China Briefing 4 April 2024: Heat-driven impact on economy; Coal capacity ‘pushed down’; China’s WTO complaint

Anika Patel

04.04.24Anika Patel

04.04.2024 | 3:14pmWelcome to Carbon Brief’s China Briefing.

China Briefing handpicks and explains the most important climate and energy stories from China over the past fortnight. Subscribe for free here.

Key developments

China submits WTO complaint against US over EV tax credit

US-CHINA SUBSIDY CONFLICT: On 26 March, China filed a complaint with the World Trade Organisation (WTO) against the US’s “discriminatory” requirements for electric vehicles (EV) subsidies, which, it argues, makes EV containing components made in China, Russia, North Korea and Iran ineligible for tax credits worth $3,750 to $7,500, said the Associated Press. A day later, the US treasury secretary Janet Yellen raised the issue of “overcapacity” of “green technologies” from China, including solar, EV and lithium-ion batteries, during her visit to a solar cell factory in the US, reported the New York Times. The outlet quoted Yellen saying “China’s overcapacity distorts global prices and production patterns and hurts American firms and workers, as well as firms and workers around the world”.

PRESIDENTIAL CONVERSATION: Earlier this week, Chinese president Xi Jinping and US president Joe Biden held a phone conversation. The read-out of the conversation released by the US embassy in China said: “President Biden also raised continued concerns about the PRC’s unfair trade policies and non-market economic practices, which harm American workers and families.” But it said the two leaders “reviewed and encouraged progress on key issues discussed at the Woodside summit…and continuing efforts on climate change.” The briefing from the Chinese Ministry of Foreign Affairs said: “The two sides agreed to stay in communication…carrying out dialogue and cooperation in such areas as counternarcotics, artificial intelligence and climate response.”

CLIMATE DIPLOMACY: Meanwhile, Rick Duke, the deputy US special envoy on climate change, told Reuters that the cooperation between the US and China on methane emissions is “advancing”. He added: “We are, indeed, in the process of propelling that work together.” According to Politico, EU climate envoy Tony Agotha and top climate diplomats from Germany, France, Denmark and the Netherlands will join a trip to Beijing on 8 April to build a “multinational diplomatic track to engage China on climate change”. Separately, the US embassy and Chinese foreign ministry confirmed upcoming visits to China by Yellen on 4-9 April and US secretary of state Antony Blinken “in the coming weeks”.

EV EXPANSION: According to a report in the Hong-Kong based South China Morning Post, anti-subsidy probe and trade restrictions “reduced” the export volume of Chinese EVs to the EU and US by 20% and 42%, respectively, in the first two months of this year, prompting Beijing to look towards other markets. Chinese EV sales in Central Asia have increased 2.3 times during the same period. Meanwhile, an analysis by Transport & Environment showed Chinese EV sales are “on track” to reach 25% of electric car sales in the EU by the end of 2024. The outlet added that the bloc should not aim to shield its carmakers from “meaningful competition”, which would limit affordability of EVs for Europeans.

EU probes Chinese solar firms

SOLAR INVESTIGATION: The Financial Times reported that the EU has opened investigations into the subsidiaries of two Chinese solar manufacturers which may have “been granted foreign subsidies that distort the [EU’s] internal market”. The outlet adds that “the probes reflect a hardening stance in Europe towards cheap Chinese imports, which the EU’s solar industry has blamed for the heavy losses and plant closures of several European solar panel manufacturers”.

SECOND INQUIRY: The South China Morning Post said that this marks the second use of the EU’s foreign subsidies regulation to investigate Chinese firms, which “demonstrates Brussels’ willingness to use the commercial weaponry at its disposal to counter what it sees as unfair competition from Beijing”. In February, the EU investigated a Chinese rail firm, which later withdrew its bid to enter the Bulgarian market, it added.

Renewable installations push coal capacity share down

COAL SHRINKING?: The China Electricity Council, a government-affiliated research thinktank, announced that coal’s share of installed capacity has fallen to 39% of the total mix, as of February 2024, according to industry news outlet BJX News. This was driven by the rapid installation of renewables, the outlet added. China Energy Net reported that, in January and February this year, China installed 36.7 gigawatts (GW) of solar, which is 80% more than last year. Total installed solar capacity stood at 650GW at the end of February, a 56.9% increase, while wind capacity grew 21.3% to 450GW. However, it added, utilisation of both solar and wind shrank slightly in the first two months of the year compared to a year ago.

GRID OVERLOAD: According to Bloomberg, following “record” solar and wind power installations last year, “several regions in China have shown strains handling the new surges of electricity”. Meanwhile, London Stock Exchange Group analyst Chen Xuewan shared on Twitter that the southern provinces of Guangdong, Yunnan and Guizhou may face “power gaps” this year unless power system flexibility is improved.

2024 TARGETS: The National Energy Administration (NEA) released its guidelines for the department’s energy work in 2024, which pledges both to “focus on improving energy security capacity” and to “focus on promoting green and low-carbon energy transformation”. It aims to have non-fossil energy comprise 55% of the energy mix and 18.9% of power consumption. More specifically, wind and solar power will account for more than 17% of power generation by the end of the year. Meanwhile, coal production will be “stabilised and increased”, while oil production will be “stabilised at more than 200m tonnes” and natural gas will “maintain its rapid pace of production”.

China’s climate envoy reinforces role of fossil fuels at Boao

‘CLEAN’ FOSSIL FUELS : At this year’s “Boao forum for Asia” in Hainan – Asia’s version of Davos – China’s climate envoy Liu Zhenmin said that “[China] will still keep our fair share of fossil fuels, but they must be used purely”, adding that this was a “critical” point, Bloomberg reported. Liu also said that the world needs to “massively scale up deployments of solar, wind and hydropower”, but that US trade restrictions increase the cost of clean energy overseas and slow the energy transition, added the outlet. State news agency Xinhua quoted Liu saying at the same event that “humanity’s response to climate change depends on the development of technology” and that developed nations must help meet the financing needs of developing nations.

‘GREEN’ ECONOMY: Zhao Leji, chairman of the standing committee of the National People’s Congress, China’s legislative body, also spoke at Boao. He stated that “[China is] speeding up efforts to promote green and low-carbon economic and social development” and will “strive” to meet its dual carbon goals, according to the Associated Press. CGTN published the full text of Zhao’s speech, in which he also said the country will “cultivate large-scale new growth drivers in green infrastructure, green energy, green transportation and green lifestyle, which is expected to generate investment and consumption markets with a size of 10tn yuan ($1.4tn) every year”. Other notable speakers, the South China Morning Post said, included former central bank governor Zhou Xiaochuan and former deputy trade minister Long Yongtu, who both argued that overcapacity in the “clean-energy sector” will be temporary, as long as global demand for energy transition technologies remains robust.

Spotlight

How climate change could reduce China’s GDP growth

A new study by a group of Chinese scientists, published in Nature, finds that China could significantly constrain future economic growth, due to the impact of climate change on global supply chains.

Carbon Brief invites the paper’s lead authors Prof Guan Dabo and doctoral candidate Sun Yida from Tsinghua University to outline their main findings of the potential impacts of global warming on China’s manufacturing capabilities and economic growth.

In recent years, global supply chains have faced a global pandemic, commercial ships under attack in the Red Sea and a container ship getting wedged in the Suez Canal for six days. The impact of each of these events has rippled across the global economy.

In our new research, published in Nature, we show that climate change poses a similar threat to supply chains around the world, bringing economic losses that will increase exponentially relative to the rise in global temperatures.

Focusing on heat extremes, our research team constructed a “disaster footprint” model to assess the health risks and economic losses associated with heatwaves.

To estimate the impact of extreme heat on global GDP, our model combines projections of future climate, simulations of future population dynamics in response to warming and estimates of heat-induced labour loss on the global economy and supply chains.

Our study is the first to chart “indirect economic losses” from climate change on global supply chains, underscoring the risk to regions that will likely be less affected by warming directly.

The results suggest that, by 2060, China could suffer soaring economic losses amounting to 1.5-4.8% of GDP growth by 2060. Some of its industries, including construction and manufacturing, could lose around 4.6-6.4% of their value.

How could indirect disruptions affect economic growth?

While the direct mortality and productivity loss resulting from heat stress have been extensively studied, previous analysis has yet to account for indirect economic loss.

Indirect economic loss is the reduction in economic output or welfare due to disruptions caused by feedback loops after a shock to the economic system, rather than by a direct impact from a shock. These losses could be due to changes in production, consumption or employment.

For example, crop failures, labour slowdowns and other economic disruptions in one part of the world can affect the supply of raw materials flowing elsewhere. This can cause production stagnation where trading partners cannot access the supplies they need.

These indirect disruptions could cause a projected net economic loss of $3.75-$24.7tn globally by 2060, depending on how quickly climate change is tackled.

We estimate expected economic losses across three scenarios, called “shared socioeconomic pathways” (SSPs), broadly covering futures under very low, intermediate and very high emissions.

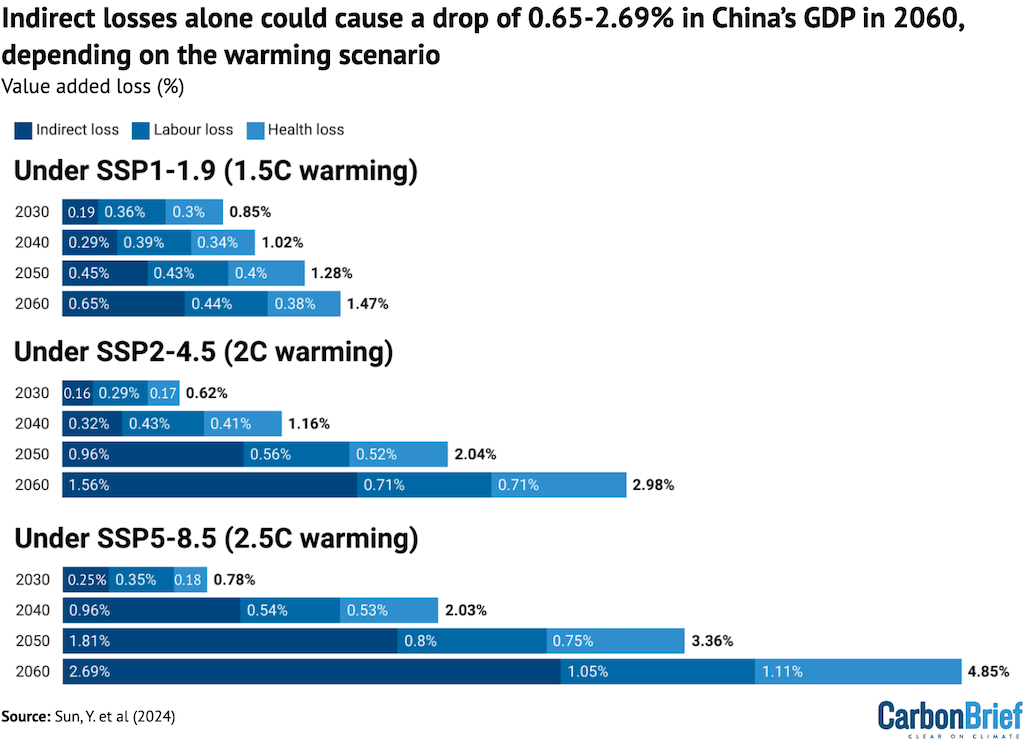

The charts below illustrate the potential economic losses as a percentage of GDP China may face under the SSP1-1.9, SSP2-4.5 and SSP5-8.5 scenarios, which project an average global temperature rise of around 1.5C, 2C and 2.5C by mid-century, respectively. Economic losses are split into indirect losses (dark blue), labour losses (blue) and health losses (light blue).

What is the impact on China?

As the global economy has grown more interconnected, disruptions in one part of the world have knock-on effects elsewhere in the world.

For example, as a manufacturing-heavy country, China faces indirect economic losses of up to 2.7% of total GDP in 2060.

Overall, indirect losses were the most significant component of China’s economic losses, accounting for just over half of total losses.

By 2060 China’s heat-induced economic losses could total about 1.5% of total GDP under 1.5C of global warming, 3% under 2C of warming and 4.9% under 2.5C of warming.

Sectors such as the extractive industries, construction and non-metallic manufacturing – which are some of China’s “key industrial sectors” – could see the highest losses.

These industries are not only located in regions with significant warming, but also import large quantities of upstream primary products from south-east Asia, Africa and South America – regions which are expected to face heightened exposure to production volatility caused by high temperatures.

They are projected to lose about 4.6-6.4% of their “value-added” under the compounded impacts of direct production reductions and indirect spillover shocks.

In addition, under the lowest emissions scenario, 2060 could see an additional 590,000 heatwave deaths annually across the globe, rising to 1.12m additional annual heatwave deaths under the highest scenario. This human toll entails economic costs as well, such as increased healthcare costs and production losses stemming from lost labour.

What next?

This research is an important reminder that preventing every additional degree of climate change is critical.

It should be noted that China’s recent investments in south-east Asia, the Middle East and Africa have shifted towards renewable energy and low-emission mining technology, rather than coal projects and large-scale infrastructure. This will contribute to building climate resilience and creating more stable global supply chains.

In addition, understanding which nations and industries are most vulnerable is crucial for devising effective and targeted adaptation strategies, including establishment and targeted use of the “loss-and-damage funds” agreed at COP27 in 2022.

Watch, read, listen

HUMAN COST: Environmental activist Wang Xiaojun gave a TED talk on his experience growing up in China’s top coal-producing province and the impact that environmental degradation had on his village and family.

SECURITY DILEMMA: The state broadcaster CCTV “exposed” a case of the illegal use of reserved farmland being converted into a solar power plant in Hubei.

FEATURE OR BUG?: An article in World Politics Review argues that excess capacity is a “tolerated feature” of China’s industrial system because it allows China to meet high-level targets, while “local governments clean up the mess [of] bankrupt firms or laid-off workers”.

LITHIUM’S FUTURE: A podcast by the Oxford Institute for Energy Studies discussed the possible path of the lithium market as it matures and grapples with China’s dominance of lithium processing.

575

In gigawatts, the estimated heat pump capacity for buildings (residential and commercial) in China by 2030 under the stated policies scenario (STEPS), according to a report by the International Energy Agency on the future of heat pumps in China.

New science

End-year China wind power installation rush reduces electric system reliability

Energy Economics

Research identified “significant adverse effects” of the rapid installation of wind power on electricity reliability. It found that a faster rate of installation led to lower reliability rates and more power outages. The authors raised the importance of “improvements in grid infrastructure and management in the transition to a low-carbon world”.

Managing fragmented croplands for environmental and economic benefits in China

Nature Food

A new study found that improving the management of croplands could “achieve synergies between food security, economic benefits and environmental protection” without needing to use more land. It revealed that “10% of Chinese croplands have no potential to be consolidated for large-scale farming” and, if the land was instead used to grow animal feed, nitrogen and greenhouse gas emissions could drop by 10% and 101%, respectively.

China Briefing is compiled by Wanyuan Song and Anika Patel. It is edited by Wanyuan Song and Dr Simon Evans. Please send tips and feedback to [email protected]