New coal plants rise in 2015 despite falling consumption

Sophie Yeo

03.30.16Old coal plants are increasingly lying dormant, yet new ones keep getting built, according to a new report.

The analysis by CoalSwarm, which includes researchers from Greenpeace and the Sierra Club, looks at the state of global coal over the last year.

Their findings highlight a disconnect between the recent reductions in demand for coal, and the hundreds of gigawatts of new capacity that developers want to build in the future.

Dormant plants

Enthusiasm for burning coal has waned in recent years due to climate regulations and efforts to combat air pollution.

In 2014, falling demand for coal in China meant that consumption fell for the first time, dipping by around 0.9%. While a relatively small decline, it is in sharp contrast with the annual average growth of 4.2% for the last decade. The trend is expected to have continued during 2015.

Beijing recently released its statistics for 2015, showing that coal demand had dropped again, and this time by a wider margin.

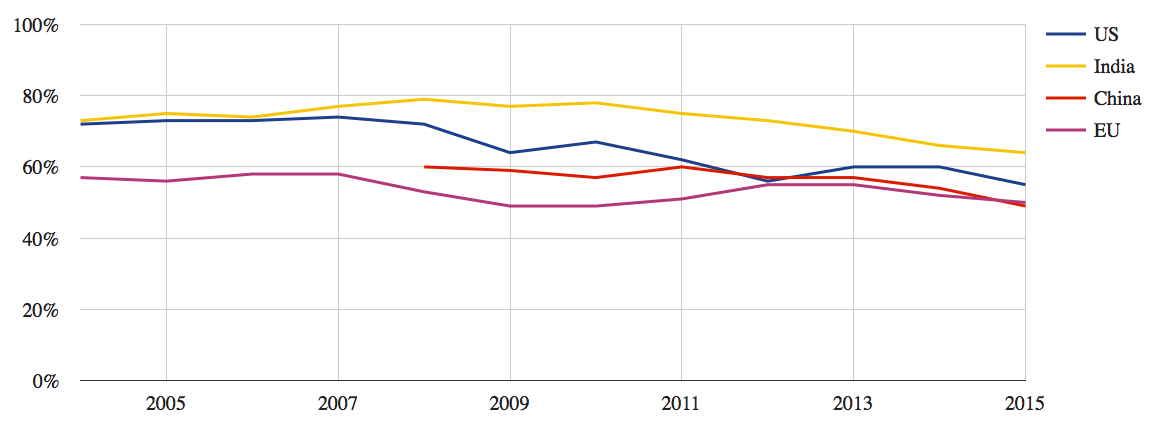

The upshot is that existing coal plants are being used less across major coal-burning economies. The graph below shows that plants are, on average, producing a smaller percentage of their maximum possible output every year.

These are “symptoms of excess capacity and overbuilding”, says the report. Alternative sources of energy, weakening demand and more plants means that those in operation simply do not have to produce as much power anymore.

Percentage of maximum output achieved for coal plants in US, India, China and EU. Source: CoalSwarm. Chart by Carbon Brief.

But despite the fact that they are using less coal overall, the pace at which countries built new coal plants in 2015 was faster than it has been since 2011.

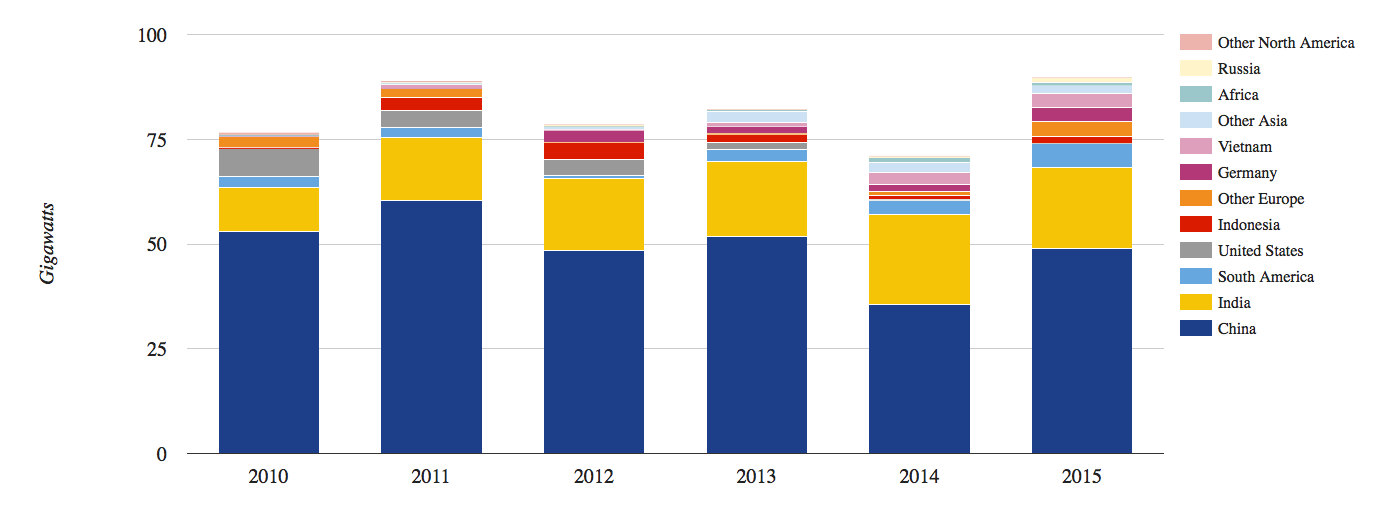

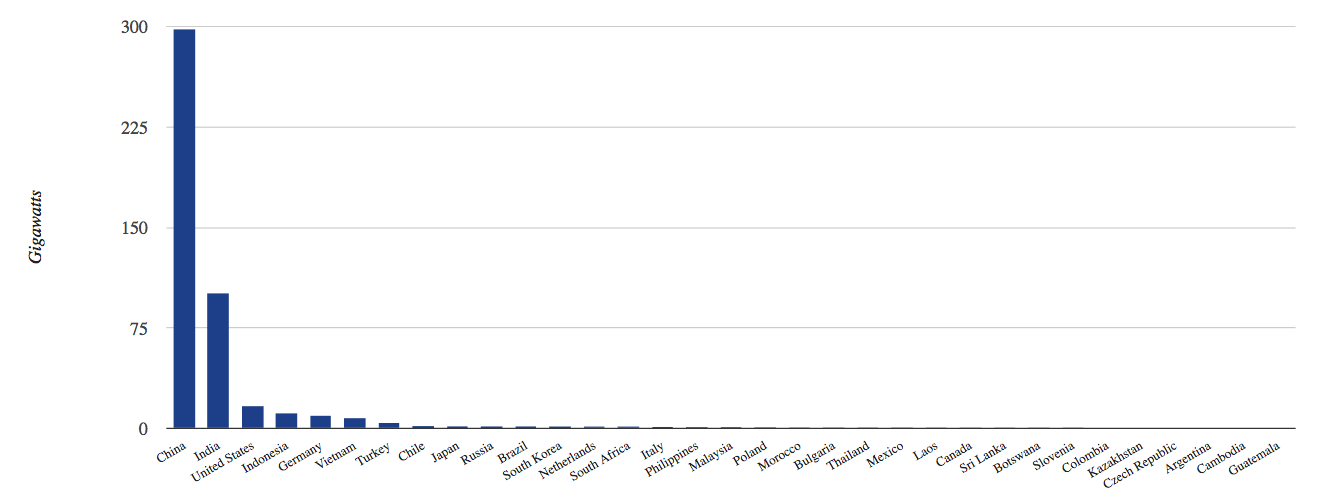

Since 2010, new plants have been constructed in 33 countries. China and India between them account for 85% of all new capacity. Seven regions and provinces of China each completed more new coal capacity between 2010 and 2015 than the entire US.

Globally, 473 gigawatts (GW) of new coal capacity was added between 2010 and 2015. The graphs below show where and when new capacity has been added.

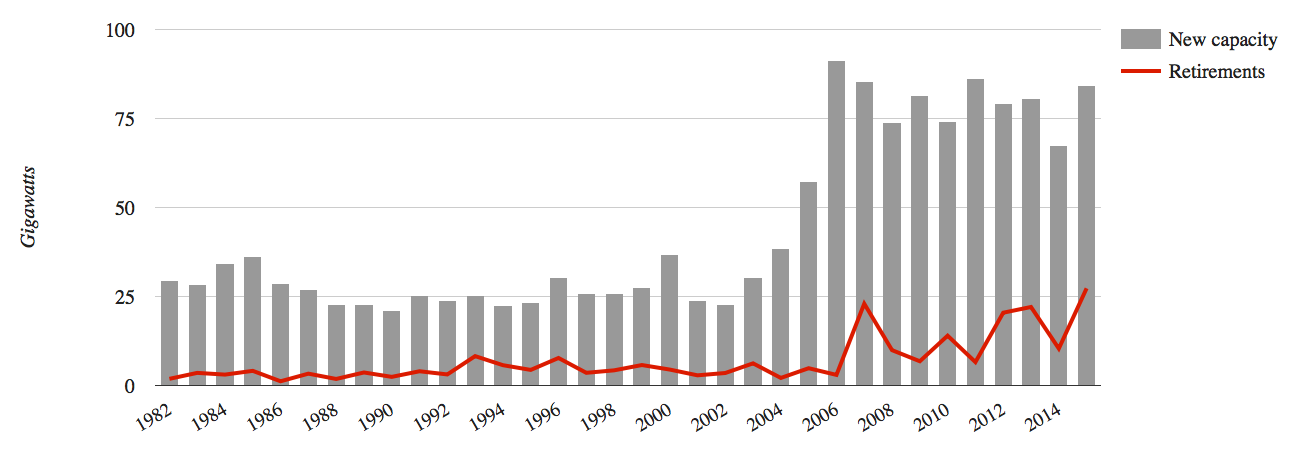

Gigawatts of new coal capacity added per year. Source: CoalSwarm. Chart by Carbon Brief.

Total gigawatts of new capacity added between 2010 and 2015, in the 33 countries to have added new plants in this timeframe. China and India dominate. Source: CoalSwarm. Chart by Carbon Brief.

Looking at new capacity over a longer period provides important context to this pattern.

Before 2006, coal was being built at a pace of 20 to 25GW per year. The following years witnessed a boom, as China aggressively increased its capacity, bringing the global total up to around 75GW a year.

In 2014 there was a downturn, with only 68GW of new coal coming online, compared to an average of 81GW over the previous five years. But another upswing in 2015 to 84 GW meant that any hope for a slower pace of new coal expansion was short-lived.

The IEA’s 2015 Medium-Term Coal Market report was also effective in dashing hopes of an end to coal’s hegemony. It predicted that global coal demand would continue to grow by 0.8% per year until 2020, thanks to more demand in India and Southeast Asia expected to make up for a levelling off in China.

Planned coal

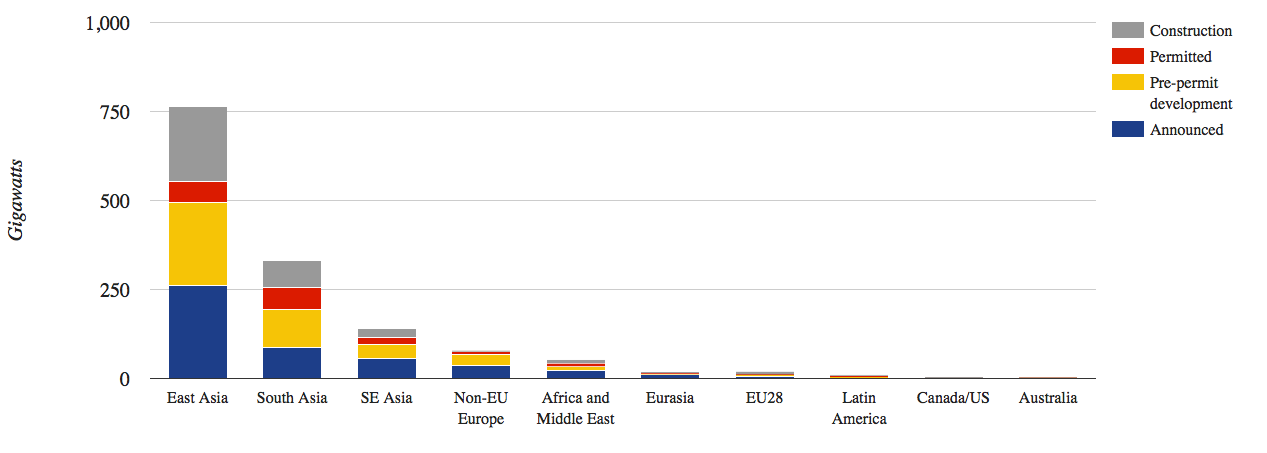

Countries are not only constructing new coal in the present — they are also planning to construct huge volumes of new capacity in the future.

There is currently 1,086GW of new coal capacity in the pipeline, including projects that have been announced, that are being developed but have yet to receive permission, and those that already have permits. Another 338GW is under construction.

This 1,086GW is equivalent to around 1,500 new coal plants, which would emit 186 billion tonnes of CO2 over their expected lifetimes. This means that new coal, and therefore higher emissions, is potentially being locked into future energy infrastructure.

Alternatively, it could mean that investors are putting their money into infrastructure that cannot be used in the future if climate change is to be tackled. The report estimates that the spending on these new plants could amount to almost a trillion dollars.

A UN deal agreed by all countries in Paris in 2015 stipulated that temperature rise must be kept to well below 2C, and below 1.5C if possible. According to another study released by academics at the University of Oxford today, coal and gas plants can only be built for one more year before emissions that will exceed this target are locked in.

“China is effectively adding more than one redundant coal power plant each week,” the CoalSwarm report says.

Gigawatts of coal projects in the construction pipeline in January 2016. Source: CoalSwarm. Chart by Carbon Brief.

Retirements and cancellations

However, this is not a linear tale of ever-multiplying coal plants. While some plants are being planned and built, other projects are being shelved and cancelled, and existing plants are being retired.

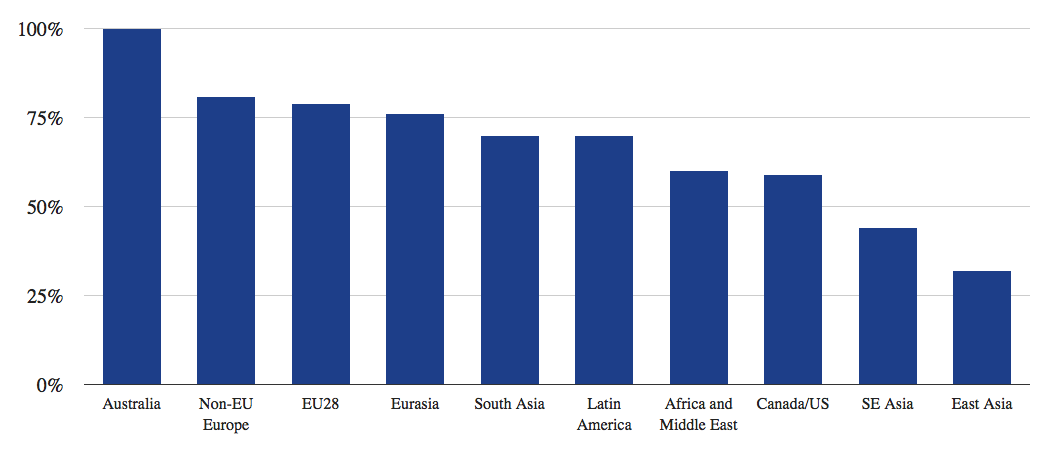

On average between 2010 and 2015, just half of coal plants in the pipeline have been completed. Within this, there is considerable regional variety, with 79% halted in the EU compared to just 32% in East Asia, for instance.

Gigawatts of new coal capacity coming online, compared to gigawatts of retired coal. Source: CoalSwarm. Chart by Carbon Brief.

Percentage of pipeline coal projects shelved or cancelled in 2010-2015. Source: CoalSwarm. Chart by Carbon Brief.

Conclusion

These statistics present an image of coal as a fuel whose fortunes hang in the balance as the world simultaneously tries to shift to clean energy and increase access to energy in developing nations.

The fact that coal consumption has now declined for two consecutive years is a major factor in allowing carbon emissions to stall and perhaps fall in 2014 and 2015. An increasing number of plants are being retired, while many intended projects are failing to go beyond the planning stage.

But the news that the construction of new coal capacity accelerated in 2015 is equally significant.

“The danger of continued expansion remains very real,” warns the report. For example, it points out that construction in China continued to increase by as much a 55% year-on-year in 2015, despite a slowdown in total power use.

The emissions associated with planned coal plants would push global temperature rise well above the 2C limit. If all the coal plants in the pipeline were to be built, then by 2030 emissions would be five times higher than the level associated with a 2C pathway, according to research by Climate Action Tracker.

These plants would not only be detrimental to the climate. The additional air pollution would increase deaths by 130,000 people per year, according to the CoalSwarm study.

There is also the risk to investors, who could be sinking money into energy infrastructure projects that cannot be used — to the detriment of providing clean energy access to the people who need it. The report concludes: