EU’s solar and wind growth pushes fossil-fuel power to lowest level in 40 years

Molly Lempriere

01.22.25Molly Lempriere

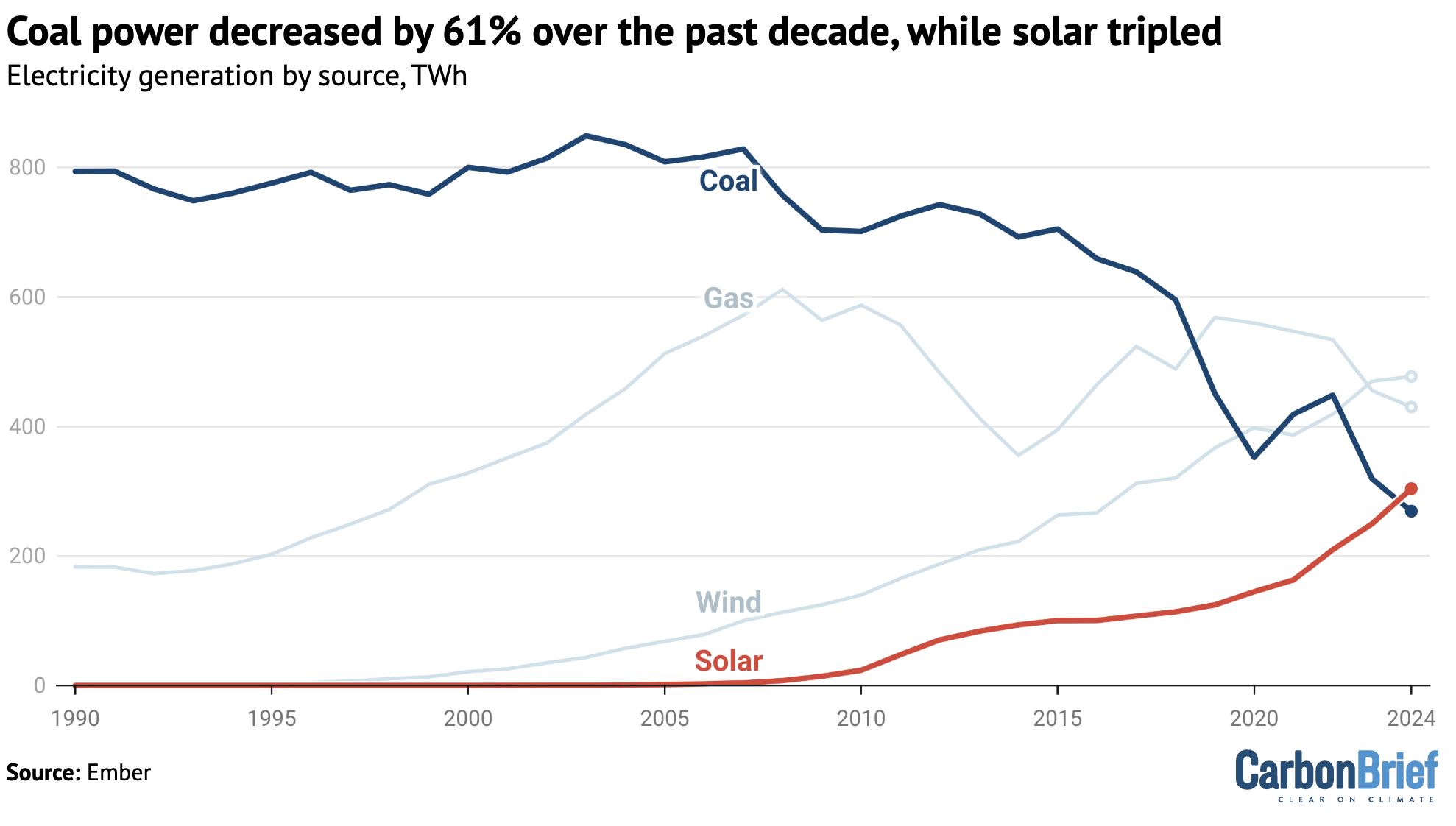

22.01.2025 | 11:01pmOver the past decade, coal power use in the European Union (EU) has fallen by 61%, according to Carbon Brief analysis of new figures from energy analysts Ember.

Solar power output in the EU more than tripled between 2014 and 2024, the report shows, with last year seeing coal generation overtaken for the first time.

Meanwhile, wind generation has more than doubled over the same period.

Wind and solar growth over the past decade pushed EU fossil-fuel generation in 2024 to its lowest level in 40 years, despite the long-term decline of nuclear power.

The increase in wind and solar generation in the EU also helped avoid €59bn in fossil-fuel imports over the past five years, Ember says.

Without the increase in solar and wind capacity since 2019, the EU would have imported an extra 92bn cubic metres (bcm) of gas and 55m tonnes (Mt) of hard coal. Ember says this helped avoid cumulative emissions of some 460m tonnes of carbon dioxide (MtCO2).

Accelerated wind and solar growth facilitated by permitting reform and other measures could help the EU end Russian energy imports entirely, adds Ember.

Five years of falling fossil fuels

Last year marked five years since the passing of the European Green Deal, officially declaring a “climate emergency” and requiring the European Commission to adapt all its proposals to fall in line with limiting global warming to 1.5C above pre-industrial levels.

Since then, the EU’s electricity sector has seen a “deep transformation”, according to Ember, with a “surge” in renewables driving down the use of fossil fuels and related CO2 emissions.

In 2019, fossil fuels provided 39% – some 1,130 terawatt hours (TWh) – of the EU’s electricity, while renewables provided 34% (979TWh). By the end of 2024, fossil fuels had fallen to 29% (793TWh) – the lowest level in at least 40 years – while renewables had grown to nearly half of the mix (47%, 1,300TWh).

The growth of wind and solar ensured that, despite a decline in nuclear over the past 10 years, coal and gas are both being squeezed out of the electricity generation mix in the EU, as shown in the chart below.

The growth of solar and wind over the past five years has cumulatively avoided 736TWh of fossil-fired generation. This is equivalent to 460m tonnes of CO2 (MtCO2), or roughly the same as the power-sector emissions of Italy over the past five years, Ember states.

The emissions intensity of electricity fell by 26% over this period, to 213 grams of CO2 per kilowatt hour (gCO2 per kWh). This is a steeper decline than that seen in other major economies such as the US, notes Ember, where the emissions intensity of electricity generation fell by 13% over the same period.

Over the past five years, EU solar capacity tripled from 120 gigawatts (GW) to 338GW, continuing the rapid expansion seen in the previous five years. Wind capacity has grown by 37%, from 169GW in 2019 to 231GW in 2024.

Hydropower capacity since the passage of the Green New Deal has remained flat at 130GW and nuclear capacity has fallen from 110GW to 96GW, Ember notes.

The continued growth of wind and solar means EU electricity generation from coal has now dropped by nearly two thirds over the past decade, as the chart below shows. This is despite a small, temporary uptick in response to Russia’s invasion of Ukraine in 2021.

Moreover, while gas-fired generation in 2024 was slightly higher than it was a decade earlier, it has also dropped every year for the past five years, Ember’s data shows.

Without the growth in renewables since the Green New Deal was brought in, the EU would have spent €59bn on fossil-fuel imports for power generation, according to Ember. Of this, €53bn would have been spent on gas and €6bn on coal.

In total, the EU avoided importing approximately 92bcm, or around 18% of gas consumed in the power sector between the end of 2019 and the end of 2024. It also avoided imports of 55Mt of hard coal.

Coal has been particularly impacted by the growth of solar and wind, falling from 16% of the EU electricity mix in 2019 to less than 10% in 2024. This has more than cancelled out the impact of the temporary uptick in 2021 and 2022 during the gas crisis.

In 2024, coal provided less than 5% of the power mix in 16 EU countries, Ember says, 10 of which had no operating coal power plants.

Portugal phased coal out of its electricity mix completely and a new wave of coal power plant closures is “imminent”, says Ember. There are 11 EU countries that have announced plans to totally phase out coal from their electricity mix in the next five years.

Along with the fall in coal power, gas fell by a quarter over the past five years from providing 20% of EU power in 2019 to 16% in 2024, according to Ember.

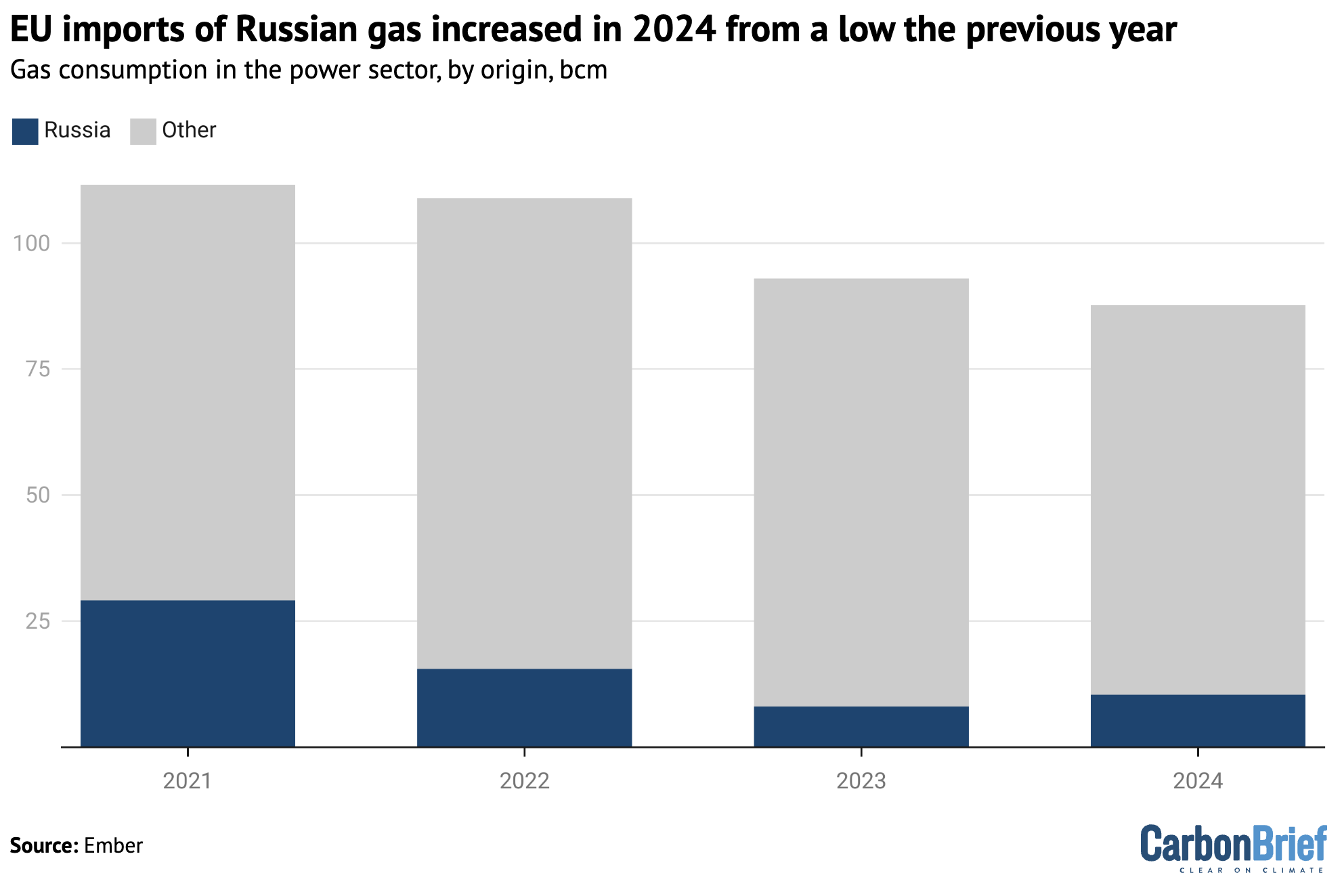

This drop has contributed to efforts to limit EU reliance on Russian gas, although imports from the nation still accounted for 14% of total gas consumption in 2024.

While this was down from around 50% in 2019, it was an increase of 18% on the previous year, mainly due to increased imports into Italy, the Czech Republic and France.

According to Ember, the power sector consumed approximately 88bcm of gas in 2024, of which 10bcm (12%) was Russian, as shown in the figure below. These imports provided the country with an estimated €4bn in revenue.

Even with the uptick in 2024, the EU’s power sector is far less reliant on importing Russian gas than it was five years earlier, Ember’s data shows.

Solar continues to surge

There was a record increase in solar generation in 2024, up 54TWh (+22%) year-on-year, according to Ember. This is despite the sector having already seen growth of 40TWh in 2023.

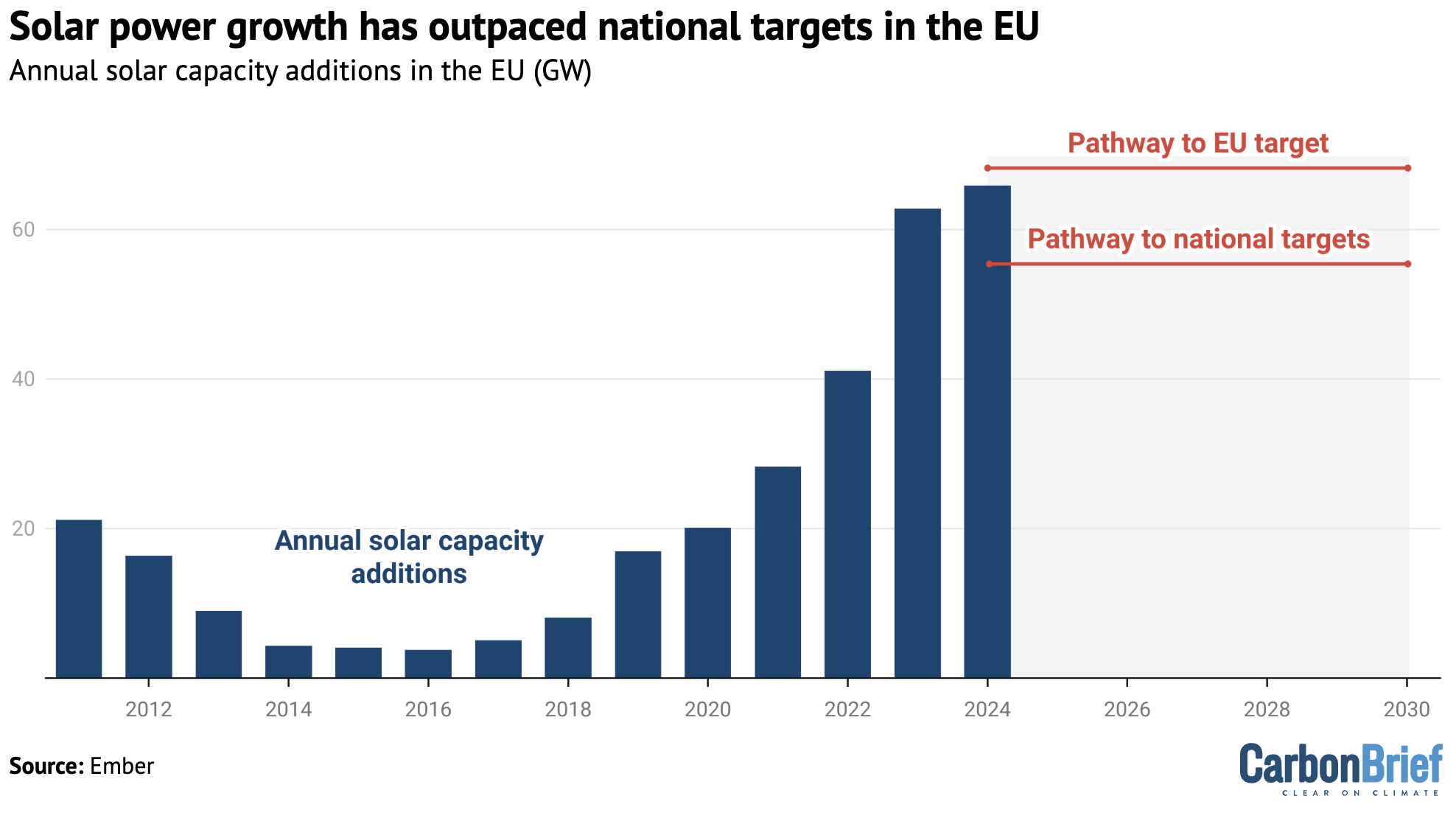

Additionally, 2024 saw record annual capacity additions, with the EU solar fleet growing by 66GW, 4% more than the 63GW addition seen in 2023.

This growth rate is above what national targets would require and nearly sufficient to hit the EU’s 2030 goal, notes Ember, as shown in the figure below.

Ember says this is “highlighting a disconnect between the rapid pace of on-the-ground market trends and the slow response of governments in updating their targets”.

In 2024, solar output grew in all EU members and 16 countries generated more than 10% of their electricity from the technology, the report notes – three more than the previous year.

However, in some countries, solar is getting close to exceeding demand during peak hours, according to Ember. Its report says that 12 EU countries saw solar generating 80% or more of power demand for at least one hour in 2024.

As such, plentiful solar is pushing hourly power prices to zero or even below. In 2024, negative or zero price hours became more common, growing from 2% of hours in 2023 to 4% in 2024 across the EU.

The increase in negative pricing periods highlights the business case for more flexibility options, notes Ember, with consumers able to save money by shifting demand to periods of abundant generation or using battery storage to take advantage of low-cost solar generation by selling it back to the grid during demand peaks.

While the deployment of battery storage has been growing in recent years – doubling to 16GW in 2023 from 8GW in 2022, the report notes – capacity is concentrated in a small number of countries, with Germany and Italy together housing 70% of existing battery capacity in the EU as of the end of 2023.

Additionally, demand flexibility and smart electrification could help consumers reduce their bills, Ember states. Grids and cross-border interconnectors can help to provide additional flexibility across the EU, it adds.

Wind woes easing

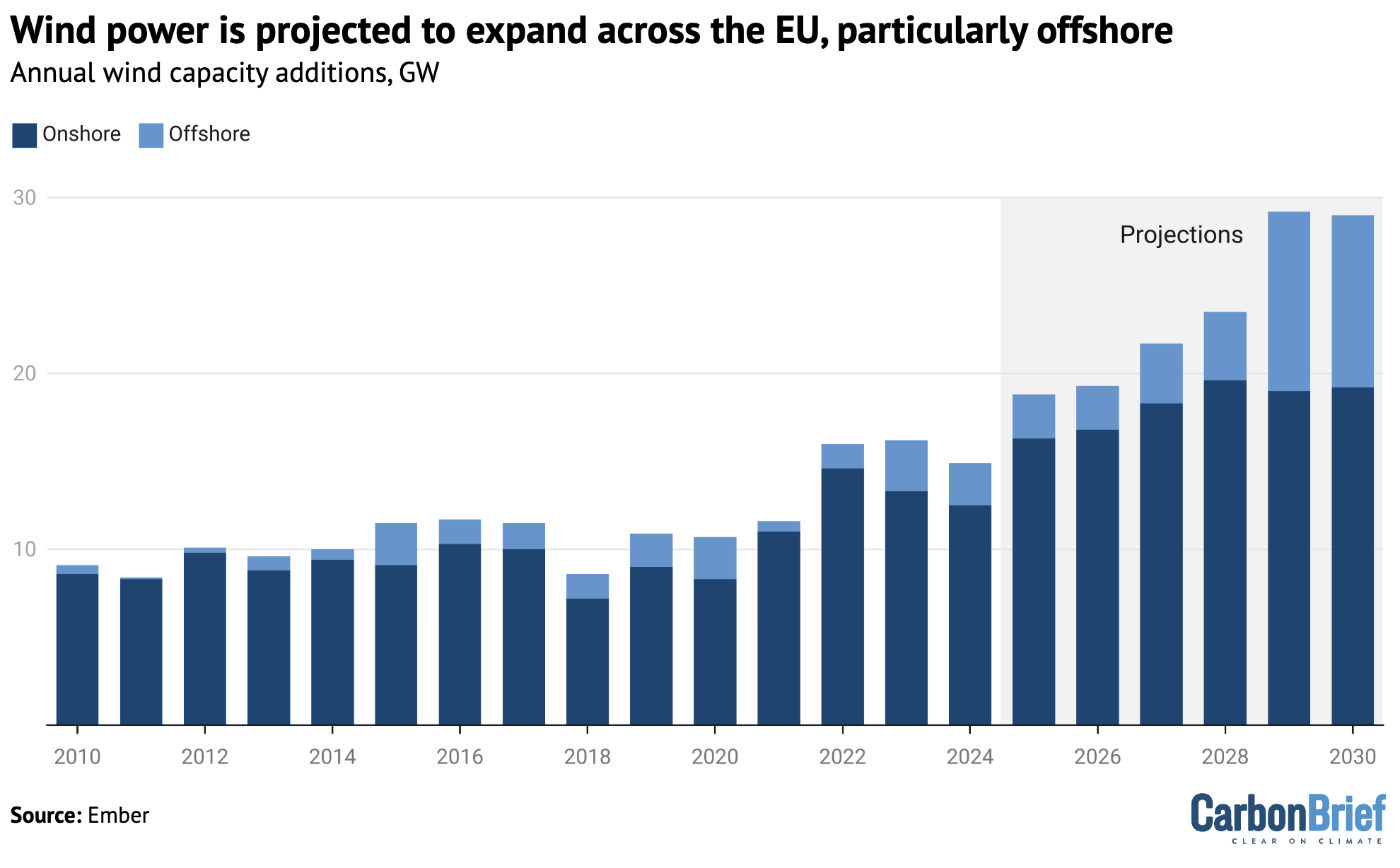

Beyond solar, wind generation grew 7TWh year-on-year in 2024, to reach 477TWh, according to Ember.

While this growth is lower than the average of 30TWh seen between 2019 and 2023, the technology remains cost-competitive with fossil power and installation rates are expected to increase in coming years, the report says.

Between 2010 and 2021, the cost of European onshore and offshore wind fell by 68% and 60%, respectively, Ember notes, based on levelised costs, a standardised metric used to gauge the average cost of electricity generation of a technology.

However, wind costs have broadly plateaued since then, according to the report, due to high inflation and supply chain problems following the Covid-19 pandemic and the global energy crisis.

While these issues have affected a range of sectors, the wind industry has felt them more acutely than solar, according to Ember, due to longer lead times and relatively higher upfront investment requirements.

This has been seen around the world, with the UK and the US amongst the nations to have seen their wind sectors knocked by higher prices.

Despite the impact of these factors on the deployment costs of wind, it remains competitive compared to gas generation, argues Ember. The price of buying gas fuel on European markets has grown throughout 2024, sitting at around €50 per megawatt hour (MWh) at the end of the year – well above the pre-crisis norm of €20/MWh.

As such, the average short-run marginal cost of EU gas-fired power across 2024 reached a high of around €125/MWh in December, continues Ember. This remains above the typical costs of both onshore and offshore wind.

In addition to facing macroeconomic headwinds, Ember says that expanding grids, permitting new projects and managing grid connections have been “inadequate for the pace of the energy transition”.

Action is being taken by governments within the EU however, for example, rules brought in to cut the permitting times for onshore wind from six years to two years.

Permitting rates were higher in the first half of 2024 than the previous year in most markets, which Ember says boosts confidence that the project pipeline for wind is strengthening.

In Germany, for example, approvals reached 12GW, up by 60% compared to the same period in 2023, notes the report.

Turbine orders also recovered, up 40% between January and September 2024 compared to the same period in 2023, while auctions awarded contracts to a record 28GW of new capacity across the EU in 2024.

However, while there are signs of growth, delays in recent years have created a wider delivery gap between market forecasts and EU ambition, the report notes.

In a statement, Dr Chris Rosslowe, senior analyst and lead author of the report, says:

“While the EU’s electricity transition has moved faster than anyone expected in the last five years, further progress cannot be taken for granted…However, the achievements of the past five years should instil confidence that, with continued drive and commitment, challenges can be overcome and a more secure energy future be achieved.”

The report calls on the EU to build on the momentum seen in the past five years. Ember suggests this could include ending Russian energy imports, supporting the European wind industry and enacting permitting reforms, among other changes.

-

EU’s solar and wind growth pushes fossil-fuel power to lowest level in 40 years