CCC: New UK renewables ‘could be cheaper than existing gas plants by 2030’

Simon Evans

07.06.18Simon Evans

06.07.2018 | 12:56pmIt could be cheaper for the UK to build new wind and solar farms in the 2020s than to keep running some existing gas plants, according to the Committee on Climate Change (CCC).

This surprising insight comes in new scenarios for the UK power sector up to 2030, published last week in the committee’s annual report to parliament. They show how the sector can help meet the UK’s carbon targets, by cutting CO2 output to no more than 100g per kilowatt hour (100gCO2/kWh).

The new scenarios include much more wind and solar than before, but less nuclear and carbon capture and storage (CCS). This reflects much faster than expected falls in the cost of renewables since the previous scenarios were published in 2015, as well as slow progress on new nuclear and delays for CCS.

Meanwhile, the government’s current plans towards the 100gCO2/kWh goal are “not…credible”, the CCC says, with greater ambition needed. This goal is “likely to be no more expensive than alternative pathways…such as increased gas generation paying a market carbon price or importing electricity from abroad”, the CCC adds, as renewables are available on a subsidy-free basis.

The government should run auctions to secure additional low-carbon supplies, the CCC concludes, as the UK works towards legally binding carbon targets and, ultimately, net-zero emissions.

Lack of capacity

The new scenarios were published last week within the CCC’s annual report, which, as explained by Carbon Brief, found progress cutting emissions in the power sector had helped mask a “worrying trend” in other parts of the economy.

In terms of low-carbon power capacity, the UK now has 13 gigawatts (GW) of onshore wind and 13GW of solar (shown in the chart, below left). It also has 9GW of nuclear, 7GW of offshore wind and 6GW of biomass. This includes the (mostly converted) coal plant at Drax, burning wood chips, as well as many smaller sites burning landfill gas, sewage gas and other types of biomass.

Together, these low-carbon sources supplied just over half of the electricity generated in the UK last year – more than coal, oil and gas combined. Nuclear was the largest low-carbon contributor, followed by wind, biomass and solar.

Yet there is much to do for the power sector to remain on track to hit longer-term goals, the CCC says. Emissions in the power sector still stand at 263gCO2/kWh, far above the 100gCO2/kWh target.

Current plans would only support enough new low-carbon capacity to drive this down to around 150gCO2/kWh in 2030, the CCC says (chart, below right). This would be despite offshore wind more than tripling to 24GW, partly because much of the UK’s nuclear fleet is expected to retire.

UK low-carbon electricity generating capacity by type, gigawatts (GW). Left: Existing capacity in 2017. Right: Capacity in 2030 under current plans, from the CCC’s “no more low-carbon” scenario. The power sector carbon intensity in each case is shown below the chart, based on data for 2017 and the CCC’s central electricity demand forecast of 365 terawatt hours (TWh) for 2030, which allows for 2m heat pumps and 20TWh for electric vehicles. Note that the circles and lines for onshore wind and solar are overlapping on the chart. Source: Department of Business, Energy and Industrial Strategy (BEIS) Digest of UK Energy Statistics and the CCC progress report 2018. Chart by Carbon Brief using Highcharts.The government should contract for at least another 60TWh of low-carbon electricity in the 2020s, the CCC says, in order to meet the 100gCO2/kWh target. The new CCC scenarios – discussed in more detail below – explore various ways to secure this extra low-carbon generation.

It is worth adding that the “no more low-carbon” outlook takes a fairly generous view of government plans. Besides the Hinkley C new nuclear plant and already-signed contracts for offshore wind, it assumes government will spend all of the “up to £557m” pledged for offshore wind in the 2020s. The government has not spent all of the money it allocated in either of two previous auctions.

On the other hand, the outlook assumes no further cost reductions, with that £557m enough for around 10GW of offshore wind at the same record-low prices set at auction last year. If prices continue to fall, this money could support even more capacity.

Note that the “no more low-carbon” outlook sees biomass capacity increase by 2030 compared to today’s levels. In contrast, the amount of electricity generated from biomass is expected to fall.

Capacity is set to rise due to contracts signed for the 420 megawatt (MW) Lynemouth and 299MW Teesside biomass plants, due to come online during 2018. This is likely to increase biomass generation in the short term. However, the CCC assumes it will fall once subsidies expire in 2027.

The emissions impacts of biomass electricity are hotly contested, with NGOs and many scientists arguing it could be worse for the climate than coal, in some situations. Other scientists and the companies involved say biomass can substantially reduce emissions.

More wind and solar

The most striking change in the CCC’s new scenarios is that they deploy much more wind and solar than the previous pathways.

For example, the 2018 “central renewables” scenario has a combined 88GW of wind and solar by 2030 (chart below, centre). This is slightly more than the level deployed in the most ambitious renewable scenario from 2015, which at the time was “called “high renewables” (below left). The new 2018 “high renewables” scenario goes much further, with a combined 107GW of wind and solar.

These numbers can be compared to the capacities already installed today, a combined 33GW.

UK low-carbon electricity generating capacities (GW) in 2030 in three CCC scenarios meeting the target of 100gCO2/kWh. Left: 2015 “high renewables”. Centre: 2018 “central renewables”. Right: 2018 “high renewables”. Note the 2018 “high renewables” scenario surpasses the 100g target, reaching 50gCO2/kWh. Source: CCC power sector scenarios for the fifth carbon budget (2015) and annual progress report (2018). Chart by Carbon Brief using Highcharts.This increase in wind and solar is the result of rapid cost reductions that go far beyond what the CCC expected for 2030. For example, it thought offshore wind would cost £113 per megawatt hour (MWh) in 2030, whereas last year’s auction secured capacity for the mid-2020s at £67/MWh.

Though there is less direct evidence from the UK, the costs of onshore wind and solar are also “widely understood to have fallen significantly”, the CCC says. It gives £49/MWh for onshore wind and solar deploying in the mid-2020s, versus previous estimates for 2030 of £85 and £71/MWh.

(Note that these costs are expressed as “£2017 adjusted for inflation”, whereas the commonly cited £92.50/MWh cost for Hinkley C is in £2011/12. The figure for offshore wind is a weighted average of contracts from the last auction.)

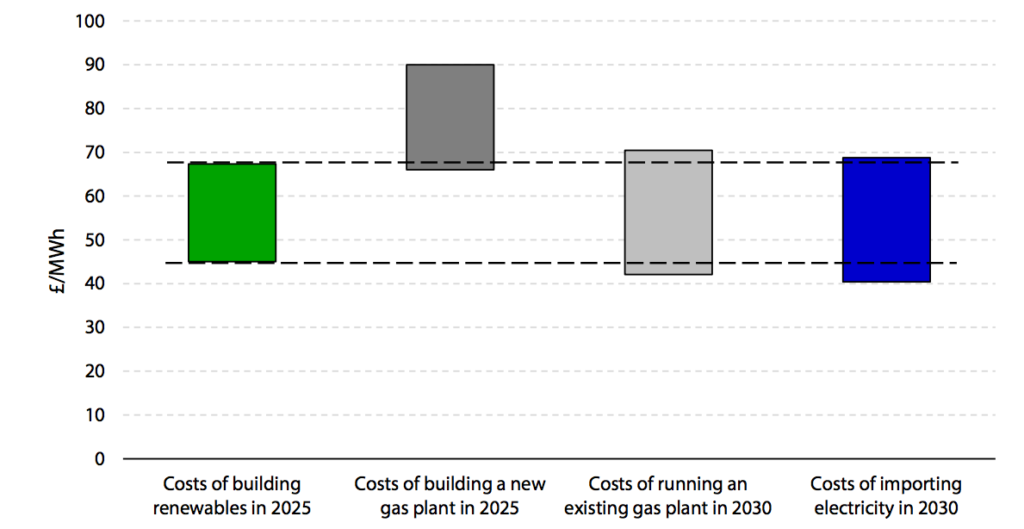

These cost reductions are so dramatic that it could now be cheaper to build new renewables in the mid-2020s than to continue running some existing gas plants or to import electricity from overseas, the CCC says. This means building new renewables is a low-regrets option, it says.

This comparison can be seen in the chart, below. It shows that new renewables are likely to be in a similar range to the price of running old gas plants or buying imports. The way costs pan out in reality depends on the actual costs of deployment, including any further cost reductions for renewables, as well as future gas and carbon prices.

Cost of building new renewables in 2025 compared to higher-carbon alternatives, £/MWh. Source: CCC progress report 2018.

The figures in the chart, above, include a range of renewable deployment costs, as well as a wide range of gas-fuel costs estimated by BEIS (39-83p per therm; current prices are around 50p), plus BEIS estimates of the cost of building gas plants and of market carbon prices in 2030 (£39/tCO2).

The figures are also adjusted to account for the system costs of integrating variable renewables onto the grid, including providing backup – via the government’s capacity market – for when the wind is not blowing and/or the sun is not shining.

The CCC puts integration costs at £10/MWh for systems with up to 50% wind and solar. However, it says experience suggests this may be too high, with the capacity market proving cheaper than expected, for example. It adds that while integration costs could rise “substantially” above 50% penetration, new evidence suggests 60% “or more” will be technically achievable by 2030.

Overall, the CCC says extra low-carbon generation in the 2020s could be delivered “at similar overall system costs to high-carbon pathways, with a range of around £0.5bn per year cheaper if gas prices are high and £2bn per year more expensive if gas prices are low”.

All of this means wind and solar meet 48-63% of 2030 electricity demand in the new scenarios, compared to a maximum of 47% in the 2015 pathways. The 2018 scenarios have electricity that is 58-73% renewable in 2030 and 74-87% low-carbon.

Less nuclear and CCS

In contrast to the rise of wind and solar in the latest scenarios, the outlook for nuclear and CCS has been scaled back. This is due to slow progress securing new nuclear capacity beyond Hinkley C, the CCC says, while CCS deployment has been hit with repeated delays and policy turbulence.

These shifts can be seen in the chart, below. Reading from left to right, this shows 2030 deployment of key low-carbon sources in CCC scenarios from 2015 (blue) and 2018 (red). Each circle on the chart represents deployment in a single scenario. Note that scenarios overlap in some cases.

Deployment is higher in the 2018 scenarios for each of onshore wind (far left), offshore wind (second left) and solar (centre). It is generally lower for nuclear (second right) and CCS (far right). (Go-ahead for Hinkley C means none of the 2018 scenarios have zero new nuclear capacity.)

UK low-carbon capacity deployed for selected technologies by 2030, in each of the CCC scenarios from 2015 (blue dots) and 2018 (red). Each dot represents deployment in a single scenario, though some dots are hidden by overlap. Hover over the dots to see the scenario names. Source: CCC power sector scenarios for the fifth carbon budget (2015) and annual progress report (2018). Chart by Carbon Brief using Highcharts.While all of the new CCC scenarios include at least some new nuclear, in the form of Hinkley C, several are now able to meet the 100gCO2/kWh target for 2030 without additional schemes. For example, the 2018 “central renewables” scenario includes 4.5GW of nuclear in 2030, comprising the new Hinkley C plant and the existing Sizewell B station.

The government is in the process of negotiating a contract for another new nuclear plant at Wylfa on Anglesey in Wales. This is set to involve direct public financing in order to secure a price rumoured to be around £15/MWh below that for Hinkley C. At £77.50/MWh over 35 years, this would remain higher than the cost of renewables, even after accounting for integration costs.

The government’s projections assume several new nuclear plants will come online before 2030 in addition to Hinkley C, whereas the CCC says there are “questions” over the likelihood of this. It adds: “If new nuclear projects were not to come forward, it is likely that renewables would be able to be deployed on shorter timescales and at lower cost.”

Another possibility is that existing nuclear plants could have their operating lives extended beyond their current retirement dates. Of 14 reactors set to retire in the 2020s, eight are scheduled to close in 2023-24 and the remainder in 2028-30. Even if these timelines are stretched, however, the UK will need to deploy additional new low-carbon supplies towards its longer-term carbon targets.

Similarly, while several of the 2018 scenarios reach the 2030 target without CCS, this should not be taken to mean CCS is not needed, the CCC warns. It says: “Those scenarios without CCS in the power sector do not imply the absence of CCS, but rather deployment elsewhere in the economy (ie industry and/or hydrogen production).”

Meeting the targets

The UK needs to deploy significantly more low-carbon generating capacity to meet its 2030 carbon targets, the new CCC scenarios show. There are a range of ways to do this, but all of them include new wind and solar, which are cheaper to build and integrate onto the grid than expected.

The new 2030 scenarios include at least 22GW of onshore wind, up from 13GW today, plus 28GW of offshore wind, up from 7GW and 23GW of solar, up from 13GW. More would be needed without additional new nuclear or CCS, which are in any case “likely to be more expensive”, the CCC adds.

The CCC progress report says:

“A further 50-60TWh of renewables could be deployed in the 2020s at no, or minimal, additional cost to consumers…Steady deployment of low-carbon technologies has the potential for significant cost reduction, with limited downside risk.

“Early power sector decarbonisation helps to manage risks around economy-wide decarbonisation, given limited progress…in other sectors and any potential revision of long-term emissions reduction targets following the 2015 Paris Agreement.”

It says the government should, therefore, move to contract for additional low-carbon capacity and that – in the case of wind and solar – this could be bought on a subsidy-free basis, under several different definitions of “subsidy-free”.

Finally, there may also be a case for supporting more expensive technologies with potential for cost reductions, which may include CCS or floating offshore wind, the CCC says.

-

CCC: New UK renewables ‘could be cheaper than existing gas plants by 2030’

-

Radical new CCC scenarios include much more wind and solar