Analysis: China’s new 2030 targets promise more low-carbon power than meets the eye

Lauri Myllyvirta

12.15.20Lauri Myllyvirta

15.12.2020 | 8:38amIn one of the most anticipated speeches at this weekend’s Climate Ambition Summit, Chinese leader Xi Jinping announced a new set of updated national climate targets for 2030.

Together, they are expected to help deliver the country’s longer-term Paris Agreement commitment, which was recently strengthened by Xi’s 2060 “carbon neutrality” goal.

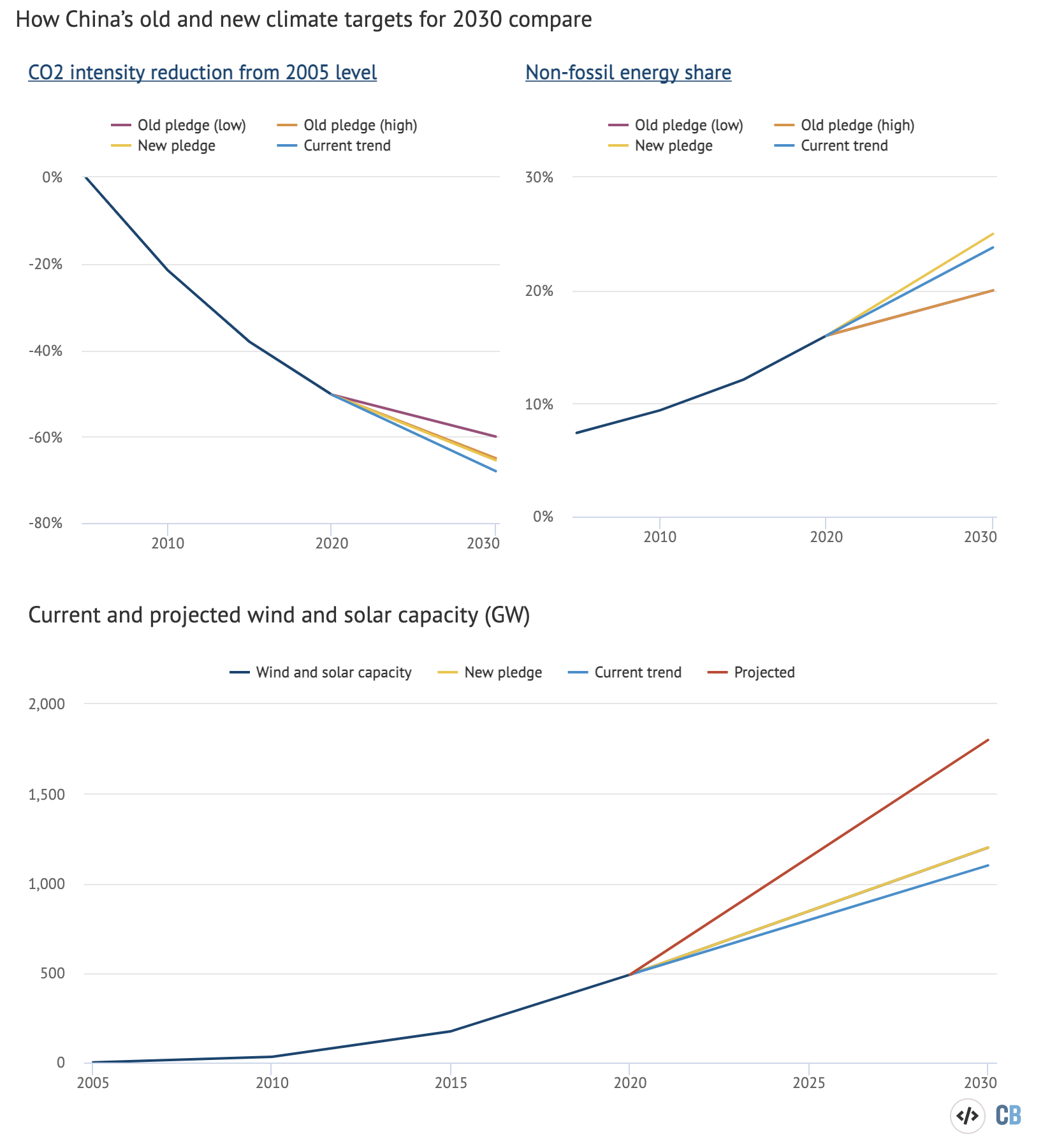

On the surface, the new “nationally determined contribution” (NDC) pledges are a linear extension of the trends of the past five years up to 2030.

The new NDC targets for 2030 are:

- Cut CO2 intensity of GDP by more than 65% from 2005 levels – compared to the earlier target of 60-65%.

- Reach a non-fossil fuel (renewables and nuclear energy) share of 25% in primary energy – compared to the earlier target of 20%.

- Increase forest stock by 6bn cubic meters from 2005 – compared to the earlier target of 4.5bn m3.

- Raise combined wind and solar power capacity to 1,200GW – up from the installed capacity of 415GW at the end of 2019.

However, the implications of these new targets for clean electricity generation are more significant than they might first suggest.

CO2 intensity

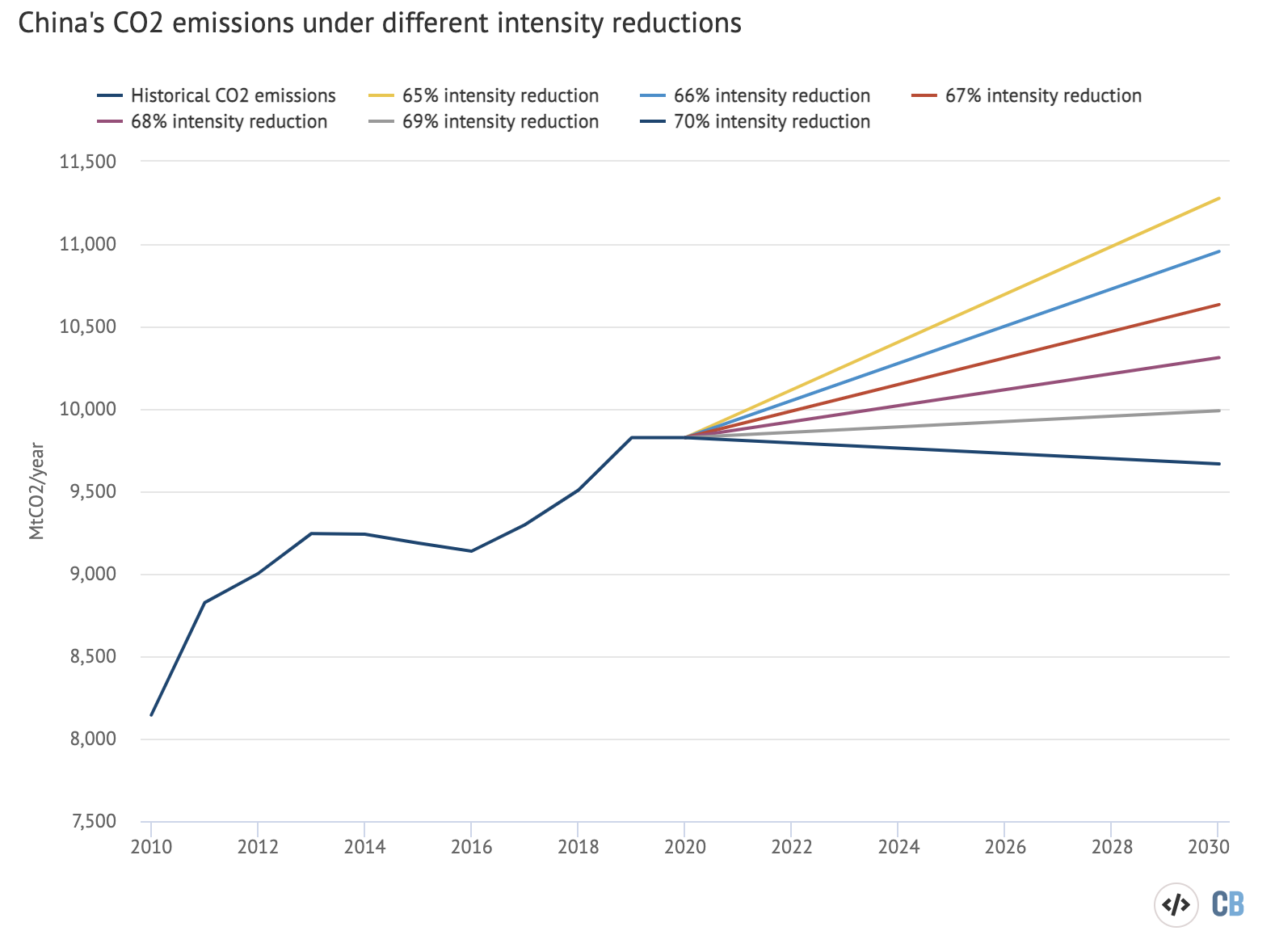

The “CO2 intensity” target means reducing emissions per unit of GDP by at least 16% per five-year period from 2021 to 2030, compared to a rate of 20-22% in the previous five-year periods.

Even taking into account the likely slowdown in targeted GDP growth, this still allows emissions to increase. Assuming a 5% average GDP growth rate, down from 6.1% in 2019, emissions could grow another 15% by 2030 – or, to put it in absolute terms, increase by 1.5 billion tonnes of CO2 (GtCO2). For context, that is roughly equivalent to twice the annual emissions of Germany.

On the surface, this does not appear to amount to much progress. After all, this is the same rate of emission growth as over the past five years and with a slower rate of emission intensity gains.

However, the emissions implications of the intensity target are very sensitive to small changes. Since China has already cut emissions per unit of GDP by almost 50% since 2005, the difference between targeting a 65% and 69% reduction is the difference between increasing emissions by 15% and keeping them flat over the next decade, as illustrated by the chart below.

Since Xi’s announcement dealt in round numbers, he definitely did not rule out China’s emissions peaking and then declining during this decade. But he did not commit to that either.

The pledge to peak and decline emissions before 2030, similarly, leaves quite a lot of room for different emissions trajectories and interpretations.

Non-fossil energy and wind and solar targets

The non-fossil energy target is a marginal acceleration to the current trend: the share went from 12% in 2015 to 16% in 2020, so “business-as-usual” would be 24% in 2030.

For wind and solar, keeping average annual installations at the 2015-2020 average would mean reaching a total capacity of around 1,100GW in 2030. So, on the surface, the 1,200GW target seems like a very modest step up.

However, a more detailed analysis shows that meeting the non-fossil energy target requires a much faster increase in wind and solar.

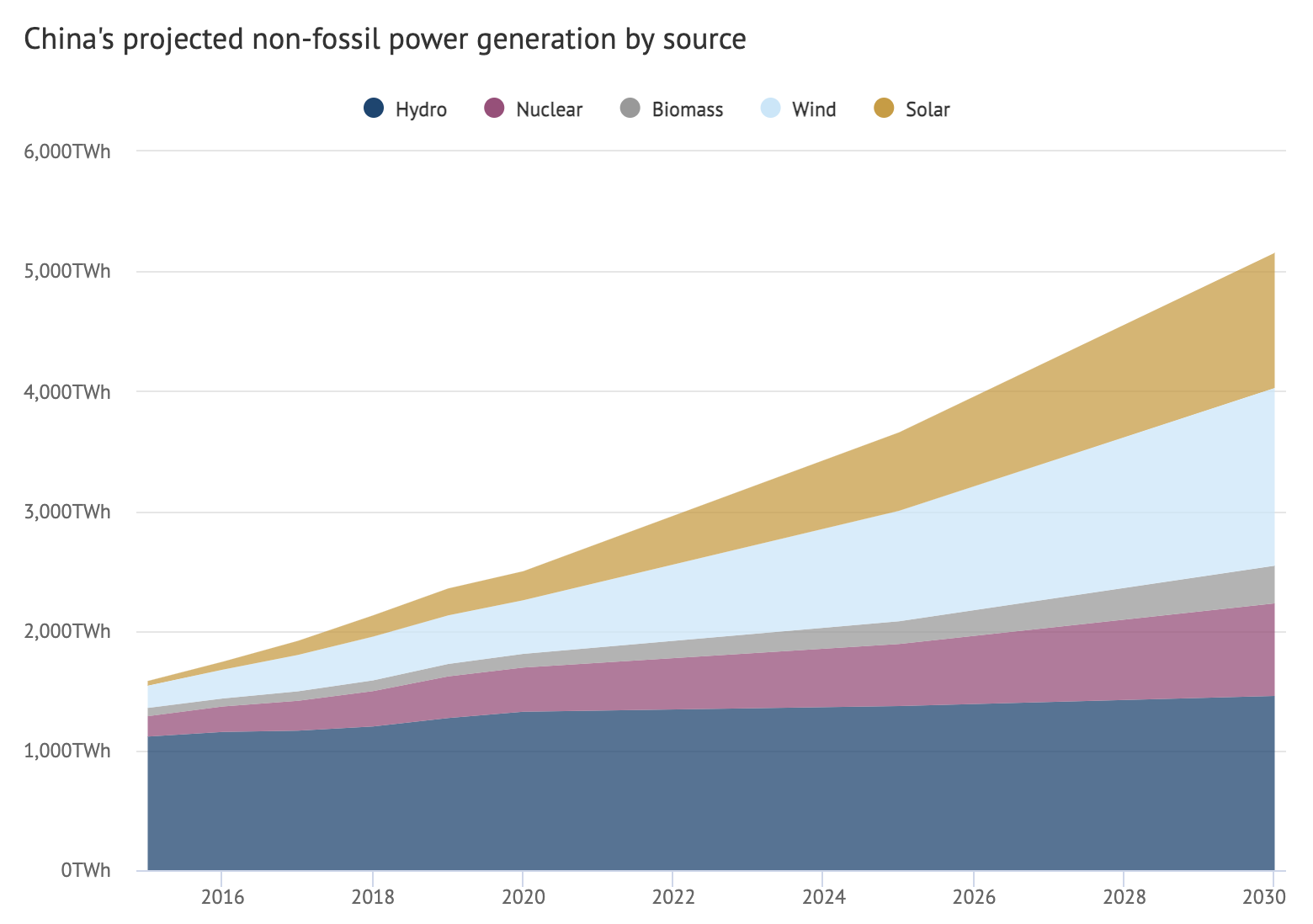

The 25% target covers all energy use, not just electricity, but China’s non-fossil energy portfolio is almost entirely made up of electricity generation – hydropower, wind, nuclear and solar, in that order – with biomass and solar heating bringing up the tail.

The bulk of the increase in non-fossil electricity to date has been delivered by hydropower which is bound to slow as most of the potential has already been exhausted: the hydro industry is expecting 20GW new capacity by 2025, down from 40GW over the past five years.

Nuclear power additions will also slow until 2025, with potential for pick-up afterwards. The industry expects 17GW under construction at the end of this year, with any capacity not yet under construction is very unlikely to be commissioned by 2025. This is not an insignificant amount of new capacity, but is still less than the 25GW that was expected to go into operation in 2016-2020.

Therefore, to maintain the current growth in total non-fossil energy, wind and solar will need to be scaled up very substantially.

Extending the expected growth in hydropower and nuclear to 2030 – even assuming total energy demand growth slows to 2%, down from 3.5% over the past five years – the total installed capacity of wind and solar in China will have to reach around 1,600-1,800GW by 2030 to fulfill the target of producing 25% of all energy from non-fossil sources.

📉A ‘hidden gem’ in China’s new 2030 NDC?

— Yan Qin (@YanQinyq) December 14, 2020

In my view, 25% non-fossil fuel in energy consumption could imply faster transition away from Coal and more rapid Renewables build-out.

Tsinghua professor He Jiankun has said RES capacity need to rise 100 GW/year. pic.twitter.com/hdJBPzHhDW

The required wind and solar capacity means adding an average of around 110-140GW of wind and solar capacity every year, in line with the doubling of annual installations for which the industry and researchers have been calling for.

Put another way, China will need to install wind and solar power equal to Germany’s entire installed capacity every year from 2021 to 2030.

The 25% non-fossil target was recommended by the Tsinghua University researchers whose work underpinned the 2060 carbon neutrality pledge. The same researchers said that their scenario requires annual wind and solar installations of 100GW.

The required clean electricity growth also means that the share of non-fossil generation in China’s electricity mix will reach between 45% and 50%, with the share of wind and solar between 25% and 30%.

Why did China ‘lowball’ its capacity number?

The purpose of the wind and solar capacity target might have been to illustrate the scale of the nation’s clean energy investment. It is true that 1,200GW is a big number, but it is one that does not in any way constrain the planning machinery that is working to realise the energy projections and targets for 2025 as a part of China’s five-year planning process.

The total renewable generating capacity needed was used by the Barack Obama administration in 2014 to communicate the significance of the Obama-Xi climate deal in which China targeted 20% non-fossil energy by 2030.

However, 2030 is obviously much closer than it was six years ago. Releasing a cautious number now might have had an opposite effect to the one intended, at a time when the renewable energy industry is anxiously awaiting new growth milestones and has already grown much larger than it was in 2014.

Many of the targets that determine exactly how much power generation from wind and solar is needed to meet the 25% target have not yet been decided, with the nuclear, hydro, thermal, wind, solar, biofuel and other sectors vying for a larger piece of China’s total energy spending. The targets for GDP growth, total energy consumption, nuclear and hydro generation, biofuels and many others all affect this calculation.

A figure such as 1,200GW sounds impressive, while leaving the planning process room to run its course.

Another factor that has to be considered by Xi and civil servants when pledging these targets is that a major debate has arisen in China about the capacity of the grid to integrate rapidly growing wind and solar power.

As wind and solar approach and cross 10% of power production, and as the global market for storage takes off, there is a push to reduce wind and solar variability. Several provinces now require storage for up to 20% of wind capacity for new projects.

— Anders Hove (@derznovich) December 13, 2020

Grid integration of renewable energy has been beset by institutional challenges. The share of variable renewables of around 25-30% is still lower than the current share in many European countries, so there is little doubt that the technical issues can be resolved. However, the institutional resistance is considerable and this could have affected the number that China was prepared to pledge at this point.

Conclusion

China’s new 2030 targets confirm the observation made about its proposed pathways to the 2060 carbon neutrality goal: cautious progress until 2030, followed by a steep acceleration afterwards.

There is upside potential – wind&solar targets are always exceeded by a wide margin, Xi has markedly left space to improve with “before 2030” and “over 65%”. But if you were waiting for a definite sign that China is accelerating action after the 2060 announcement, this is not it.

— Lauri Myllyvirta (@laurimyllyvirta) December 12, 2020

It is clear that there is potential for the targets to be strengthened. China has always exceeded its wind and solar capacity targets by a wide margin. Xi has notably left space to increase ambition for this decade with the targets being worded as peaking emissions “before 2030” and cutting CO2 intensity by “over 65%”.

However, there are two omissions, compared to what Tsinghua researchers and others have been recommending. First, the setting of an absolute cap on emissions. Second, redirecting China’s overseas energy financing, which is currently the main source of funds for new coal power plants outside of China.

But, overall, Saturday’s announcement has filled in one piece of the “carbon neutrality by 2060” puzzle – an ambitious scaling up of clean power generation.

-

Analysis: China’s new 2030 targets promise more low-carbon power than meets the eye

-

Analysis: How China new 2030 targets promise more low-carbon power than first thought