The implications of $50-a-barrel oil for the worlds energy mix

Mat Hope

01.09.15Mat Hope

09.01.2015 | 12:40pmOil prices keep sliding, sending economic shockwaves around the world. Analysts are scrambling to try and understand what it means for the world’s future energy mix and efforts to cut emissions. But the relationship between oil prices and energy investments is complex.

Much depends on how low the price goes as, beyond a certain point, lots of projects are no longer economically viable.

We take a look at what may happen to the oil price, what it means for the industry, and how it could affect the world’s efforts to move towards a zero-carbon energy system.

Oil prices

Over the past year, oil prices have gone from a high of about $115 to a current low of about $50 a barrel, far below many analysts’ original expectations.

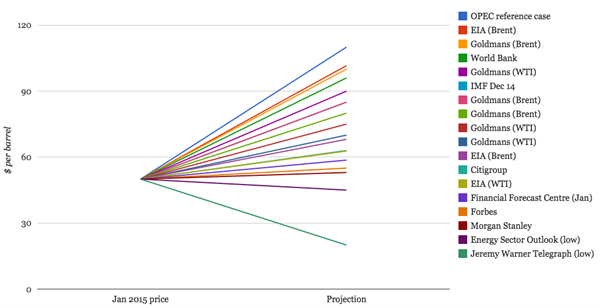

Those same analysts are now busy revising their projections. While most seem to think the oil price has hit or is nearing rock bottom, there’s a wide range of projections for where it may rebound to in 2015.

This chart shows just how varied those predictions are. They’re not all like for like – some are estimates of a low point, some are average price projections for the next twelve months, or predictions for particular financial quarters – but they do give an idea of the spread of projections:

Source: Data collated and graphed by Carbon Brief.

As you can see, hardly any analysts expect the oil price to dip below current levels. Most expect the price to recover to somewhere around $70 a barrel by the end of the year.

The projections have major implications as companies use them to decide if current and future oil projects are profitable. If the price of oil drops below a particular point, companies may decide to abandon or scale back their activities.

Breakeven prices

Companies’ investments are vulnerable to volatile oil prices, so they stress-test their projects by working out how much a barrel of oil needs to cost for them to remain profitable. The reference point for whether companies persevere with the projects is known as the “breakeven price”.

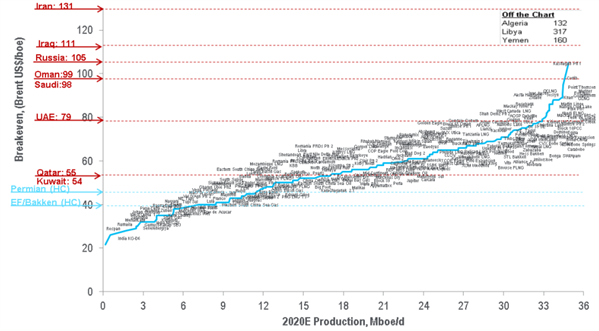

A range of analyses suggest the majority of the world’s oil projects struggle to break even with the oil price hovering around the $50 mark.

Citigroup has collated the breakeven price of all the oil projects in the world. As you can see from this chart, most projects need the oil price to be much higher than $50 per barrel:

Source: Citigroup

Carbon Tracker, a thinktank focusing on the financial risks facing fossil fuel companies, separately focuses in on the different types of projects.

It calculates that almost $10 trillion of company investments are potentially at risk if the oil price is below $60. Arctic oil exploration projects potentially worth $2.8 trillion in capital expenditure have a breakeven price of at least $100, it estimates.

![]()

Source: Carbon Tracker.

Shale oil projects and drilling activities in tar sands, such as those in Alberta, Canada, which the controversial Keystone XL pipeline would link to, are slightly more robust. Nonetheless, companies investing in such activities risk losing $1.2 trillion and $2.3 trillion, respectively, if the oil price is below $60. Last October, analysis from the Wall Street Journal suggested none of the US’s largest shale formations can operate at the current price of $50 per barrel.

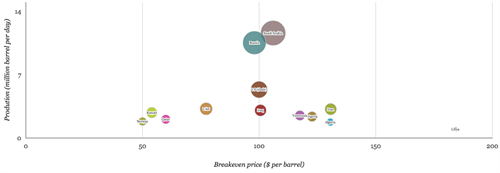

The breakeven price for different countries’ industries also varies, as the chart below shows. The size of the bubble and its position on the vertical axis shows how much oil each country produces each day. Its position on the horizontal axis shows the breakeven point for its industry.

Sources: Data from the Wall Street Journal. US shale industry data from the US Energy Information Administration. Graph by Carbon Brief.

As you can see, some countries, above all Libya, are unlikely to be able to compete with the oil price at its current level. That would seem to include Saudi Arabia’s industry, which has a breakeven price of around $100. Only Norway’s industry, with a breakeven price of about $50, can remain competitive at current prices, according to WSJ’s data.

So why won’t OPEC, the influential group of oil-producing states, act to cut supply and help the price rebound?

Saudi Arabia, the de-facto head of OPEC, says one reason it’s not acting to bolster the oil price is to squeeze its shale-based competitors. The country has a $700 billion financial reserve, so can afford the hit its economy is currently taking due to a low oil price. That’s not the case for any of the other countries that need a similar breakeven price: Russia, Iraq, and the US’s shale oil industry.

What it means for decarbonisation

OPEC’s decision may have a big impact on the world’s energy mix. While oil is only a marginal part of most developed countries’ energy mixes, gas prices are still linked to the cost of oil in many parts of the world. That has a knock-on effect on how much investors are willing to spend on low-carbon projects.

Many suppliers operating in some of the world’s largest oil producing states still work based on contracts that link the two fuels’ prices, though this is becoming rarer. Nonetheless, about 65 per cent of Europe’s gas is still sold on contracts linked to oil price, Reuters estimates.

Unlike oil, gas is still a major part of most countries’ electricity mix. As gas gets cheaper, it potentially becomes harder for renewables to compete.

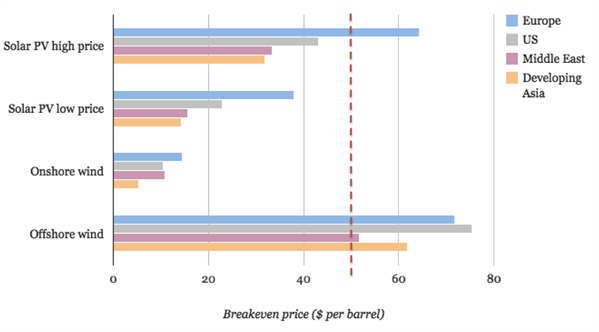

Energy Intelligence, a consultancy, has modelled the breakeven price for renewables compared to the oil price. It finds that most renewable technologies shouldn’t be too affected by a low price.

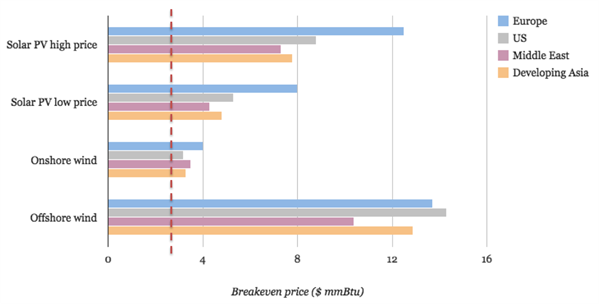

As you can see from this chart, renewable technologies in most parts of the world should still be competitive with an oil price of around $50 – only those where the bar goes to the right of the red line may struggle:

Source: Data from Energy Intelligence. Graph by Carbon Brief.

But renewables are more vulnerable to a falling gas price. No renewable technologies can directly compete with the current gas price of about $3 per million British thermal units (mmBtu), according to Energy Intelligence’s data. Offshore wind is the most vulnerable, with an average breakeven price of about $13:

Source: Data from Energy Intelligence. Graph by Carbon Brief.

But the falling oil and gas prices are unlikely to affect investment in renewable energy in the long term as the industry continues to be bolstered by government subsidies and support, Energy Intelligence argues. The industry is also well established enough in many parts of the world to be able to see out a short-term price drop. “These technologies are no longer fragile infants”, it says.

The oil price may rebound soon anyway, bringing gas prices with it. If the Saudi’s plan to squeeze production in other countries works, supply rates may drop, and the price may rise again. That certainly seems to be what most analysts expect to happen.

So renewable power sources are unlikely to be greatly affected by falling oil and gas prices in the long term. In contrast, the data suggests that the majority of the world’s oil projects, particularly costly new exploration in the Arctic, are most threatened by oil priced at $50 a barrel.

Main image: Stacked yellow oil barrels.

Updated 09/12/15, 12.45: The graph showing breakeven costs for different types of oil projects was changed.