Guest post: Saudi Arabia’s surprisingly large imports of solar panels from China

Multiple Authors

03.31.25Multiple Authors

31.03.2025 | 10:30amSaudi Arabia and Pakistan were among the top importers of Chinese solar panels in 2024, with more than half heading to countries in the global south.

The findings come from Ember’s China’s solar PV export explorer, which tracks shipments to more than 200 countries and was recently updated with figures for the full year of 2024.

In total, China’s solar panel exports rose by 10% in 2024, with imports by global-south countries rising by 32% and those to the global north falling by 6%.

This means Chinese exports grew less quickly than the 30% rise in solar installations outside China last year, indicating that other countries have been boosting their own solar manufacturing capacity and that already-imported stocks were being run down.

Apart from Pakistan and Saudi Arabia, which both witnessed different solar booms last year, there was also a sharp uptick in sales to many small African and Latin American countries in late 2024, suggesting that China may be finding new markets for its solar exports.

China itself – the biggest of all the global-south solar markets – installed more solar panels than it exported for the second year in a row.

This article analyses the latest trends from China’s solar export data, highlighting the markets currently seeing record growth and the trends that underlie this.

Global-south sales surge

China’s exports of solar panels to the global south have doubled in the past two years, overtaking global-north sales for the first time since 2018, according to data collated in the Ember export explorer.

Global-south imports more than doubled from 60 gigawatts (GW) in 2022 to 126GW in 2024. That surpassed global-north imports, which were only 12% more in 2024 than in 2022, as shown on the chart below.

Biggest solar importers

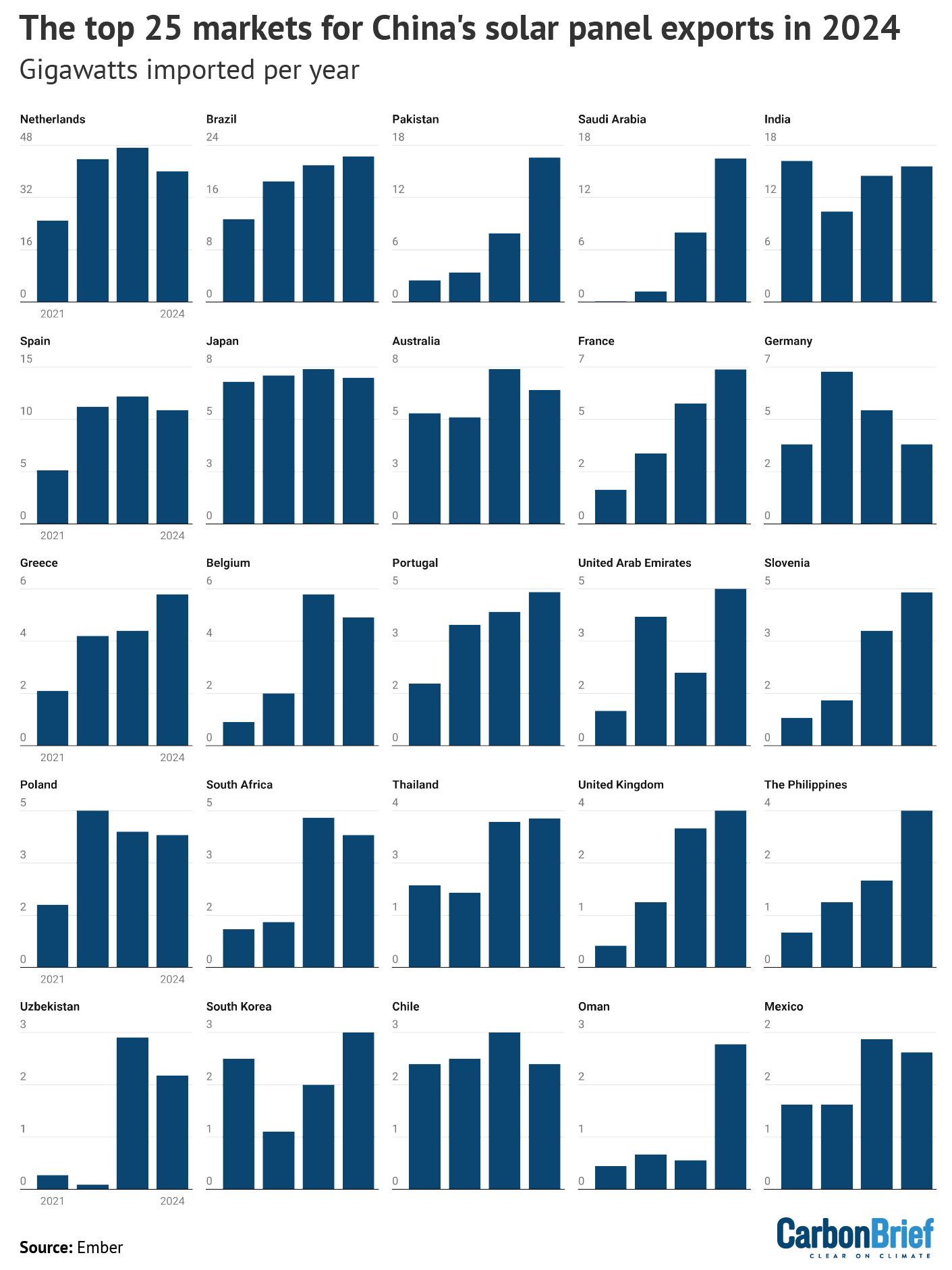

The Netherlands was the biggest importer in 2024 and has been every year since 2019, as a result of Rotterdam serving as an import hub for much of continental Europe. The following four places were all global-south countries, the data shows.

Brazil was in second place again, importing more than 20GW for the second year in a row. However, the imposition of import taxes by the government, the refusal of electricity distributors to connect new solar systems and solar “curtailment” are all causing headwinds in 2025.

Pakistan and Saudi Arabia jumped to third and fourth, respectively. (The next section charts the rise of these two very different solar giants, from the 12th and 26th biggest importers, respectively, in 2022 into the top five.)

India was in fifth place in 2024. Its module imports remained similar to those in 2023, but its installations rose to a record high, enabled by a step up in new domestic solar panel manufacturing capacity.

In January 2025, that helped India hit 100GW of solar installed, according to government figures. India is partly relying on Chinese imports, whilst simultaneously scaling up its own manufacturing industry.

The other large global-south markets – identified in the export explorer data – are also spread across the world, as shown in the figure below.

They include the UAE and Oman in the Middle East, Thailand and the Philippines in south-east Asia and then South Africa, Chile, Uzbekistan and Mexico.

Pakistan and Saudi Arabia

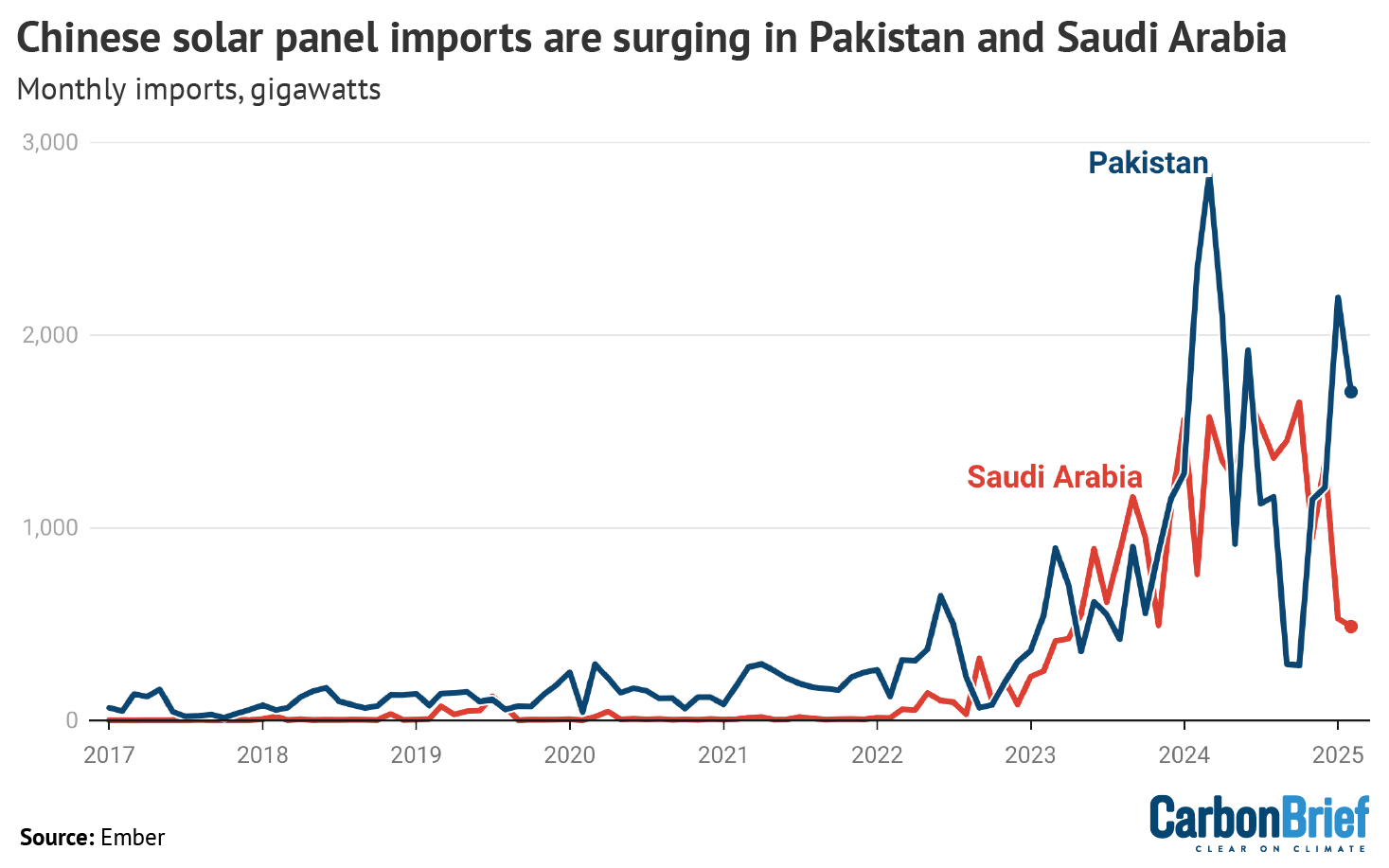

Pakistan and Saudi Arabia have had almost identical imports of Chinese solar panels for the past two years. They stood at 8GW in 2023 and then more than doubled to 17GW in 2024, placing them as the third and fourth largest importers in the world, the export explorer shows. Their monthly imports from China are shown in the figure below.

However, that is where the similarities end. Pakistan’s growth has come almost entirely from small-scale “distributed” installations, without co-located battery storage and paid for by consumers. Saudi Arabia’s growth has come almost entirely from desert solar farms, complete with some battery storage and paid for by international energy companies.

Pakistan’s solar boom was ignited by spiralling electricity costs and chronic power shortages, which have put energy at the heart of the country’s economic problems.

The country installed 10-15GW of solar in 2024 alone, according to Bloomberg estimates. Pakistan’s peak electricity demand was just 30GW in 2023, which gives an idea of how big solar has become in the country.

Large utility-scale solar is minimal – only 0.63GW of such capacity is operational. Instead, almost all of the new solar capacity was installed on rooftops or next to factories or fields, for direct use by consumers.

However, hardly any battery capacity was installed alongside the new solar panels, meaning people and companies still rely on the grid for electricity outside of sunny hours.

The surge in solar capacity has helped drive down electricity generation from fossil fuels, despite fast-growing electricity demand. However, it also “threatens to disrupt” the grid, where demand has created at the same time as becoming more variable.

Turning to Saudi Arabia, solar panels are used mostly in large desert renewable auction tenders. There have been five solar tender rounds in 2017, 2019, 2021, 2023 and 2024.

The latest tender round contracted 3.7GW of large-scale desert solar parks, achieving the cheapest reported electricity prices in the world of $13 (£10) per megawatt hour. (Note that these reported prices are somewhat artificial and are likely to underestimate the full cost.)

None of the winning solar parks were contracted with batteries. However, parallel battery tender rounds are now commencing.

There are estimated to be only 3.3GW of solar projects currently operational in Saudi Arabia, but a further 5.4GW are under construction. The solar plant owners are international energy firms including KEPCO, EDF Renewables, Masdar and TotalEnergies, as well as Saudi companies.

The country plans to move from near-zero renewables in 2020 to 50% of its total electricity generation coming from renewables in 2030. In relative terms, this is one of the most ambitious renewable targets anywhere in the world.

New markets

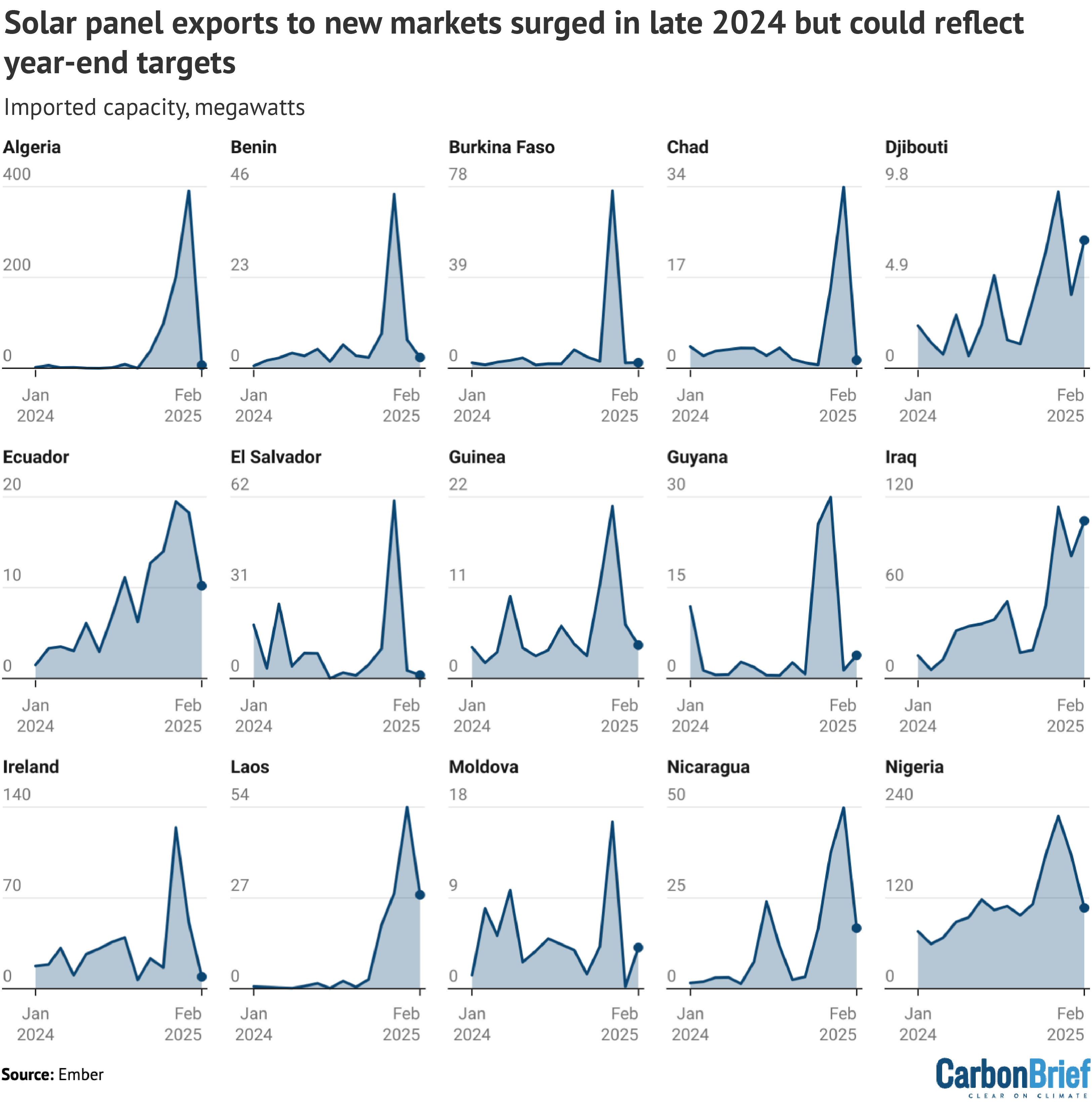

There were 15 countries that saw a large uptick in imports of Chinese solar panels towards the end of 2024, according to the export explorer data and shown in the figure below.

There were large increases in Nigeria, Algeria and Iraq, where there is clear evidence that demand for panels is growing.

For example, Nigeria’s growth was driven by blackouts in 2024 and the removal of fuel subsidies, making diesel generators more expensive to run.

Iraq is currently constructing its first large solar plant, while another 7.5GW of projects were approved by the government in 2024 to meet growing electricity demand.

Meanwhile, Algeria has a plan for 3GW of solar projects, which is now underway.

For a cluster of a further 12 countries, it is less clear if the recent uptick in solar panel imports is a structural change that will continue into 2025 and beyond.

There are large incentives for China’s solar manufacturing companies to meet year-end targets, so it is possible that containers of solar panels were sold at discounted rates to help meet these goals.

The cluster includes many small African countries – Benin, Burkina Faso, Chad, Djibouti and Guinea – and Latin American countries – Ecuador, El Salvador, Guyana and Nicaragua.

The December 2024 imports are quite large in the context of the small electricity systems of many of these countries. As such, these solar panels would provide a relatively meaningful increase in renewable electricity generation if they go on to be installed.

China installs more than exports

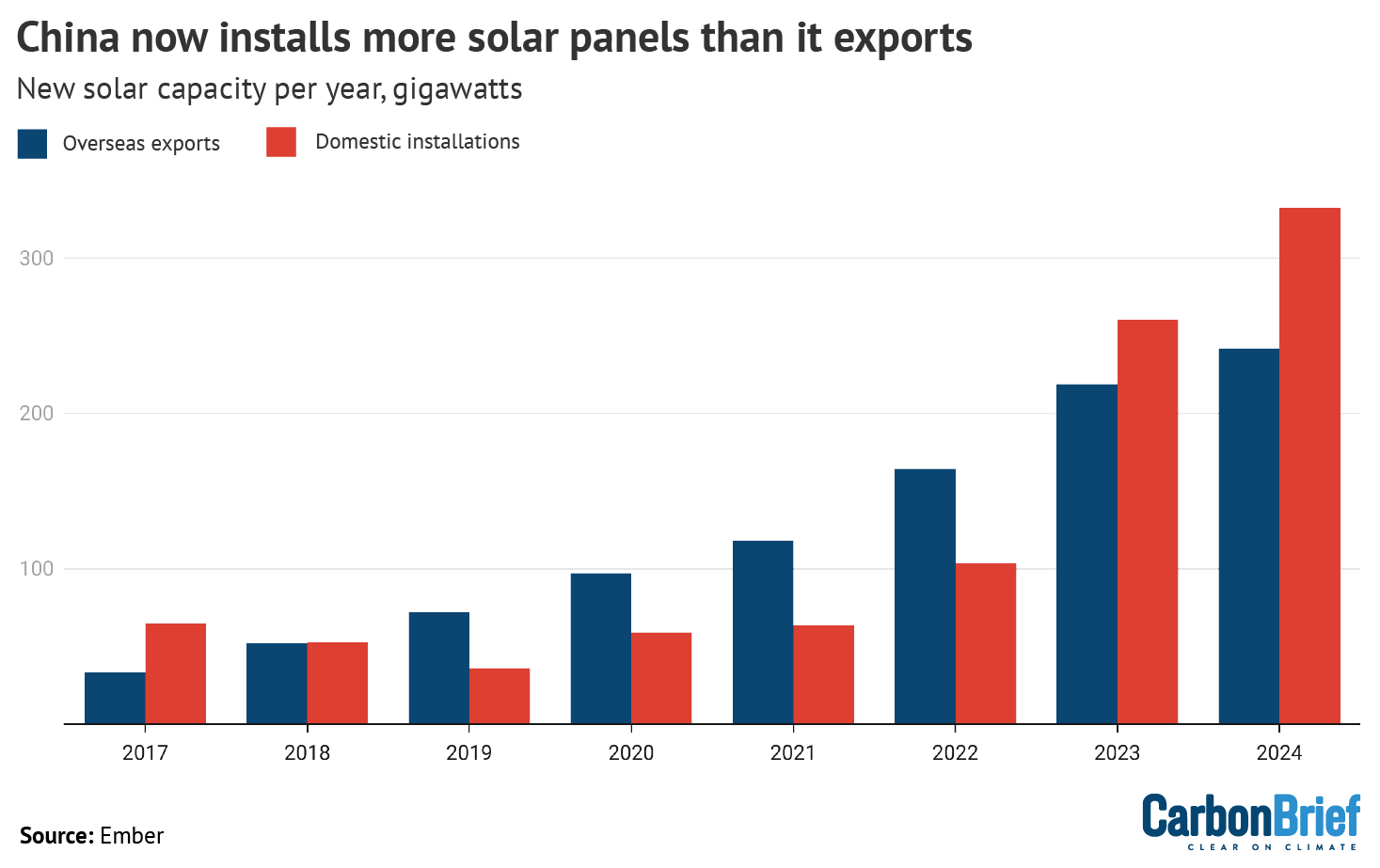

China has not just been exporting growing numbers of solar panels. – In 2024, it installed more solar panels than it exported for the second year running, according to Ember analysis.

Indeed, China installed 333GW of solar capacity domestically in 2024, some 38% more than the 242GW of solar panels that it exported, as shown in the figure below.

From 2019 to 2022, China had been exporting more solar panels overseas than it installed domestically. However, that changed when China’s solar panel installations surged from 103GW in 2022 to 260GW in 2023.

By the end of 2024, China had a total installed solar capacity of 1,064GW, making it the first country to achieve the 1 terawatt (TW) benchmark.

Reducing reliance on China

China’s solar exports grew for the seventh consecutive year in 2024, rising to a record 242GW, Ember’s data shows.

Exports rose by 10% year-on-year, which was a significant slowdown from the rate of growth seen in recent years. However, solar installations outside of China grew by 30%.

This demonstrates a step-up in ambitions to reduce reliance on Chinese solar panel imports by a number of countries around the world.

For example, India’s solar panel manufacturing capacity has skyrocketed in recent years. In 2023, it added 23GW and a further 11GW was completed in the first half of 2024. India’s reported module and cell production capacities stood at around 80GW and 7GW, respectively, as of March 2025.

However, the country still relies on imported Chinese solar cells. The value of shipments to India rose 30% from $970m in 2023 to $1.3bn in 2024, accounting for almost half (48%) of China’s cell exports.

This reliance is seen as a temporary but essential part of the transition to full India manufacturing capability, as solar cell manufacturing capacity steps up, with the aim that projects contracted through the government solar auctions only use locally-sourced cells from June 2026.

The EU is on track to meet its 30GW of solar panel manufacturing target in 2025. However, the numbers are relatively small compared to other regions. Europe had 22GW of solar module manufacturing capacity in 2024, with 12GW in the construction pipeline.

The US does not import Chinese panels, but it does rely heavily on imports from other Asian countries. It imported 51GW of solar panels in the first 10 months of 2024, more than 90% of which were from Vietnam, Thailand, Malaysia, India or Cambodia.

US manufacturing capacity rose from 7GW in 2020 to 50GW in early 2025, with plans announced for a further 56GW, according to trade association the Solar Energy Industries Association.