opportunity

The FEO systems model allows us to quantify, with greater spatial and temporal granularity than ever, the benefits of leveraging international climate finance into early coal retirement in Indonesia, in terms of both lower emissions and costs.

The question now is whether the money will be forthcoming and offered on terms that are acceptable to Indonesia.

Donor countries and financial institutions are yet to sign off on any of the promised JETP funds. It is unclear whether these will be primarily grants and concessionary loans, or whether lenders will insist upon commercial interest rates.

The cost and emissions benefits of early coal retirements are less likely to materialise if Indonesia is required to saddle itself with burdensome repayments to unlock capital inflows.

JETPs are a promising, but untested mechanism for accelerating decarbonisation in low- and middle-income countries, such as Indonesia.

If JETP members can align on the terms of investment and how best to deploy capital, they could create a model for successful north-south climate cooperation for other recipient nations to replicate.

There will be many pitfalls to navigate, but at least the benefits of mobilising climate finance for coal PPA buyouts are now more clearly understood.

Full details on the Future Energy Outlook modelling platform and the findings of the first model runs are available on the TransitionZero website.